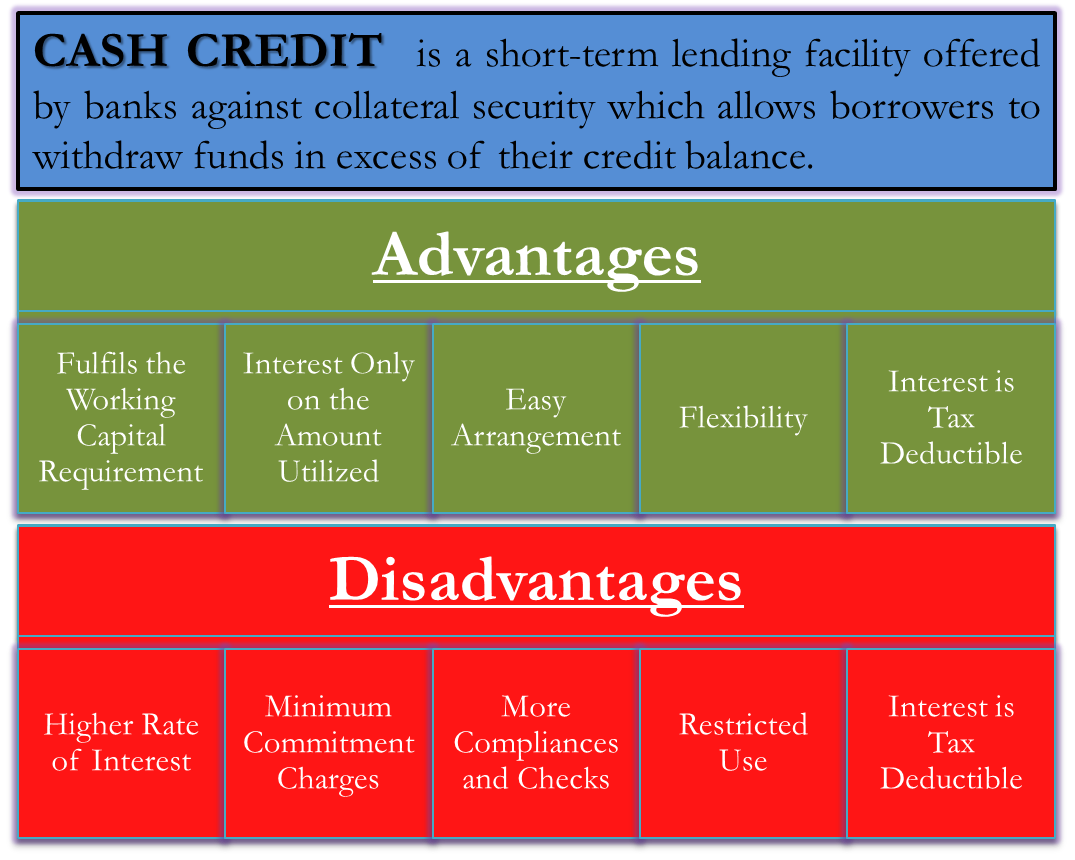

Cash credit is a short-term lending facility offered by banks against collateral security, allowing borrowers to withdraw funds in excess of their credit balance.

What is Cash Credit?

Cash Credit, commonly known in short as CC, is a short-term loan facility under which the borrower can withdraw funds in excess of his credit balance as per his requirements and business needs. Under this type of finance, the lender offers the borrower a certain specified limit (called ‘cash credit limit’ or drawing power) up to which the borrower can withdraw from the cash credit account. The borrower obtains the loan by pledging/hypothecating its collateral security.

Below are some of the advantages and disadvantages of cash credit. Let us see them.

Advantages of Cash Credit

Fulfills the Working Capital Requirement

Working capital is required for day-to-day business operations. The facility of cash credit majorly finances working capital requirements in an entity. For example, the lender may grant the cash credit up to 75% of the working capital gap, and the rest, 25%, would come through the owner’s contribution.

Interest Only on the Amount Utilized

Another justifiable benefit of cash credit is that the lender charges the interest on the amount actually withdrawn (i.e., the running balance in the cash credit account) by the borrower, not on the whole sanctioned amount as in the case of term loans.

Easy Arrangement of Loan

Cash credits are arranged at ease and at short notice by the bankers. The finance is easily available provided the requisite collateral security (collateral maybe inventory, accounts receivable, etc.) is adequately available to be pledged/hypothecated. Its existence and current realizable value are properly determined and authenticated.

Also Read: Cash Credit

Flexibility

The cash credit facility offers flexible withdrawals and deposits into the loan account. The withdrawals can be made up to the sanctioned amount at any point of time during the course of a loan. The borrower can also deposit excess cash into the loan account to lower the interest burden.

Interest is Tax-Deductible

Bankers extend cash credit loans specifically for the purposes of business. The interest payments made to the lenders are thus eligible for a tax deduction while filing Income Tax Return. Hence, they reduce the overall tax burden on the entity.

As we have seen the advantages, let’s see about the disadvantages of cash credit.

Disadvantages of Cash Credit

Higher Rate of Interest

Finances under the cash credit system come at a higher rate of interest than other forms of loans as the lending is based on collateral security, which carries uncertainty over its value. For example, take the collateral as inventory. It might be worth millions today, but a policy change or emergence of new competitive products in the future may lead to a permanent decline in its value.

Minimum Commitment Charges

The lender would always be willing to extract a minimum charge from the lent amount regardless of the fact that the borrower has utilized that much limit or not. For example, when a bank sanctions a cash credit of up to $100 million, the lender would stipulate a clause that the borrower would pay a minimum interest on $20 million or the amount withdrawn, whichever is higher.

Also Read: Difference between Overdraft and Cash Credit

More Compliance and Checks

One of the cons of the cash credit system of finance is that the borrower is under an obligation of quarterly/semi-annually (depending on the terms and conditions) filings of reports with the banker, which would state the present conditions of his collateral, e.g., filing of the monthly stock statement with the bank. These obligations hamper the usual operations of the business and create an extra administrative burden on the borrower.

Restricted Use

The cash credit facility is usually given for a maximum period of 12 months. Hence it is unfit for long-term purposes. To continue this facility after the expiry of the tenure, it has to be renewed under new terms and conditions.

Difficult for New Businesses to Secure

The lender extends a cash credit loan on the basis of turnover for past years, accounts receivables balances, projected performance in the next few years, collateral security offered, etc. It is difficult for new businesses to obtain it because they lack the above-mentioned requirements.

Withdrawal For a Specific Purpose

The borrower takes this type of loan for specific purposes only, e.g., for financing the working capital gap. Thus, the withdrawn funds cannot be used for other business purposes like the acquisition of assets, repaying other loans, etc.

Conclusion

As seen above, the advantages and disadvantages of cash credit taking a cash credit are one of the best financing methods, especially for short-term needs. Still, the borrower should cautiously assess its pros and cons, keeping in mind his business needs and current situation to be sure of the loan’s feasibility to the business. The borrower should also keep a watch on the levels of his current assets and business performance for smooth renewals.