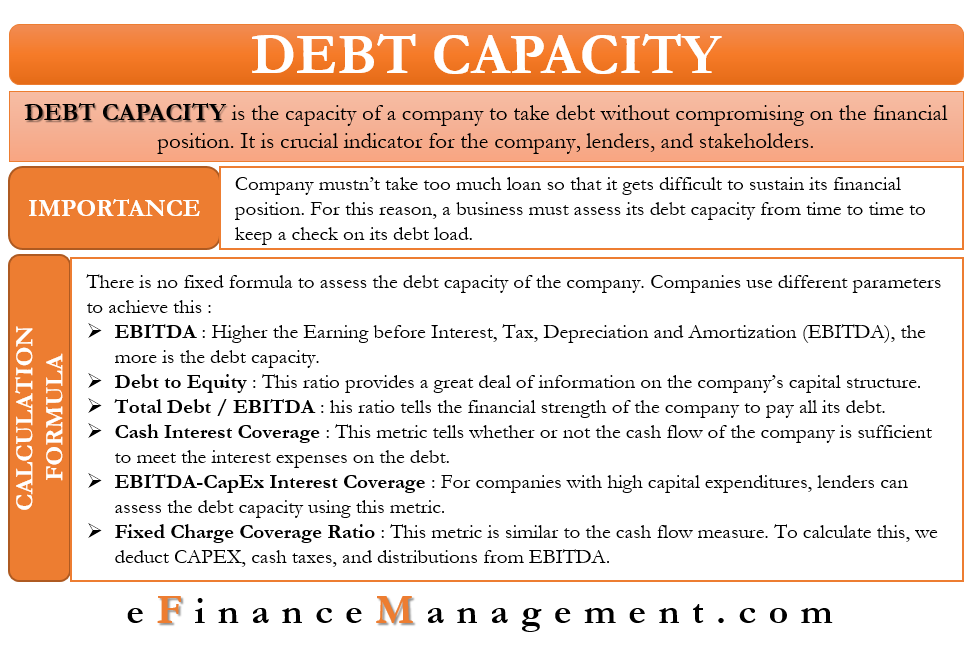

Debt Capacity, as the name suggests, is the capacity of a company to take debt. Or, we can say it is the amount of debt that a business can take without jeopardizing its financial position. In other words, a company can meet its financial obligations regularly without any operational setback.

It is a crucial metric not just for the company but also for lenders and other stakeholders. It assists in assessing the creditworthiness and the ability of the company to repay debt.

Debt Capacity – Importance

Almost every business takes on debt to fund its expansion or meet operating expenses. But, a company mustn’t take too many loans so that it gets difficult to sustain its financial position. For this reason, a business must assess its debt capacity from time to time to keep a check on its debt load. Companies often use debt capacity models to set their debt capacity limits. For example, a company may set its debt limit at 5% of its earnings.

On the other hand, lenders also use this concept before approving a loan to a business. They want to ensure if a borrower can handle such a level of debt or not.

Also Read: Debt Ratio

Formula

There is, as such, no fixed formula to calculate this capacity. Different companies use different techniques to get an idea of their debt limit. For instance, a company may use the current ratio, debt to total asset ratio, and more to come up with the capacity.

However, depending on just one metric for the calculation may not give a clear picture. Thus, experts recommend a thorough analysis of a company’s financials using a few key metrics.

Assessing Debt Capacity

The best way to determine the debt capacity of a business is to scan its balance sheet and cash flow of a company. Apart from these two, a few more metrics are there that can help assess such a company’s capacity. These metrics are:

EBITDA

A company with a higher EBITDA (Earnings before Interest, Tax, Depreciation, and Amortization) is likely to have more retained earnings. A company can use these retained earnings to pay the debt. Thus, we can say, the higher the EBITDA, the more is the debt capacity. Along with the amount, one should also consider stability in the company’s EBITDA.

Debt to Equity

This ratio provides a great deal of information on the company’s capital structure. But, calculating this metric is tricky as several factors may result in an inconsistency between the book and market value of the debt and equity. These factors include goodwill, acquisitions, and any adjustments to the asset.

Total Debt / EBITDA

It is the most popular cash flow metric to assess debt capacity. This ratio tells the company’s financial strength to pay all its debt. Lenders can use this metric to focus only on senior debt or the debt that a company needs to pay first in case of financial distress.

Cash Interest Coverage

This metric tells whether or not the company’s cash flow is sufficient to meet the interest expenses on the debt. Moreover, if the company has enough cash flow, this metric could also tell about the company’s ability to repay the principal.

EBITDA-CapEx Interest Coverage

For companies with high capital expenditures, lenders can assess the debt capacity using this metric. In this, we deduct capital expenditure from EBITDA to examine if the company has enough amount to cover the interest expenses.

Fixed Charge Coverage Ratio

This metric is similar to the cash flow measure. We deduct CAPEX, cash taxes, and distributions from EBITDA to calculate this.

Unused Debt Capacity

As the name suggests, it is the available debt capacity for a company if there is a need to borrow more funds. Companies with ample unused capacity will have easy access to funds and possibly at a lower interest rate.

Such companies usually have a debt-to-equity ratio of less than one, suggesting less liability on the balance sheet. If the debt to equity ratio is more than one, the company could face difficulty accessing the funds.

Insufficient Debt Capacity

It is a scenario when a company’s cash flows are inadequate to cover the additional debt. Such a company could face difficulty in accessing the debt. Or will likely get the debt at a higher cost.

Thus, a company with insufficient capacity should make efforts to improve cash flows and reduce debt. If not, the outsiders would tag the company as high risk, leaving it with fewer and more expensive financing options.

Debt Capacity and Enterprise Value

The debt capacity of a company must be less than the value of the business. A company with 100% debt in the capital structure is hazardous and does not make sense. The debt amount should be in-line with future cash flows to assure lenders that they won’t lose money.

When calculating cash flows for debt purposes, the cyclicality aspect must be taken care of. If there is a significant rise in the cash flow, the debt capacity and enterprise value should also grow. If the higher cash flow is because the economy is in full boom and not due to the firm’s growth strategies, then it is better to normalize the cash flows to calculate the capacity.

It is because a cyclical rise would magnify the enterprise value and the company’s debt capacity. It could hurt the company later when there is a slowdown in the economy, and the cash flows are insignificant to service the interest expenses. Moreover, if the debt goes above the enterprise value, it is very likely that the creditors will lose money.

How Much Debt is Good?

It is a tricky question. There is no hard and fast rule; rather, the amount of debt (good) depends on several factors. These factors are industry, size of the business, macro environment, and more. From the aspect of the lender also, enough debt amount would vary from company to company.

Nevertheless, we can still determine the right amount of debt with the help of a few financial metrics. These metrics are the same as we discussed above for assessing the debt capacity. Along with the result of these metrics, managers will have to use their due diligence to come up with a specific amount or a range of values for good debt.