What are Dilutive Securities?

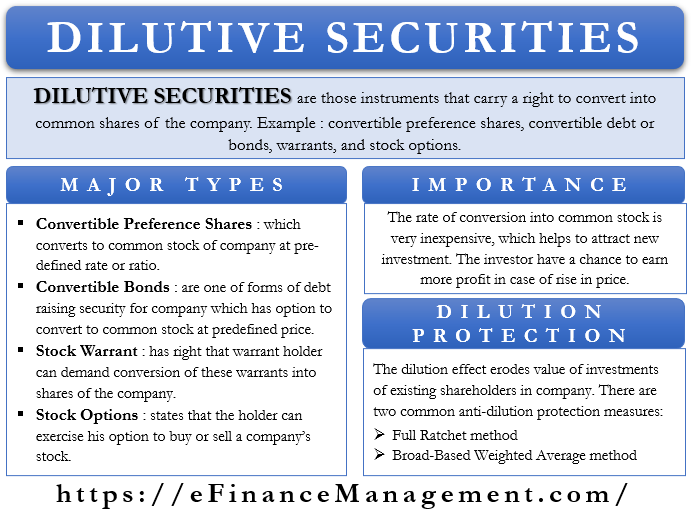

Dilutive securities are those financial instruments that carry a right of conversion into the common shares of a company. These instruments commonly take the form of convertible preference shares, convertible debt or bonds, warrants, and stock options. These securities have a major role in bringing the Earnings per share (EPS) down in a company.

The addition of these shares happens to the total outstanding shares of the company. The EPS reduces upon conversion due to an increase in the number of shares. The reason is, so that market capitalization does not change. But the number of shares outstanding of the company increases. These shares are known so because of their “dilutive” nature. They dilute the basic Earnings per share (EPS) in a company. The holders of dilutive securities have conversion rights with them.

What are the types of Dilutive Securities?

The major types of dilutive securities are:

Convertible Preference Shares

Preference shares are the shares that have preferential rights in the case of dividends and repayment. Preference shareholders receive the dividend before its payment to the common shareholders. In the case of dissolution or bankruptcy of the company, these preference shareholders also receive repayment of capital before the equity shareholders.

The conversion of convertible preference shares can happen into the common shares of the company at a pre-decided rate or ratio. For example, a preference shares issue can happen with an option of conversion into three common shares of the company in the future. Hence, it will increase the number of common shares of the company; at the time of exercise of their right of conversion by the preference shareholder. As with preference shares, here also, the total market capitalization does not change, but due to the increased number of shares, the EPS reduces, or dilution happens.

Also Read: Diluted EPS Calculator

Convertible Bonds

Convertible bonds are one of the forms of debt-raising security for a company. They have an option of conversion into the common stock of the company at a pre-determined rate in the future. For example, the bonds issued may give a right of conversion to the bondholder of 1:1. This will mean that conversion of one bond can happen into one common stock of the company at the time of conversion.

These convertible bonds carry a fixed rate/coupon interest rate on the full amount until conversion. And on the non-convertible portion after the conversion takes place. Moreover, the bondholder has an option or right to convert them into the company’s common stock on a pre-decided date, at a pre-decided price. This right is optional. The price of the common stock of the company and the prevailing interest rates affect the price of these bonds.

These convertible bonds will have a dilution effect on the EPS similar to the preference shares. EPS will reduce once the conversion of these bonds takes place into the common shares of the company.

Stock Warrants

Outside investors from the general public have the right to purchase stock warrants of a company. These warrants are issued with a right attached to them. And the right is that the warrant holder can demand conversion of these warrants into the shares of the company. This demand or option is exercisable upon paying the amount specified at the time of issue, if not already collected. This conversion takes place in the future, the timing of which had been decided and informed at the time of issuance of these warrants.

Also Read: How to Calculate Diluted EPS?

