Investors use hedging strategies to lower their risk exposure. These are strategies to handle the given situation in the market in case things do not go as per the plan or expectations. Basically, using hedging strategies allows investors to lower uncertainty and limit their losses without compromising significantly on their overall return. In the financial world, there are many hedging strategies available and practiced across the market spectrum using forwards, futures, and options contracts for the underlying security/commodity/stock or currency.

In this article, we will take a look at the hedging strategies using forwards, futures, and options that investors can use to hedge their risk.

Hedging Strategies Using Forwards

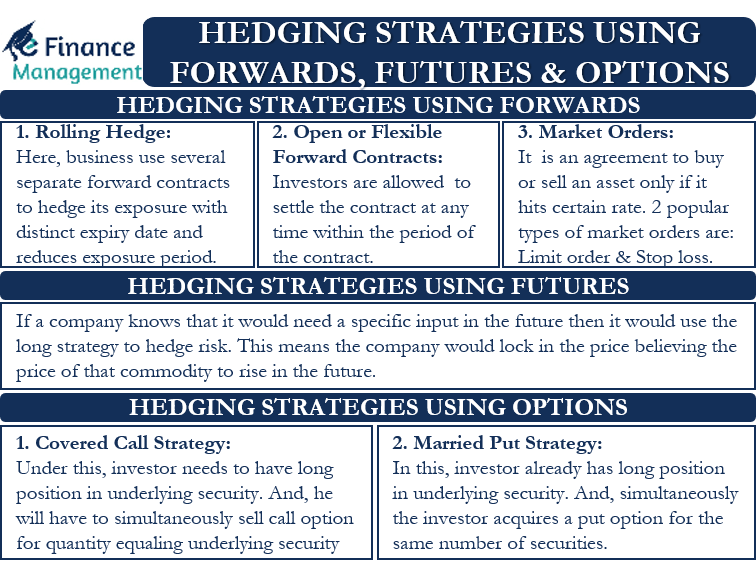

Primarily there are three hedging strategies using forwards contract that investors can use. These are:

Rolling Hedge

In this, businesses use several separate forward contracts to hedge their total exposure. Each contract has a distinct expiry date. Moreover, each contract covers a specific part of the risk for a set period. Along with reducing risk, such a strategy ensures that businesses continuously monitor and evaluate their risk. Moreover, it also reduces the volatility in the price from one period to another as there are many successive contracts. And this reduces the exposure period as well.

When Used

It is used basically when the stock or commodity delivery dates are beyond the expiry date of the futures or forward contracts. To continue to cover the position, the investor or the company will close the near expiring contract and enter into a fresh contract for the same quantity. Still, for having a future/later validity date will cover the prospective delivery date of the stock/commodity. The important point to note here is that the hedge contracts can be rolled over several times.

Also Read: Hedging

Please note the exposure in such contracts could be about Raw Material prices, Finished Goods selling prices, currency exchange rate changes, etc.

Similarly, the spot price refers to the Forward Contract’s price for the underlying raw material, finished goods prices, currency prices, and so on.

Example

In April 2020, company A was aware that it would have 10,000 tons of special steel to sell in June 2021. To avoid any adverse impact, it decides to hedge its risk with an equal quantity of future contracts. The current spot price of special steel is, say, $79. Futures contracts can be traded for every month of the year for up to 12 months. However, liquidity is an important criterion, so we assume there is enough liquidity available only for the first 6 delivery months. Company A has, therefore, no option but to short 10 October 2020 contracts (assuming the lot size for each contract is 100 tons).

The deliveries are, however, spread up to 2021. Hence company A, in September 2020, rolls over the existing hedge forward contract into the March 2021 contract. Similarly, in February 2021, company A rolls the existing hedge forward contract into the July 2021 contract. This way, it continues to roll over the contract to coincide and extend beyond the delivery period. And thus, it hedges its risk of any downward price movement of special steel.

Possible Outcome

During this entire process of exiting and entering into fresh, forward contracts, there is a cost involvement. So each rollover may have a minor cost. And if the company is trading well, it may be possible that sometimes it may be able to exit at a higher price and enter again at a lower price. In that circumstance, the company may earn profits even from the hedging contracts, besides covering the risk of any downfall in the finished goods selling prices.

Open or Flexible Forward Contracts

For some investors, it is difficult to decide on the specific future date when they would want to settle the contract. To overcome this, investors can use open or flexible forward contracts. Such contracts allow investors to settle/close the contract at any time within the validity period of the contract.

