We put in a lot of hard work to earn money. However, investing your hard-earned money is also a very important and equally challenging task. Though an investor has plenty of options available, it is never easy to select the right one, even for experienced investors. And, if the investor is new to the investing world, then it is very important that he keeps an open mind about the information and knowledge that could help him make the right investment decision. This is something that even senior investors would also agree to. Thus, it is crucial that the investor knows about all the sources of investment information that could help him to make investment decisions. As well as the extent of dependency on those sources and the credibility of the information.

This article will try to discuss key and widely known important sources of investment information.

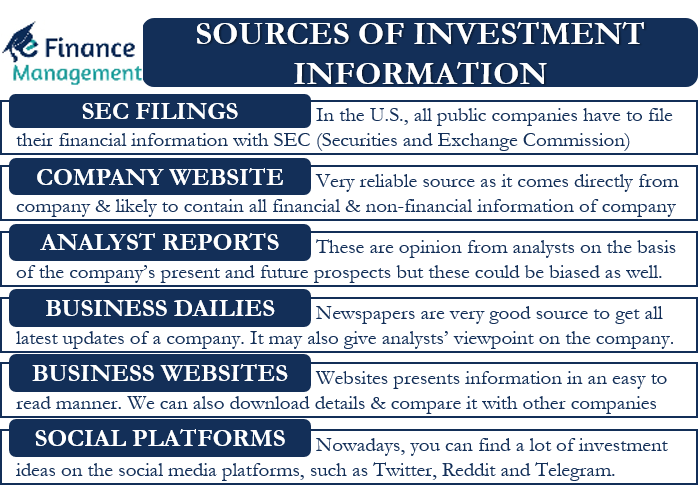

Sources of Investment Information

Following are the important sources of investment information:

SEC Filings

In the U.S., the SEC (Securities and Exchange Commission) requires all public companies to file their financial information with it. These filings contain all the information on a public company.

Annual Reports and Financial Documents

For instance, it includes the company’s financial statements (Balance Sheet, Profit & Loss, and more), details about insider transactions, future plans, details of Management, their opinion, and guidance about the working and future prospects of the company, and much more. Companies file an annual report (10-K), Quarterly Report (10-Q), Current Event report (8-K), Insider trading report (form 3, 4, and 5), as well as report on institutional investment (Schedule 13D and 13G). The director’s report and the management discussion and analysis (MD&A) sections are good sources to get information on the company and industry in the annual report. As well as future plans of the management with regard to expansion, diversification, technological change, capital, organizational structural changes, etc.

Foreign firms that list on the U.S. exchange also need to provide their financial information to the SEC. You can easily access all the SEC information through its EDGAR database. Also, there are several business websites that give easy access to such information.

Also Read: Best Books on Corporate Finance

Offer Document

Apart from these sources, another document that could assist investors in knowing a great deal about the company is its offer documents. All companies that go public have to file their offer document with the SEC. Along with offering facts and figures on the company and its promoters, this document also provides a great deal of information on the industry in which the company operates.

So, in all, SEC information gives you the complete information on any public company. Also, the SEC information is very reliable since it comes directly from the company. There is, however, one shortcoming of using SEC information. And, it is that you have to go through loads of information as these reports run into several pages.

Company Website

Again, this is a very reliable source of information as it comes directly from the company. A company’s website is likely to contain all the information on the company, including financial and non-financial information. For instance, the company’s website will carry financial statements, press releases, product or service information, blogs, presentations, and more.

Moreover, going through the financial information on a company’s website is much easier than on SEC filings. This is because the website may offer an overview or a snapshot of the numbers that are important to the investors.

Also Read: Various Avenues and Investments Alternative

For instance, a company’s website usually carries presentations. These presentations give an overview of the past performance and may offer quarterly or yearly projections as well. One can easily find these presentations by glancing over the investor relations section of the website.

Analyst Reports

The above two sources just give one the information on the company. But if one needs to understand what this information means or an interpretation of the information, then you should go for the analyst reports.

Analysts’ reports basically are an opinion from analysts on the basis of the company’s present and future prospects. Or, we can say that these reports are an analyst’s take on the present and future performance of the company.

However, since these reports are an opinion, they could be biased as well. So, this is something that one must always keep in mind when reading an analyst report. Moreover, one must not blindly follow what the analysts recommend. Instead, use other sources to confirm it.

One can easily find these analyst reports on financial websites like Morningstar and Yahoo Finance. The stockbroker may also offer one such report from their in-house research or subscribe to third-party analysts.

Business Dailies and Other Media

Reading business newspapers is a very good source to get all the latest updates on a company. Similarly, viewing business channels could also give a lot of details on a company. Along with providing updates, business channels may also give analysts’ viewpoints on the company. However, such information may not always be reliable. So, one needs to be careful when picking any information for decision-making from these sources.

Business Websites

One can find every bit of information on any company on business websites. Moreover, these websites present the information in an easy-to-read manner that one can easily understand and act. One can also download the details and compare them with other companies or with the past performance of the same company. Apart from the information, these websites also provide expert commentary on the stocks or investments one is looking for. Some of the best websites one can refer to are Yahoo Finance, Motley Fool, and more.

Social Platforms

Currently, social media has spread all over more than print media. Finance, investments, and savings stream is also now available on social media. Hence, one can also find many investment ideas, analyses, information, and action points on the social media platforms, such as Twitter, Reddit, and Telegram. Most social media platforms have groups that focus on investments. Such communities could prove a valuable source of investment information.

Final Words

These are the best sources of investment information that one can use to support their investment decisions. A point to note is that there is no one best source; rather all the above sources are more or less equally important. Each source has its own importance and could help the investor in one way or the other. With technological advancements, all this information can now be accessed through the latest smartphones, even on the go. This way, one can save time and add to the investment knowledge as well. One critical observation is that while information gathering and understanding are all right, however takes enough validation and evaluation before acting on any advice as that may be biased.