Conversion Cost: Meaning

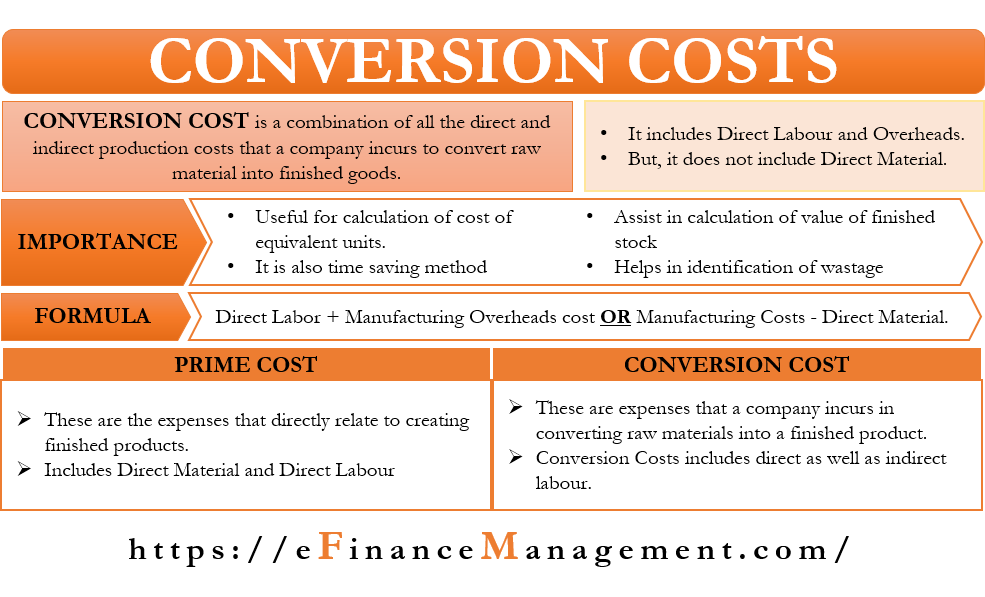

Conversion cost is a combination of all the direct and indirect production costs that a company incurs to convert raw material into finished goods. It includes direct labor costs and manufacturing overhead costs, but not the cost of direct materials. Companies primarily use such a metric to track production and inventory efficiency.

Direct labor is the wages of workers who can be directly identified and associated with the production. An example of direct labor cost is the wages of the employees working on the assembly line.

Overhead costs are the expenses that a company incurs in manufacturing the product. But, one can’t directly attribute these expenses to a production process. Examples of manufacturing overhead are depreciation, utilities, rent, testing, and more costs that a company incurs within its manufacturing facilities.

A point to note is that one may exclude individual costs from the calculation of conversion costs if a business does not incur them regularly. For instance, if certain expenses are for a specific production run, such as reworking parts to get the correct output, then we may exclude such costs.

Also Read: Conversion Cost Calculator

Conversion Cost – Importance

Such costs are useful to calculate the cost of an equivalent unit in a process costing system. It is logical to use this cost in cases where the percentage of completion of the semi-finished unit is usually the same as direct labor and manufacturing overheads at the end of the accounting term.

Calculating equivalent units and unit costs by adding direct labor and manufacturing overheads is more time-saving than calculating the two costs separately.

Further, it is also a crucial cost accounting concept that assists in calculating the value of the finished inventory. One can also use the conversion cost concept to come up with the incremental cost of developing a product. It, in turn, helps in setting the prices.

Conversion cost also helps managers to identify waste and assess the efficiency of the production process. It also provides information on how much the company can spend on inventory production.

Formula

As said above, the conversion cost is the combination of manufacturing overheads and direct labor. Thus, its formula is Direct Labor Plus Manufacturing Overheads cost.

Also Read: Process Costing- A Guide with Illustrations

There is another formula for conversion costs. Total manufacturing costs are a combination of three factors – direct material, direct labor, and manufacturing overheads, while conversion costs do not include direct materials. Thus, we can get conversion costs if we subtract direct material from total manufacturing costs.

So, the second formula for Conversion Costs is the Total Manufacturing Costs Less Direct Material.

Example

Let us understand the calculation of conversion cost with the help of an example. Company A incurs the following expenses for producing 25000 units. Direct Wages – $19,000; Indirect Wages $2,500; Direct Material – $14,500; Indirect Material – $500; Equipment Depreciation – $3,250; and Factory Insurance $1,000. For simplicity, let’s assume there is no process inventory.

Now, we have Direct Labor of $19,000, but we need to calculate manufacturing overheads first.

Total manufacturing overheads = $2,500 Plus $500 Plus $3,250 Plus $1,000 = $7,250

Now, putting the values in the formula for conversion cost = $19,000 Plus $7,250 = $26,250

We can also calculate the Conversion Cost per unit, or $26,250/25000 = $1.05.

You can also use our calculator to make the calculation easier – Conversion Cost Calculator.

Prime Costs vs. Conversion Costs

Prime costs include the expenses that directly relate to creating finished products. Conversion costs, on the other hand, are expenses that a company incurs in converting raw materials into a finished product. The calculation of prime costs includes the cost of direct materials and direct labor. Both Conversion and Prime cost include direct labor, but the former also include indirect labor as well.

Both types of costs include many same expenses, yet they provide a different viewpoint on how efficient the production process is. Prime costs assist operations managers in making sure that the production process is efficient. Further, the prime costs also assist in setting prices at a level that allows a company to get an acceptable level of profit.

Read more about other types of costs @ Types of Costs and their Basis of Classification.

Final Words

Every company must calculate conversion costs as they assist in making crucial business decisions, such as determining the price of the product, calculating the cost of sales for use in the income statement, inventory value, and more.