What is Equity Carveout?

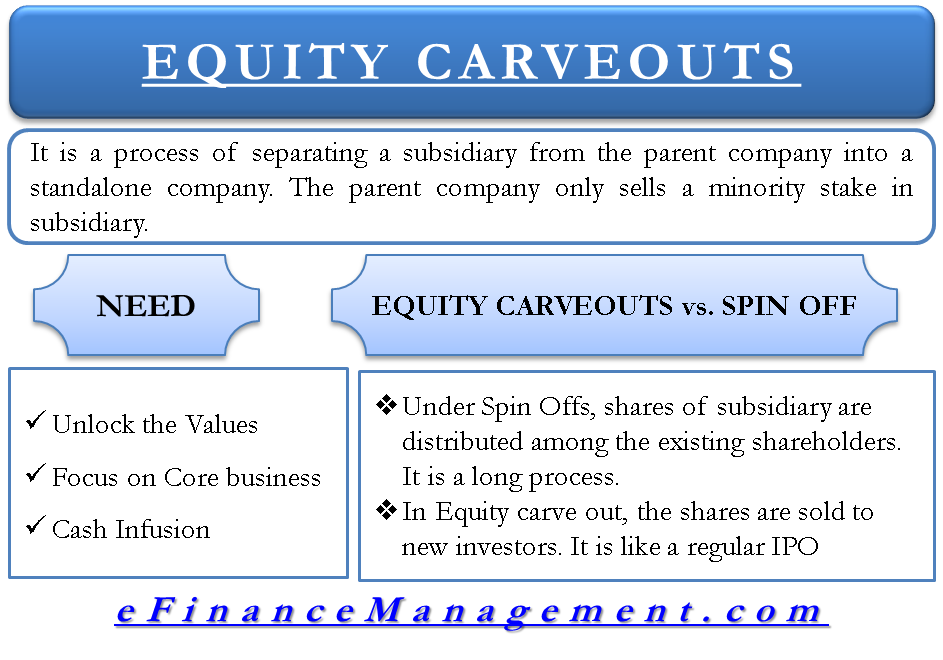

Equity Carveout is a type of corporate restructuring strategy (divestiture) wherein a company sells a part of its business or one division through IPOs (initial public offerings). To put it simply, it is a process of separating a subsidiary from the parent company into a standalone company. The subsidiary company works like a full company with its board of directors and financial statements.

Though the parent company sells the stake in the subsidiary, it retains the majority stake in the latter. Usually, the parent company retains more than a 50% stake in the subsidiary for the purpose of retaining control over its management. Moreover, the parent company also continues to offer support to the newly formed entity.

Thus, we can say that the parent company only sells a minority stake in the subsidiary. Also, a point to note is that under equity carve-out, the parent company does not sell the business unit outright. Instead, it only sells a minority stake. Such a process is also known as an IPO carve-out or a subsidiary IPO.

What’s the Need?

Equity Carveout helps both – the parent company and the subsidiary – in the following ways:

Unlock Value

Some business units often offer low synergies and don’t relate much to the parent company’s core business. So, investors usually overlook such a business unit or value it at a lower valuation, or the operation of the parent company overshadows it.

Now, if that business is carved out, it can work independently, and investors will have full access to its operations. This could help it to achieve more valuation.

Focus on Core Business

a carveout helps both the parent company and the subsidiary focus on their core business. Also, after the Carveout, the parent company may not have to share its resources with the subsidiary and thus, can divert those to its core business.

Cash Infusion

cash proceeds from the sale of stake help to capitalize on a newly formed entity. Moreover, the parent company can also share the cash proceeds.

How is it Different from Spin-off?

The spin-off is also a type of carveout. Under spin-off, the distribution of the shares of the subsidiary takes place among the existing shareholders of the parent company. In the Equity carveout, the shares are sold to new investors.

Also Read: Spin off

Further, a parent company usually goes for an equity carveout if it believes that no single buyer will be available for the subsidiary. Or if it aims to maintain some control over the subsidiary.

Also, a spin-off is a long process and may take a few years to complete. So, if a parent company needs a quick infusion of funds, it is not a preferable option. On the other hand, equity carveout is like a regular IPO, which is filed with the SEC, priced and marketed to the investors, and may take about 4 to 6 months.

Does Equity Carveouts actually Help a Parent Company?

A parent company usually goes for such a carveout to retain control over its business unit or to boost its (parent company’s) share price. But, this does not actually happen as the third party acquires the new company (after a few years). A parent company with a majority stake may block such a takeover, but doing this hampers the growth of the subsidiary. This may result in a conflict of interest between the management of the two companies.

An analysis by research firm McKinsey also supports the same thing. The research firm says very few carveouts actually lead to higher share prices for the parent company. And that very few create value for the shareholders “unless the parent company follows a plan to subsequently fully separate the carved-out subsidiary,” McKinsey says.

To learn more, visit our article Equity Carve-Outs – Advantages and Disadvantages.