What is Insider Trading?

Illegal insider trading is defined by the U.S. Securities and Exchange Commission (SEC) as the “buying or selling a security, in breach of a fiduciary duty or other relationship of trust and confidence, based on material, non-public information about the security.”

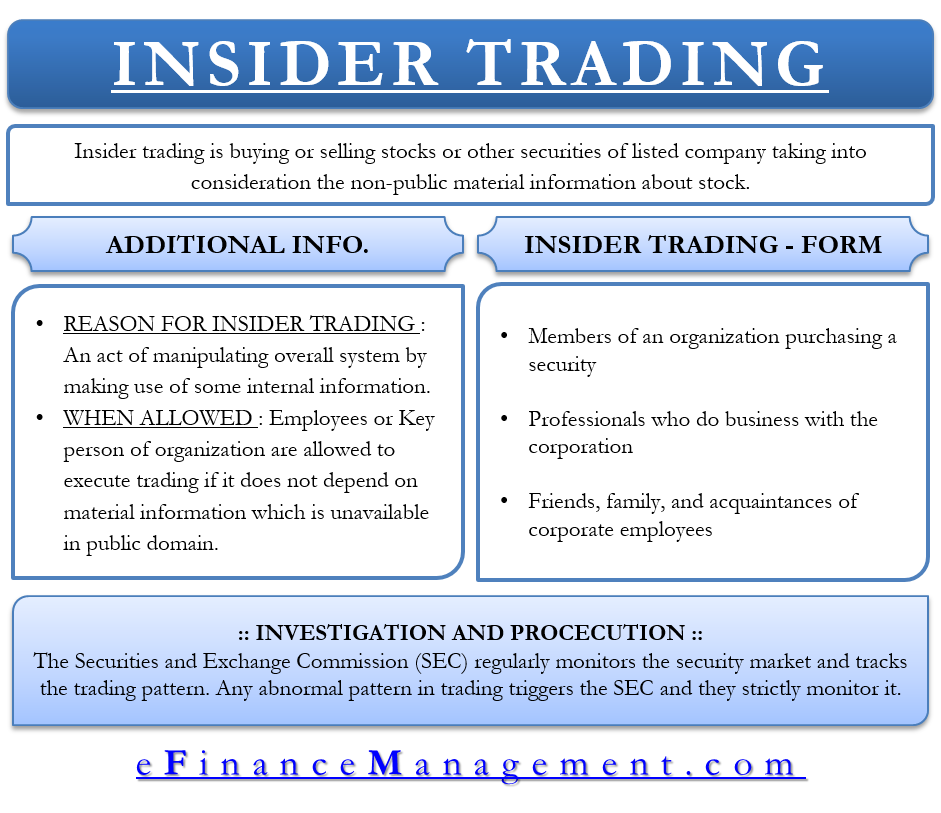

Insider trading is buying or selling stocks or other securities (such as bonds or stock options) of a listed company, considering the non-public material information about the stock. Insider trading violations may also include “tipping” such information, securities trading by the person “tipped,” and securities trading by those who misappropriate such information.

When an individual takes undue advantage of non-public information, i.e., material information that is not legally available to the public and might impact the investment decision substantially, that comes under the roof of insider trading; therefore, it is unfair as investors having insider information could make substantial profits compared to other investors who have not made profits due to non-access to such information.

What Leads to Insider Trading?

According to the efficient market hypothesis, investors should have access to equal information to be an effective investment market. These markets reward investors who can use this information in the best possible manner and invest accordingly. However, some of them opt to manipulate the overall system by making use of some information that constitutes insider trading.

When Insider Trading is Allowed?

Employees or Key persons of an organization are allowed to execute trading if it does not depend on material information that is unavailable in the public domain. It is of due importance to report such trading in many jurisdictions. For instance, trading executed by such an insider has to file Form 4 with U.S. SEC.

Forms of Insider Trading

The following ways lead to this trading

- Members of an organization purchasing a security

- Professionals who do business with the corporation

- Friends, family, and acquaintances of corporate employees

Members of an Organization Purchasing Security

Employees or key members may access the information and may misuse it in purchasing or selling the securities.

Professionals who do Business with the Corporation

Professionals like bankers, lawyers, or brokers associated with the corporations, access confidential documents and misuse the data to generate profits.

Friends, Family, and Acquaintances of Corporate Employees

Corporate employees sometimes share information related to their organization with their family or friends. These disclosures may be made innocently or are made to allow their family or friends to trade securities. This may lead to substantial profits on account of this information which might not have been available to them.

Investigation and Prosecution of Insider Trading

The Securities and Exchange Commission (SEC) regularly monitors the security market and tracks the trading pattern. Any abnormal pattern in trading triggers the SEC, and they strictly monitor it. Thus a strong market surveillance system is important to find insider trading.

Once SEC finds a different trading pattern, they vigorously pursue anyone they believe may be involved. They try to make strict surveillance. They search for financial records and wiretaps through warrants or any other means to clarify their doubts. An individual will be arrested and handed over to the U.S. attorney if strong evidence is found against him.

There are different penalties for insider trading in different jurisdictions. Prison, charging a fine, or both are the punishment for insider trading. An investor can have any of the punishments if caught for this trading. According to the U.S. Securities and Exchange Commission (SEC), an investor may have a maximum fine of $5 million and up to 20 years of imprisonment for this.

Insider trading example: Amazon Insider Trading Case

In September 2017, Brett Kennedy, the financial analyst of former Amazon.com Inc., was notified and charged for insider trading. It was accused that he passed on non-public information about Amazon’s 2015 first-quarter earnings before the release to the University of Washington alumni Maziar Rezakhani. Therefore Brett Kennedy was paid $10,000 for passing the information. Rezakhani made $115,997 just using the tip from Kennedy as per SEC.

Also, read advantages and disadvantages of insider training.

Conclusion

Thus the act of insider trading is a serious crime. Anyone thinking of using any sensitive information which is not available in the public domain may face strict consequences and end up having 20 years of imprisonment along with having fines. Therefore it is always better to stay away from such acts.

Continue reading about various other Sources of Investment Information.