Cost Accumulation: Meaning

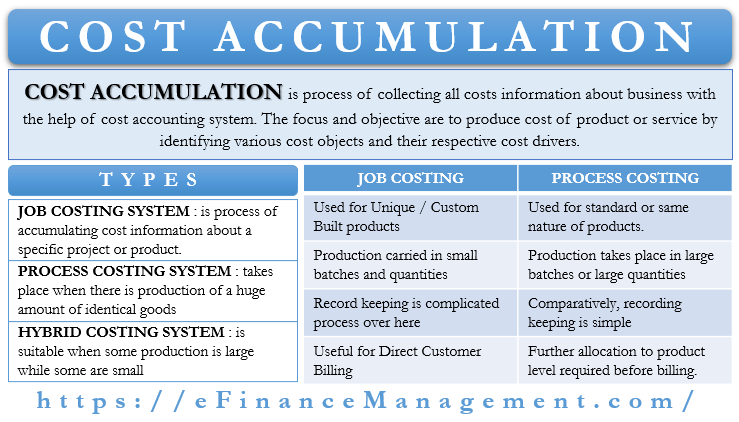

Cost Accumulation is the process of collecting all costs information about the business with the help of the cost accounting system. It is a process of collection of all relevant data regarding the various costs incurred by the company at various stages of production. This calculation is the result or outcome of the cost accounting system prevalent or practices in the company.

Cost Accumulation calculates all manufacturing costs in a sequential pattern. It considers all costs in the production process, starting from inventory to the finished goods. The focus and the objective are to come up with the cost of a particular product or service by identifying various cost objects and their respective cost drivers. Here there exists a cause-effect relationship between cost object and their cost drivers. Thus Cost Accumulation becomes a very connected and integral part of the Cost Accounting System.

Whether Cost Accumulation a part of Managerial accounting too?

The management of the company, after collecting and analyzing the cost data, makes calculative decisions regarding the day-to-day working of the company. The costing data helps the management at all stages of operations, including planning, monitoring, controlling, and decision making. The management also decides when and how the assignment of cost to a particular job or process will happen. And thus, Cost Accumulation becomes a part of both Cost Accounting and Managerial Accounting.

Types of Cost Accumulation

There are majorly three types of Cost Accumulation methods, as follows:-

Job Costing System

Job Costing System is most useful when the total production quantity is small or there exist small batches of production. It is also relevant and important when each job is unique. It is a process of accumulating cost information about a particular project or a specific production or product. Under this system, linking and recording the accumulation of direct labor, direct materials, and manufacturing overhead costs happens with respect to the particular job or batch.

Also Read: Types of Costing

This system is widely useful in the delivery of a special or customized product. It also helps while asking for cost- reimbursements or stage-wise advances from the customer. Once the job completion happens, all the costs of the respective job are accumulated. And after that, that particular job sheet and costing exercise on that job also close. It is necessary to consider both direct and indirect costs under this system. At times calculation of indirect costs for a particular job may become difficult.

Thus under the Job Costing System, accumulation takes place according to the respective job order.

Process Costing System

Accumulation of cost through the Process Costing System occurs when the production of a huge amount of identical goods occurs. In this system, the accumulation of costs for a large batch of products takes place. And afterward, further allocation of all such accumulated costs takes place for an individual unit.

Process Costing System accumulates costs on the basis of departments or divisions. In this system, identification and booking of costs to respective cost centers take place. Cost centers are the places of origination of the costs. Accumulation of costs takes place according to the cost centers they belong to.

This method is best suitable when the production is very large in quantity. The production process is also generally continuous in nature without any customization.

Assumptions of Process Costing System

- The first assumption is that all products are identical in nature.

- The second assumption of this system is that the costs of all units of production are the same.

At the end of this process, the creation of a ‘Cost of Production Report’ takes place. This report shows the total cost for a particular cost center and the state of both opening and closing inventory.

Hybrid Costing System

Manufacturing units where some production is large while some are small, this is best suitable. Under Hybrid Costing System, process costing is used where the production quantities are large. While if the product is in small batches, the Job System is used. Thus this hybrid system is widely used and now well accepted in such circumstances.

Difference between Job Costing and Process Costing

The key differences between both this system of cost accumulation and accounting are:

| Job Costing System | Process Costing System |

|---|---|

| This is an easy and acceptable system for unique or custom-built products. | This system is used for continuous production of standard or same nature of products. |

| Production takes place in small batches or small quantities. | Production takes place in large batches or large quantities |

| Record Keeping and Accounting are complicated, as it keeps on modifying for each job/process | Comparatively, Record Keeping and Accounting are simpler. |

| It is useful for direct customer billing. | Of course, these costs will ultimately be used for customer billing. However, these costs further need to be allocated to the product level, and then only billing can happen. |

Cost Accumulation Vs Cost Assignment Vs Cost Tracing

Sometimes, both Cost Assignment and Cost Accumulation are loosely called and referred to as the same. But it is not so, and they both are different. Cost Assignment is the identification and attachment of costs to the respective costs driver. It is a process of linking costs to their place of origin. Cost Assignment is mainly useful for an activity-based costing method, where linking of overhead expenses occurs where incurrence takes place of these overheads. Cost Allocation is the other name of Cost Assignment.

On the other hand, Cost Accumulation is a completely different concept. And here, the focus and objective are to collect all costs/total costs of that product or service. It is to know the overall cost of production and stages of the cost incurred and analyze this information about the costs for further management decisions. In this system, the process begins with recognizing cost objects and their respective cost drivers.

Cost Tracking is the third term here, which is useful in assigning costs to the departments. Cost Assignment and Cost Tracking helps in the Allocation of costs to the respective department. Thus the main focus of Cost Tracking is to trace back the origin of indirect costs and also establish a causal relationship with the cost driver.

In simple words, Cost Assignment and Cost Tracking helps in the allocation of costs, and Cost accumulation helps in the collection of costs.

Conclusion

Cost Accumulation is an important step in the cost accounting process. Moreover, accumulating the costs according to the cost object and its drivers is the base of all other cost accounting processes. And the decision is with the management whether to adopt a Job, Process, or Hybrid Costing System. Moreover, it is of vital importance to accumulate costs without any error. Because all further processes are dependent on the accuracy of these figures. Thus Cost Accumulation is one of the important tools for the management of the company to guide and help them in making correct decisions.

Refer to Costing Terms for various other basic cost concepts.