Meaning

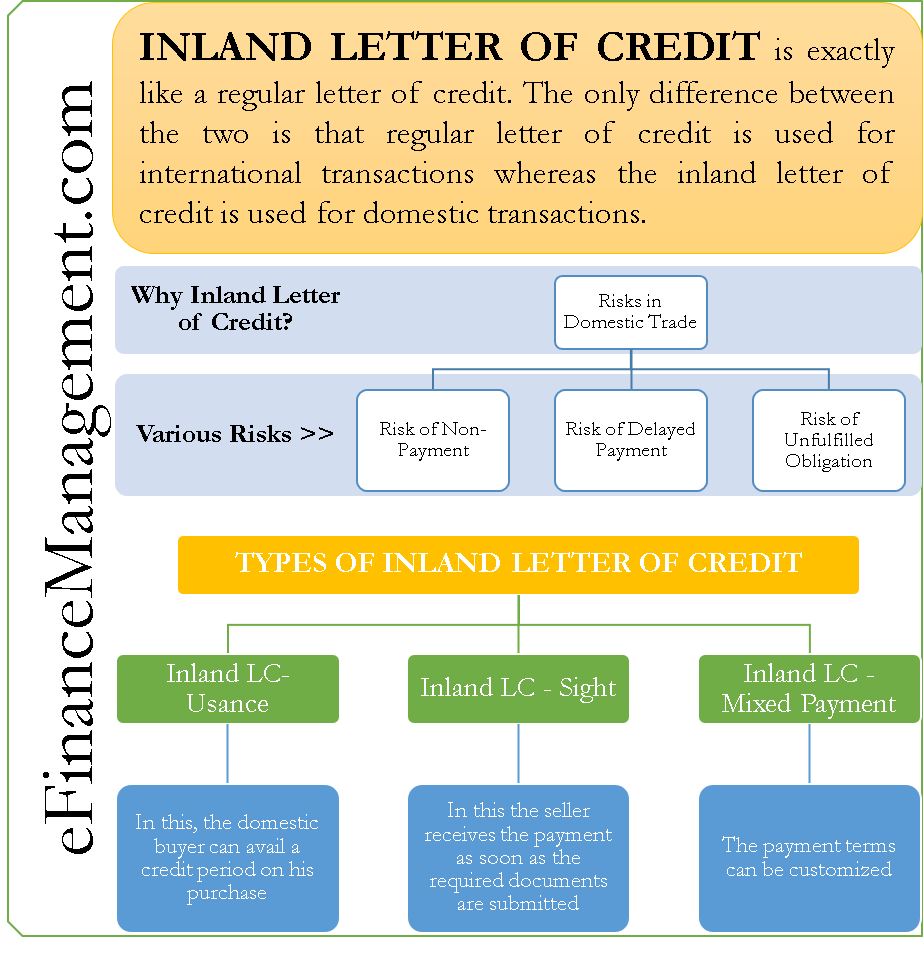

An inland letter of credit is exactly like a regular letter of credit. The only difference between the two is that a regular letter of credit is used for international transactions, whereas the inland letter of credit is used for domestic transactions. Consequently, we can say that this letter of credit is a payment instrument used to facilitate domestic trade.

Why Inland Letter of Credit?

If we understand the common usage of the letter of credit, we can understand that a letter of credit is used to mitigate risk related to international trade. The bank becomes the intermediate between the buyer and the seller to ensure a smooth and risk-free transaction. Some may wonder why a letter of credit is designed specifically for domestic trade transactions?

The answer lies in the type of risks associated with domestic transactions. If we take a closer look at the risks in the domestic transaction, we will understand that a lot of risks that are present in the international trade are also in the domestic trade. Let’s understand this further –

Risks in Domestic Trade

- Risk of Non-Payment

A major risk associated with any transaction, regardless of its geography, is the risk of non-payment. In simpler terms, the seller will be afraid that he will not receive the payment for his supply. With this letter of credit, this risk is hedged as the letter of credit issuing bank promises to pay if the terms of the letter of credit are met.

Also Read: Letter of Credit Example

- Risk of Delayed Payment

Also, any transaction carries an inherent risk of delayed payment, which means a possibility that the seller may not get his payment on time. When this letter of credit is used as a payment instrument, the seller has the security that he will receive timely payment. This way, he can manage his working capital better.

- Risk of Unfulfilled Obligation

Sometimes in a domestic transaction, the buyer and the seller lack trust and may feel that the opposite party will not fulfill their obligation. In such cases, an inland letter of credit comes in very handy. The beauty of this payment instrument is that it ensures that both parties fulfill their obligations.

This discussion helps us understand that a letter of credit can be as useful in a domestic transaction as in an international one.

Types of Inland Letter of Credit

An inland letter of credit is different from any other type of letter of credit. In a way, it is customizable as per the needs of the transaction of the parties. An inland letter of credit can be –

- Inland letter of credit – Usance – In this, the domestic buyer can avail of a credit period on his purchase.

- Sight – Inland letter of credit – In this, the seller receives the payment as soon as the required documents are submitted

- Inland letter of credit – Mixed Payment – The payment terms are customizable.

Finally, it is important to note that even though the inland letter of credit looks useful on paper, it is not very widely used in practicality. Multiple reasons contribute to this reality. The reasons include growth in alternate banking products such as bank guarantees, bill discounting, etc. Also, the rise of the internet has promoted transparency. It has become much easier for business houses to assess their clients and vendors, thereby increasing trust. These factors have made this letter of credit quite obsolete.

Hi Sanjay, thanks for this write-up on inland letters of credit. Typically, what are the documents to be called for in an inland LC transaction. I think for companies like mine that have trade finance facility lines to be drawn as dollar or naira, this will be quite useful, but we need to understand the documents to be called for in such transactions. Thank you for the anticipated response

Hi Ikpehai Daniel, It is nice to hear from you!

Let’s understand the documents required in Inland Letter of Credit. Most banks require basic L/C documentation i.e. invoice, packing list, transport document & insurance. However, every bank has a different requirement and it is good to check with your bank regarding their requirement.

I hope that is satisfactory. Do keep writing!

“copy of lorry receipt showing the consignee name as consignee and marked freight paid notify the openers bank”.

can you explain ?

does it mean the Lorry receipt has to be in the name of consignee and what kind of notification to the bank

Lorry receipt is the cheapest and it can be trusted also , as transport co will bear the whole responsibility .

Dear Madam/Sir

Our client given ILC with 180 days, we submitted all the documents to our bank for negotiation and we want to discount the ILC and we requested our bank and our bank said they have to receive acceptance from our client’s bank, out of box we contacted our clients bank and they said they are yet to receive acceptance from our client and our client delayed acceptance for nearly 4 months and they sent the copy of acceptance to us and when we contacted our clients bank they told there some discrepancies in the documents we will make the payment only after receipt of the payment from our customer….final bank made the payment on 182th day.

We received the payment, below few questions are scaring us

01. If client is not given acceptance.

02. Our bank sends the documents and wait to receive the message or payment & no follow up from them on acceptance.

03. Even after clients given acceptance and accepting all discripencies, client bank not giving acceptance to our bank why…

Is there any clause where applicant or applicant bank acceptance is not required and LC is negotitaed with documents as mentioned in the LC and we can discount.

Please give your views on this and suggest us….