What is the Management Discussion and Analysis?

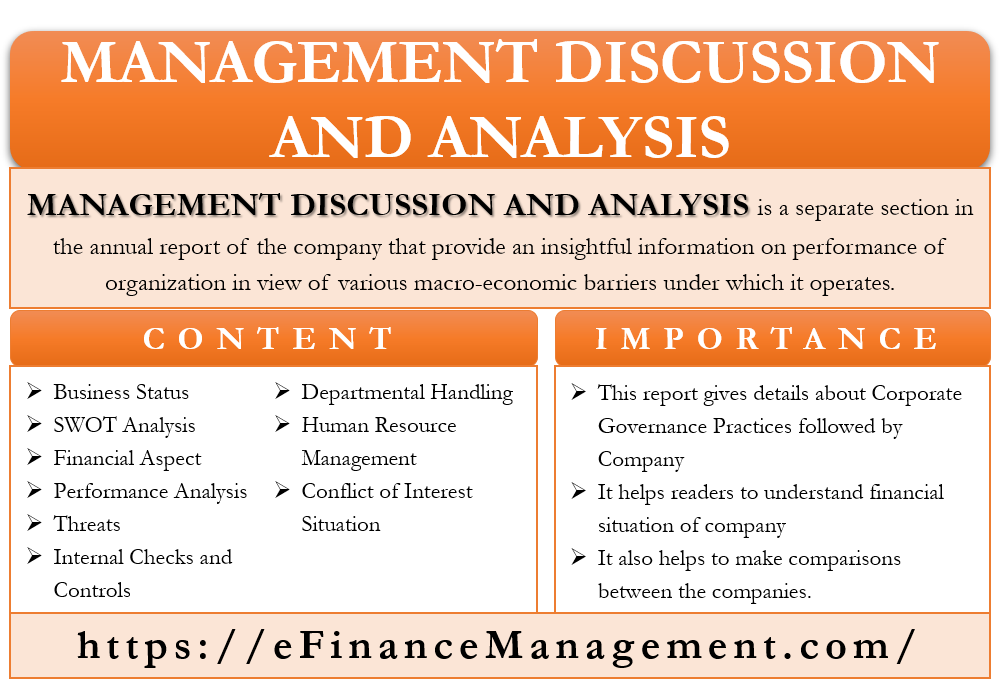

Management Discussion and Analysis is a separate section in the annual reports of the companies. It provides insightful information on the performance of an organization in view of the various macro-economic barriers under which it operates. This section helps decode the numerous financial ratios and other economic indicators for an investor. It also helps them to understand the beliefs and thinking of the management.

Management Discussion and Analysis section elaborates on the steps the company has taken to get closer to its vision. It shows the strategic intent of the management and the efforts undertaken to achieve its long-term goals. The management works continuously toward value creation, and this section elaborates on the methods and measures it undertakes to maximize value.

The section focuses on the financial aspects of the business. It throws light on what the Company has achieved financially over the plan period. It tells in detail about the current financial position of the company. Also, this section takes into account how the company has fared in its operations and human resource department. These departments are of prime importance for the success of any company and have to be taken care of. There is also a mention of the company’s future projections with regard to all these departments.

Contents of Management Discussion and Analysis

The Management Discussion and Analysis section consists of the following important points:

Business Status

Industry structure, competitive structure, and key developments in recent times with respect to the company’s business. Also, it should speak about the impact and changes in the regulatory environment or new regulations that are expected to be introduced in the near future.

Also Read: Objectives of Financial Statement Analysis

SWOT Analysis

Though no one would like to talk about its weakness. However, in an indirect manner, the report should do a proper SWOT analysis of the company. It should talk about its strengths, weaknesses, opportunities, and imminent threats.

Financial Aspects

The financial aspects of the business- its performance in the recent past and what to expect in the future. The key financial aspects of the company need to be elaborated. The report should mention any new products or portfolio the company intends to launch that can significantly lead to a rise in future revenue.

Performance Analysis

Complete performance analysis of the company. It should speak about its goals and targets for both the short-term and long-term. Also, it should give an overview of what the future should be like for the company. If any, capital expenditures to be undertaken should have been mentioned in the report. The arrangement of funds for the same and steps to manage the liquidity position should also be taken care of. If the management plans to raise funds by an issue of bonds or stock, it should be put in the report.

Threats

The threats that can affect the company in the near future. Also, the steps the management intends to take to tackle those threats. Any major change in the company’s economic environment that can affect its income from operations should have been mentioned in the report. The responsive action that the management plans to tackle the situation should be mentioned in detail.

Also Read: Three Statement Model

Internal Checks and Controls

An overview of the internal checks and controls put in place by the company. It should also tell how successful the company has been in taking care of internal errors, thefts, frauds, and other anomalies.

Departmental Handling

The report should elaborate on the company’s handling of its operations and various departments associated with it.

Human Resources Management

The report should also talk about its Human Resource Department’s performance. It should throw enough light and details on any key changes that happened or are planned in the managerial structure, if any, in the near future or past.

Conflict of Interest Situation

Any other internal matter or a conflict of interest situation that needs to be highlighted should be mentioned in the report. The management should disclose every bit of information that can create a conflict in any way to bring the utmost transparency to the company’s operations.

All of the above forms part of the Report, and all are equally important. Still, the detailing about the financial performance and management guidance about the future earnings, any changes in the capital or managerial structure, the launch of any new product, further Capex planning, etc., are the key and important information. Because this information forms the very basis of the investment analysis by the experts and investors. And accordingly, those analysts share their perception of the company’s stock prices and send their recommendations to their investor clients. Pension Funds, Mutual Funds, Investment Banks, and individual investors are basically guided by these inputs coupled with their own sourced market information.

Importance of the Management Discussion and Analysis

This report is important for an investor, creditors, lenders, and every other stakeholder in a company.

Corporate Governance Practice

The report gives details of the corporate governance practices followed by the company. It provides an overview of the management hierarchy, responsibilities that the members share, and their future planning with regard to the operations of the company. How does the company handle any complaints and whistleblower information? And how do they investigate it further?

Financial and Departmental Disclosures

It helps a reader understand the company’s financial situation and its future prospects. It also gives an insight into the strength of the operations and the human resource of the business, its capabilities, and future potential. Also, a reader can judge the transparency and standards of the disclosures made by the management. He can get an insight into the accounting methods and policies followed by the company. The report helps to do a fundamental analysis of the company.

Comparison between Companies

An investor can compare Management Discussion and Analysis reports of different companies to get a snapshot of their strengths and weaknesses. It becomes easy to compare them and helps him decide on the best company for investment purposes. The reports help an investor to get a long-term insight into the viability and future of businesses and not just the immediate present. Hence, it helps in building a long-term investment portfolio rather than just mere profit-booking.

Brief Summary

As we discussed Management Discussion and Analysis Section or Report is an integral and important part of the Annual Report (shown in financial statement notes) circulated to the stakeholders, regulatory bodies, lenders, etc. Though it is even mandatory in some countries, however, over the years, it has become a standard corporate practice across the world. And all the reputed companies do have a section on this in their Annual Accounts. The content may vary depending upon the circumstances and what the Management thinks is crucial and important to be shared. But this report, coupled with a detailed fundamental analysis, becomes the very basis for forming a critical view of the company and its management. This is very important for every investor, analyst, creditor, and lender, besides the regulatory authorities.