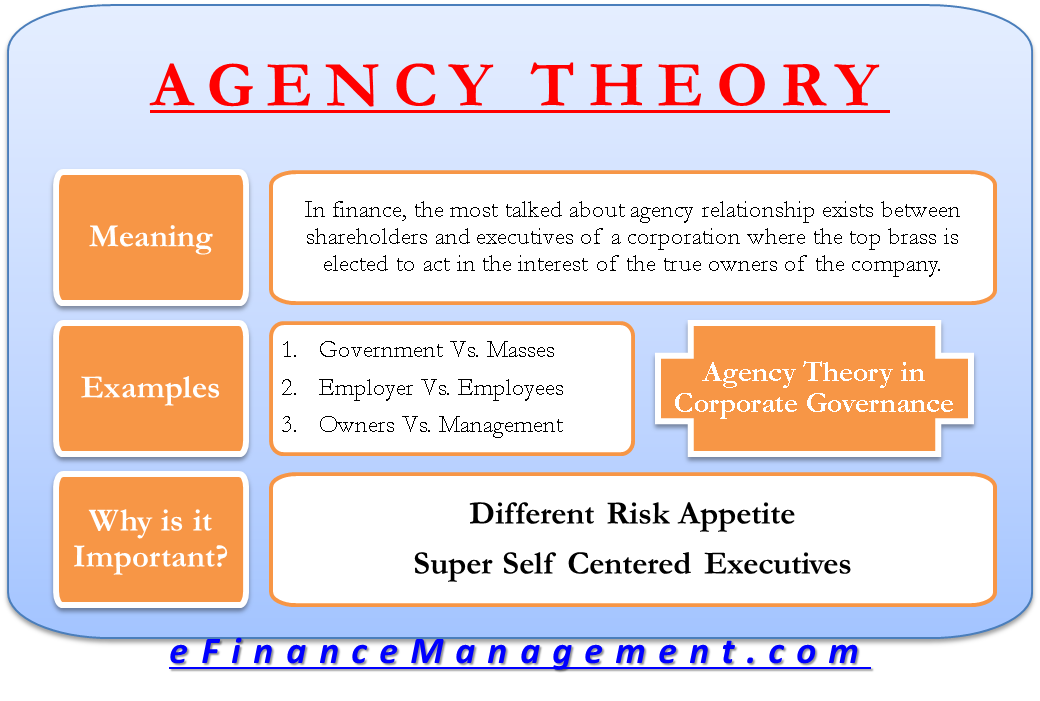

Meaning of Agency Theory

Agency theory examines the relationship between the agents and principals in the business. In an agency relationship, two parties exist – the agent and principal, whereby the former acts and takes decisions on behalf of the latter. The theory revolves around the relationship between the two and the issues that may surface due to different risk perspectives and business goals. In finance, the most talked-about agency relationship exists between shareholders and executives of a corporation where the top brass is elected to act in the interest of the company’s true owners.

Agency Theory Examples

One of the most common examples of agency theory can be seen in the way the government of a country functions. The masses elect political representatives to run the country in a way that maximizes their interests. Representatives of different political parties promise the voters to bring changes in the governing model of the country. However, the electorates of almost all sovereigns find themselves cheated when their elected candidates act in an unscrupulous manner after assuming office. Here, the voters act as principals who elect the government representatives to act as their agents.

Another common example of agency theory is between the employees and employers of an organization. The employees are hired to work in accordance with the objectives of the organization. However, the growing number of corporate scams shows that this relationship is not always taken in the way it is meant to be. The employees work against the organization’s ethics, causing it huge financial and reputational damage. Sometimes, the loss caused by such corrupt employees is beyond repair, and an organization has to wind up its business altogether.

Agency Theory in Corporate Governance

Agency theory in corporate governance is an extension of the agency theory discussed above. It relates to a specific type of agency relationship that exists between the shareholders and directors/management of a company. The shareholders, true owners of the corporation, as principals, elect the executives to act and take decisions on their behalf. The aim is to represent the views of the owners and conduct operations in their interest. Despite this clear rationale for electing the board of directors, there are a lot of instances when complicated issues come up and the executives, knowingly or unknowingly, take decisions that do not reflect shareholders’ best interest. In the dynamic business environment, the agency theory of corporate governance has garnered much attention and is seen and evaluated from different points of view.

Also Read: Agency Cost

Different subject matter experts, be it economists, financiers, accountants, or legal practitioners, have been studying the broader impacts corporate governance can have on the company’s performance. However, it is not always possible to quantify the effects of agency theory. Take, for instance, the dividend payout policy of a corporation. The majority of shareholders expect high dividends payouts when the company is making huge profits. With this, not only do they enjoy extra cash on their hands, but it also boosts the current value of the capital stock they hold.

The executives, on the other hand, as a part of the long-term strategy, may decide to retain a large part of profits. Retention could be for a requirement of some technology advancement or some critical asset purchase in the near future. A conflict of interest may arise between the shareholders and executives in such situations. Such disagreements can create a feeling of contention between the owners and controllers of the company, often resulting in inefficiencies and sometimes even losses.

Importance of Agency Theory

There are two situations that make efforts to resolve agency conflicts all the more important.

Different Risk Appetite

One of the major reasons for such strife is the levels of risk appetite each is willing to undertake. Shareholders are mostly not involved in the day-to-day working of the company and hence are not fully equipped to understand the rationale behind critical business decisions. On the contrary, managers are more far-sighted and have a far greater risk appetite due to their close access to the relevant information. They believe in the going concern concept of accounting, and most of their decisions are taken keeping the long-term view of the company in mind. While the shareholders are keen to increase the current and future value of their holdings, the executives are more interested in the company’s long-term growth. Thus, the differences in their approach create a feeling of distrust and disharmony.

Super Self Centered Executives

The situation could be exactly the opposite also when the managers have an interest in showing short-term performance to the owners to get their pay hikes. This is a more prevalent and more dangerous situation.

Also Read: Shareholders Vs Stakeholders

In a nutshell, there is a problem with goal congruence between the two parties (profit vs wealth maximization). The corporate governance policies, which aim at aligning the objectives of both the principal and agents, are likely to resolve most agency conflicts. As we know that there are no free lunches in this world, there are some agency costs also.

Conclusion

Agency theory in corporate finance is gaining momentum for all the right reasons. With markets getting volatile as ever, it becomes imperative that both the interests of the shareholders and the company are taken care of. The shareholders should trust the company’s management and go the extra mile to understand their day-to-day business decisions. Similarly, the management should also keep the interests of the company’s true owners in their mind. Clear communication should be sent out explaining the rationale behind major business decisions to help shareholders understand and appreciate changes if any. A robust corporate policy can help to keep differences at bay.

Continue reading Friedman Doctrine. As per this theory, the objective of a company should be to maximize the returns for the shareholders.

Also, read conflict theory.

Quiz on Agency Theory in Corporate Governance

Let’s take a quick test on the topic you have read here.

very clear explanation… understandable by a neophyte … thanks a lot …

The explanation is very understandable, thank you.

this is very helpful information. Thank you

understandable explanation, thanks

Thank you, it was helpful

Well appreciated

Hi . Thankyou for the explanation it real good 😃