For example, Mr. A agrees to purchase $50,000 of GBP at an exchange rate of 1.35. The expiry date is 31st March 2019. Mr. A uses an open contract and decides to buy GBP three times during the contracted period – $15,000, $10,000, and $25,000. In this case, each time Mr. A buys, he would have to send the seller of the contract (second party to the contract) an equivalent amount as per the contracted terms and price.

Investors try to get budgeted/estimated rates to implement their hedge cover to the full extent as far as possible.

Hedging Strategies Using Futures

Futures contracts are standard and legal contracts. These contracts give rights to the engaging parties to buy or sell pre-determined quantities of an underlying commodity, security, or a currency at a pre-decided price and date in the future. Investors, as well as companies, use these contracts to hedge or lower their risk. Companies basically use futures to reduce the risk of commodity prices, which they use as input, going up in the future. This way, companies prevent themselves from any unexpected losses.

If a company knows that it would need a specific commodity (as input) in the future, then it would use the long strategy to hedge the risk. This means the company would lock in the price, believing the price of that commodity to rise in the future.

Example – Long Future

For example, Company A determines that it would need to buy 5,000 ounces of silver in three months from now. Suppose the current price is $24 per ounce, and a three-month futures contract is $22. This way Company A locks the price of $22 irrespective of the market price at the end of three months. And this lowers its risk as well.

If Company A had not taken the futures, and if the price increase to $26 per ounce, then it would have to buy at $26. But, Company A has a futures contract, so it would be able to buy the silver at $22 per ounce.

Example – Short Future

Similarly, an investor or a company can also use the short position to hedge their risk. Such a strategy will be useful whenever a company or an investor plans to sell an asset in the future. In this, an investor takes a short position via a future contract.

For example, Company A plans to sell 5,000 ounces of silver in three months from now. The current market price is $24, and the futures price is $22 per ounce. Company A will take a short position. This way, they would be able to sell at $24 and buy again three months later at $22 to close their position.

If Company A did not take a short position and had the prices dropped to $20, then it would have to sell at a loss. So, by taking a short position, Company A was able to reduce its risk or hedge its position.

So, we can say that using futures contracts helps an investor to take out the element of uncertainty regarding the future price movement. This way, they are also able to save themselves from any unexpected losses.

Hedging Strategies Using Options

Options are also a very useful tool for hedging as they are not just flexible but present limited risk to the holders as well. Using options for hedging involves creating one or more positions to offset the risk of the existing position. There are two super popular hedging strategies using options. These are:

Covered Call Strategy

It is the most useful hedging strategy if an investor is bullish on the underlying security but wishes to hedge the risk against a drop in the price in the short term. Under this strategy, an investor needs to have a long position in the underlying security. Also, the investor will have to simultaneously sell a call option for the quantity equaling the underlying security.

Example

For example, Mr. X has 100 shares of company Y, bought at $20 per share. The prevailing market price of the shares is $22. And it is near to its all-time high level. Mr. X, however, is worried that the stock may drop now as it is near its all-time high. So, to hedge the risk, Mr. X goes for the covered call strategy and sells a call option at a $24 strike price at a premium of $1.

If, at the expiry, the holder exercises the option, Mr. A would have to sell the stock at $24, i.e., still above the current spot price of $22. In this case, Mr. A would gain $5 per share ($24 + $1 call option selling premium – $20 cost price of the share).

And, if at the expiry, the share price of X does not go over $24, the buyer will not use the option. Still, Mr. X would gain a $1 premium per share.

Married Put Strategy

Like covered call strategy, here also an investor already has a long position in the underlying security. Instead of selling the call option, the investor will buy a put option for the same number of securities in this strategy. The primary objective of this strategy is to protect an investor from any downward movement in the price of the security. This strategy helps an investor to limit the loss in case the price of the underlying security drops unexpectedly. Because he will be able to sell the security at the contracted price. Irrespective of the fact that the actual market price of the security is much lower than the contracted price.

Example

For example, Mr. B owns 100 shares of Company Y at $10. The current market price of the share is $15. To hedge the risk or get protection against dropping prices, Mr. B uses a Married Put Strategy. Mr. B now buys a put option of $14 by paying a premium of $1.

Now, if, at the expiry, the spot price rises to $18, Mr. B will not use the option. And he would only lose $1 for the premium. Mr. B, however, is still making a profit based on the market price. The profit would be $ 7.00 ($18-$1-$10) per share.

In case, the share price of Company Y drops to $11, then Mr. B would use the put option and sell the share at $14. This way, the profit for Mr. B based on the current market price is $2.00 ($14 – $1 – $11). And his profit based on his purchase price will be $3.00 ($14 – $1 -$10).

Continue reading – Hedging vs. Speculation and Hedge Ratio.