Stock warrants help a company to raise additional capital from the market. They are also the future capital of the company when conversion takes place into common stock. For example, if a stock is trading at US$25 on the stock exchange, Such warrants will be issued, say at $10 Or $12.50. Lower pricing is done to attract investors to buy it. Investors may find it lucrative to buy the warrants so as to gain from the higher share price at the time of conversion of their warrants into the common stock of the company.

As with other securities, upon conversion of these warrants, the total number of issued and outstanding shares of the company increases. This triggers the dilution effect and brings down the EPS.

Stock options

Stock options are financial instruments with listing on the stock exchange. They are a contract between two parties. They state that the holder can exercise his option to buy or sell a company’s stock. Exercise of this option takes place at a pre-decided price on a specific date in the future.

Investors who invest in these options believe the stock price will go up or down by the specific date. Accordingly, they can buy a call option or a put option. All the option holders always have a right but remain under no obligation to exercise their option in both cases. In most instances, companies offer stock options to their own employees. Since they also increase the number of outstanding shares of the company in case of exercise of the option, they also have a dilution effect on the EPS of the company.

What is the importance of Dilutive Securities?

Dilutive securities allow and afford an opportunity to the holder of security an option of conversion of the financial security into the shares of the company. These are available at inexpensive rates when a new company is started or even in the later years. This helps to attract new investment. Investors will have the temptation to invest more. They will have a chance to earn profits with the expectation that by that time, the company’s stock price will increase. And the holder of these securities could covert their holdings into the shares of the company and enjoy capital appreciation.

Anti-Dilutive Securities and transactions

The opposite of dilutive securities is anti-dilutive securities. They result in an increase in the EPS at the time of conversion into the company’s common shares. And the net increase or proportional increase in the EPS and earnings remains more than the net increase in the number of total outstanding shares or the proportion of total new issue of shares upon conversion in such instances.

For example, the conversion of a high-interest convertible bond into common shares of the company will increase the number of outstanding shares. However, at the same time, interest outgo due to debt reduction will also decrease, which could be substantial. This could happen when the fresh issue or conversion is on a high premium. In such a situation, the substantial reduction in the interest expense and outgo will definitely increase the earnings. This increase may be so large that, effectively, the EPS increases further even after the issuance of further shares upon conversion of such convertible bonds. This will be a case of anti-dilutive security. As a rule, we do not include any such securities to calculate diluted EPS.

Business transactions can also become anti-dilutive in some cases. In the case of the acquisition of a company by the issue of additional common stock, the number of common shares outstanding will increase. But the acquired company may add to the earnings of the merged entity in a big way, leading to a bigger increase in the earnings. Thus, it will also have an anti-dilutive effect.

Dilution Protection

The dilution effect erodes the value of investments of existing shareholders in a company. The provision of protection is possible for such shareholders. This can be done against a fall in the value of their holdings in subsequent rounds of funding. Triggering of such protection may happen in instances where the price per share is lower in the subsequent funding round than what the existing shareholders have borne. Shareholders can opt for contracts that may prohibit the company from issuing additional shares without a matching capital raise.

However, there are two common anti-dilution protection measures:

Full Ratchet method

This method revises the share prices of the existing shareholders. Its matching is done with the new share price in the funding round. Thus, an issue of additional shares may take place to match the additional consideration. This method only considers the issue price of the new shares. This new price shall apply to all the shares that are with the existing shareholders.

Broad-Based Weighted Average method

This method considers the new issue of shares in the funding round and the number of shares already outstanding. Calculation of weighted average price is also done by taking into account the price of the new shares as well as the price of the already existing shares. This is a more appropriate method and helps to make the price uniform for the existing shareholders.

Final Words

All these dilutive securities help the company attract investors and arrange funding at a cheaper rate or for a longer-term. We need to know that all these types of securities dilute the EPS and thus the market value of the existing shares due to the new issue of shares on conversion. Moreover, in most convertible securities, only conversion and issuance of new shares occur. But no more money or funds flow to the organization, except in case of warrants or options.

Very clear explanation, thank you for shaping the world of Finance.

Dear Sanjay Bulaki Borad, Remain blessed.

Regards

Mr. Issa Ndangi