Both Basic EPS and Diluted EPS are important profitability measures that help in the analysis of the companies. To learn about the difference between basic vs diluted EPS to analyze the income statement correctly, it is important that you have knowledge about different types of capital structures as follows.

Types of Capital Structure – Simple and Complex

A company’s capital is composed of its equity & debt. Equity can further be divided into preferred stock & common stock. In contrast, sometimes debt & other debt instruments can be converted into equity.

When a company has issued financial instruments that are potentially convertible into common stock, it is said to have a complex capital structure. If a company’s capital structure does not include such potentially convertible financial instruments, it is said to have a simple capital structure.

Understanding this differentiation in the capital structure is important as it will help us understand basic EPS & diluted EPS.

Basic EPS

Basic EPS is the same as the EPS. It simply measures the earnings per share without making any type of adjustments. The formula for calculating the basic EPS is the same as above. For calculating Basic EPS, we only consider the company’s common shares. It is a great indicator of the financial health and stock price, and a high EPS means that it is a good investment.

Also Read: Diluted EPS Calculator

However, Basic EPS may give an inaccurate figure in case of stock buybacks, mergers, and acquisitions, changes in accounting policy, and more.

Diluted EPS

We also consider convertible securities to calculate the Diluted EPS and the outstanding shares. Here convertible securities mean a change in the outstanding shares if all sources of conversion are exercised. These convertible securities may include employee stock options, convertible debt, convertible bonds, stock options, convertible preferred shares, warrants, etc. Dilutive effects increase the number of shares.

It can be difficult to calculate Diluted EPS. To calculate it, an accountant will first have to calculate the cost to exercise these options and other things, like strike price.

Basic vs Diluted EPS – Differences

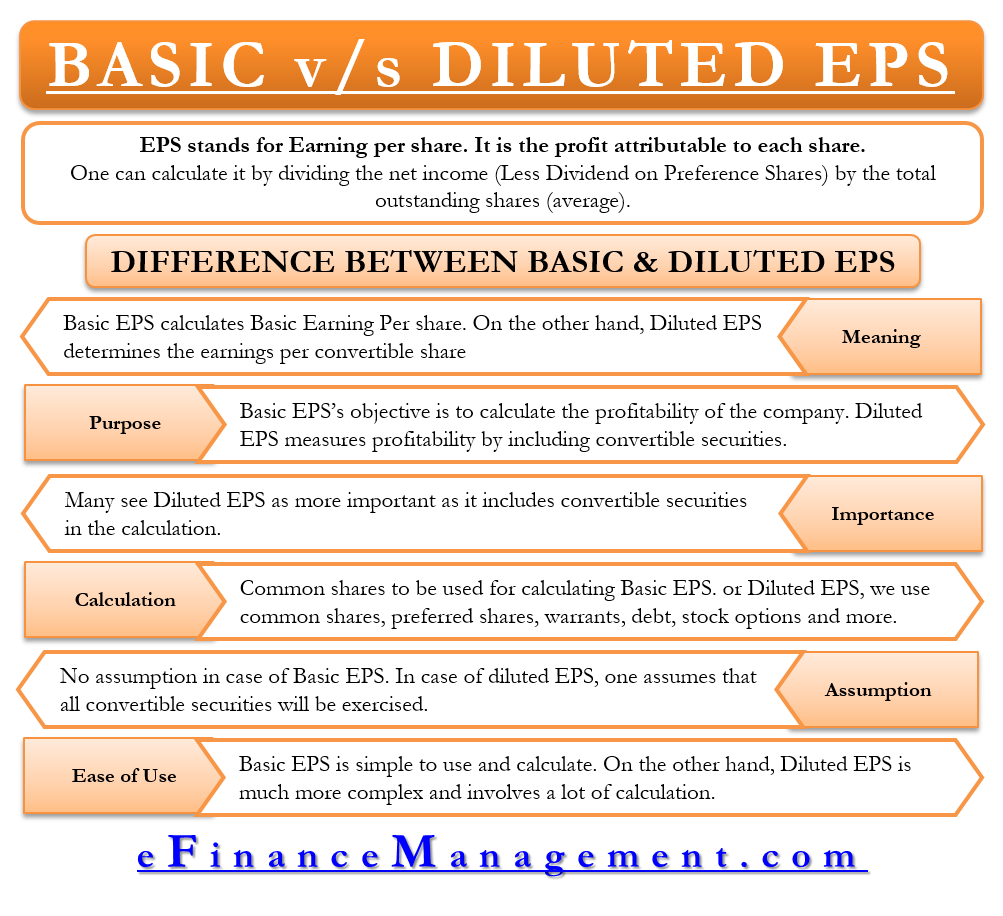

Meaning

Basic EPS is a tool that calculates the basic earnings per equity share. On the other hand, the Diluted EPS is a barometer that determines the earnings per convertible share and the quality of earnings per share.

Purpose

The main objective of the Basic EPS is to calculate the company’s profitability. Diluted EPS measures profitability by including convertible securities.

Importance to Investors

Many see Diluted EPS as more important as it includes convertible securities in the calculation.

Calculation

We only use common shares for calculating Basic EPS. For Diluted EPS, we use common shares, preferred shares, warrants, debt, stock options, and more. The value of Basic EPS is always more than the Diluted EPS because the numerator is the same in both, but the denominator increases in the latter.

Also Read: How to Calculate Diluted EPS?

Read more about How to Calculate Diluted EPS

Assumption

There is no assumption in calculating Basic EPS. However, one assumes that all the convertible securities will be exercised for calculating Diluted EPS.

Ease of Use

Basic EPS is simple to use and calculate. On the other hand, Diluted EPS is much more complex and involves a lot of calculation.

Example

Company A has 20,000,000 shares outstanding at the start of the year and 15,000,000 shares outstanding at the end of the year. The net income is $100,000,000. In this case, Basic EPS is ($100,000,000 ÷ ([20,000,000 + 15,000,000] ÷ 2)) $5.71.

In the same example, if 5,000,000 shares are held by an investor for conversion, then Diluted EPS is ($100,000,000 ÷ ([[20,000,000 + 15,000,000] + 5,000,000] ÷ 2)) $4.44.

Basic vs Diluted EPS – Why It’s Important?

For investors and analysts, it is very important to understand the difference between the two. If you pick the wrong EPS figure, you may end with a misleading PE (price to earnings ratio), dividend-adjusted PEG ratio, PEG ratio, etc. Calculation of all these ratios involves the use of the EPS, and all these ratios are very important for calculating the company’s financial health.

Moreover, the FASB (Financial Accounting Standard Board) has made it mandatory for the companies to report Basic and Diluted EPS every quarter. So, it is a must for analysts and investors to know about each of them.

Final Words

We now know that Basic EPS is a simple indicator of a company’s financial health. On the other hand, Diluted EPS goes into more detail to give earnings per share. Many see Diluted EPS as superior as it reveals how the company would perform if the investors exercise all the convertible securities.

For better understanding, one can calculate both the EPS figures. If a major difference comes between the two numbers, then one should carry out further investigations. This difference could mean that a significant amount of income is not available to the investors as it is tied up with convertible securities.