What is the Conversion Price?

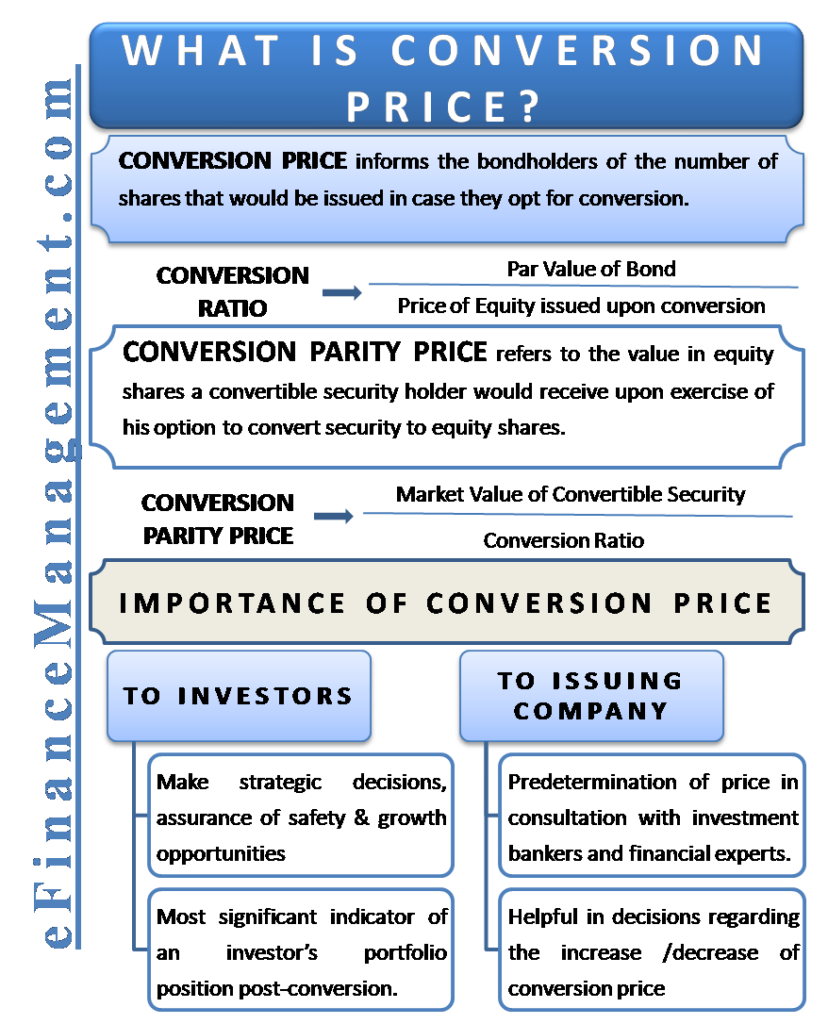

The conversion price informs the bondholders of the number of shares that would be issued in case they opt for conversion.

For example, Mary holds convertible bonds of Co. ABC bearing a face value of $5,000 (50 bonds of $100 each). Co. ABC issues an option for the conversion of bonds to common stock at a conversion price of $25. Thus, Mary would be entitled to $(5000/25) 200 equity shares of Co ABC.

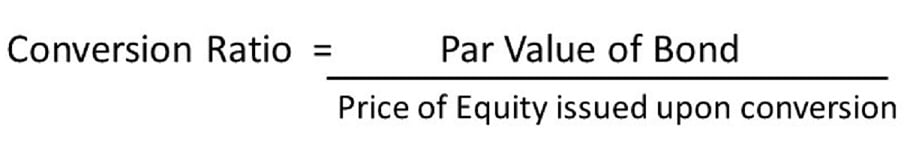

Conversion Ratio

The conversion ratio is nothing but an extension of the conversion price. The number of common stocks issued against the par value of a unit bond is the conversion ratio.

Continuing the example, the conversion ratio in the given case will be ($100/$25) 4.

Conversion Parity Price

The concepts of the conversion price and conversion “parity” price go hand in hand. The practical concept of conversion parity is crucial in grasping the rationale behind the conversion price. The question of a conversion parity price arises when dealing with convertible securities such as convertible bonds or convertible preferred shares.

Conversion parity price refers to the value in equity shares a convertible security holder would receive upon exercising his option to convert security to equity shares.

Also Read: Exchangeable Bonds

Conversion Parity Price = Market Value of Convertible Security/Conversion Ratio

Consider the following example:

The convertible bonds of Apple Corp trade at $2500 in the open market. The management has pre-set the conversion ratio at 10. Also, the common shares of Apple Corp are currently trading at $265.

Therefore, the conversion parity price = $(2500/10) = $250.

This means that a bondholder holding a single bond worth $2500 prior to the exercise of an option would now hold 10 shares at a value of $250 each. The conversion ratio divides the bigger bond pie into smaller slices of common shares while keeping the aggregate holding constant.

In order for the investor to make a profit, the conversion parity price must always be less than the current market price of the equity shares. As in this case, upon conversion, the investor receives 10 shares worth $250 each, whereas the market price stands at $265 each. Therefore, the investor can make a profit of [(265-250) * 10] $150 with this trade. Had the market price been any lower than $250, the investor would either have to square off this trade in a loss or hold a position till the price picks up.

Why is Conversion Price Important?

To Investors

The conversion price is crucial in enabling the investors to make strategic decisions regarding holding or converting. A constant battle ensues between the conversion price and the current market price. Investors prefer convertible securities since they offer the safety of a bond with the growth opportunities of stocks. A conversion price gives an idea of the potential upside upon conversion to equity. The bondholders will be willing to forgo the comfort zone of a bond and convert their holding to equity only if they are promised a significant hike in their portfolio. The conversion price is, thus, the most significant indicator of an investor’s portfolio position post-conversion.

To Issuing Company

The conversion price is a key metric for the issuing company. The management predetermines the price in consultation with investment bankers and financial experts. Factors influencing the determination of a conversion price include the current market price of stocks, retained earnings available, cost of borrowed funds, and the investor’s preferences & risk appetite.

Therefore, the company must strive to set a conversion price to achieve a dual balance. It must be high enough so that the conversion does not dilute the EPS. It should also not be prejudicial to the existing equity shareholders. Also, it must be low enough to provide the convertible security holders with some skin in the game. The low conversion price will attract investors to buy into the otherwise low-yield securities. Also, a current market price exceeding the conversion price ensures a sure shot chance to end up with profits.