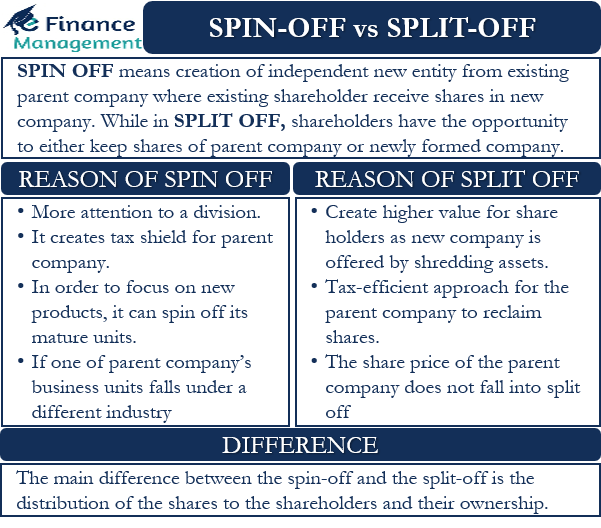

Spin-off and split-off are both types of divestitures. Let’s see what we mean by each of them.

What is a Spin-Off?

In the financial and economic world, we come across corporate spin-offs. A spinoff is a type of Divestment of existing assets by the entity. This is done by reducing or separating some existing assets, divisions, and the business activity of a parent company. And it involves the creation of an independent new entity from the existing parent company that will take over these separated assets, divisions, or business activities. In this, the existing shareholders of the parent company receive the shares in the newly formed company.

The spun-off company will have its own separate management structure with a new name. However, it takes over the assets, employees, intellectual property, etc., from the parent company in exchange for a predetermined amount of cash, stocks, loans, or other monetary instruments. In addition, the upcoming entity usually continues to get financial and technical assistance as per its requirement for some specific period at least. Hive-off is also the other name for spin-off activity.

Examples of spin-offs include Kraft Foods and Mondelez Spin-Off, Baxter, and Baxalta Spin-Off.

We must understand one important point in the event of a spin-off transaction. The shareholders of the parent company receive further shares in the newly spun-off company. The new shares are as per the scheme of separation and in the ratio of their existing shareholding. So, the existing shareholders do not have to surrender any of their existing shares for such transactions.

Reasons for Spin-Offs

- When a division or a department of the parent company needs more focus, it goes for Spin-Off. Even if it has great potential and management believes that a spin-off will lead to better growth of the division.

- The parent company may also want to spin off one of its mature business units, which has little growth in the future. To focus more on existing products or services with higher growth potential. The management does not want to bog down with the issues of non-performing or low contribution business division or activity.

- A spin-off could also occur if one of the parent company’s business units falls under a different industry or if it moves in a different direction. And spinning off as a separate entity might unlock the potential and create more value as a stand-alone business.

- If the parent company is looking for a buyer or investor for a business unit, it might consider spinning it off. As the search for a buyer or investor for a business unit is unattractive and not appealing and spinning off of this unit could provide more value to its shareholders.

- This also happens if the business and country regulations limit the production capacity or business volume under one entity.

- Whenever the market perceives and management agrees that sum of parts would substantially improve the overall financial and business benefits. And it is preferable to separate a few divisions to achieve more value.

- Spinning off also creates tax shields for the parent company.

What is a Split-Off?

Split-off is also a kind of Divestment/distribution/reduction of existing assets, divisions, or business reorganization. In Split offs, shareholders have the opportunity to

- Either keep the shares of the parent company.

- Or, if the shareholders of the parent company wish to opt for the shares of the subsidiary company, they must surrender their existing shares in the parent company in order to receive the shares of the subsidiary company or the company that has split up.

In most cases, the parent company will offer a premium for the exchange of the current shares for the shares of the subsidiary company to generate interest in the new company and encourage the shareholders of the parent company to exchange their shares.

Also Read: Spin off

For example, the price of one share of the parent company is $10, and shareholders who choose the shares of the subsidiary company may receive $11 for one share of the subsidiary company.

Some examples of Split Off are: Du Pont- Conoco Split Off, Lockheed Martin-Martin Marietta Split Off, and Viacom-Blockbuster Split-Off.

Unlike Spin-off, in the case of split-off, the shareholders of the parent company will have to surrender their existing shares. This is in order to get the shares of the new entity. To make the offer attractive enough for the shareholders and to entice them to opt for surrender, the existing shares are bought at a substantial premium to the market price. This serves a twofold purpose – the success of the split-off operations and enough oversubscription of the new company’s offer.

Further, it is also to be noted that normally in such transactions, the stock price of the parent company does not fall. Because the shareholders have the option to go for it or not, and they will ultimately opt for what is beneficial for them.

Reasons for Split-Offs

- Split-offs create higher value for shareholders as a new company is offered by shredding existing assets.

- In the case of split-offs, a new entity comes into being, and there is a change in ownership. Hence, the existing shareholders are given a choice. And they have the option either to continue with the present company and continue to hold the existing shares. Thus, effectively they are not to take any steps. However, if they found it lucrative enough to go for the new entity, then they need to exchange their existing shareholding to get the shares in the new entity.

- Split-offs are a tax-efficient approach for the parent company to reclaim its shares.

Difference between Spin-Off and Split-Off

The main difference between the spin-off and the split-off is the distribution of the shares to the shareholders and their ownership. If the shareholders opt for shares in the new entity, then they need to surrender their existing shares to the parent company. On surrender only, they will be eligible to get the shares in the new entity as per the ratio and scheme of split-off. However, this is not so in the case of the spin-off. In spin-offs, shareholders have both the shares in the parent company and in the new company. So effectively, he receives additional shares of the separated entity in the spin-off.

Also Read: Divestitures

The other difference between spin-off and split-off is the use of resources in the subsidiary company. In the case of a spin-off, the parent company uses its own assets and other resources to build a new entity, which is not the case with split-offs.

Final Words

Spin-offs and split-offs are both types of Divestiture and business reorganizations. The end goal for both is to increase shareholder value, gain tax benefits, and improve profitability for the parent company. The ultimate goal may be the same for both, but the choice of which one to use depends on the parent company’s broader perspective and mission, as each strategy brings its own challenges. Also, the parent company needs to understand the compliance perspective based on the divestment roadmap it opts for. The spun-off company requires to adhere to the existing internal and external controls of the parent company, like the financial reporting norms, and adhere to the regulations like SEC fillings (Securities and Exchange Commission), SOX (Sarbanes Oxley), etc. Hence, the end goal of both might be the same, but it comes up with their own challenges.

Frequently Asked Questions (FAQs)

There could be a number of reasons for a spin-off. Some of them are listed below:

1. When a division or department requires more attention.

2. In order to focus on new products, it can spin off its mature units.

3. It creates tax shields for the parent company.

Shareholders of the parent company will receive shares in the newly spun-off company and continue to hold the existing shares.

Shareholders can hold shares of either the parent company or the newly created company. They need to make a choice.

The main difference is the distribution of the shares to the shareholders and their ownership. In the case of a split-off, the shareholders have to give up their shares in the parent company in order to obtain shares in the subsidiary company. In contrast, in a spin-off, the existing shareholders also receive shares in the new company.