SML and CML are two very crucial concepts in finance. SML stands for Security Market Line, while CML’s full form is Capital Market Line. Both SML and CML relate to the risk and return on investment. Even though the two terms sound familiar and relate to the same thing, in reality, they are very different from each other. The primary difference between the two concepts is in determining an investor’s average rate of profit or loss in a financial market. To better understand the two terms and their usability, we must know the differences between SML vs CML.

SML (Security Market Line)

Basically, SML tells about the market risk in an investment or identifies a point beyond which an investor may run into risk. Or, we can say it tells the relation between the required rate of return of security as a function of the non-diversifiable risk (or systematic risk).

In an ideal scenario of market equilibrium, all the securities will fall on the SML. A security that is above the SML line is said to be underpriced. This is because it suggests that its return is more than what is needed to offset the systematic risk with that security. Similarly, security below the SML is overpriced. This is because it is unable to give the required return to compensate for the risk.

So, we can say that SML eventually helps investors identify over or underpriced securities.

CML (Capital Market Line)

On the other hand, CML is a graphical representation that tells the rate at which the securities are providing a return. In simple words, it helps to determine the degree of profit an investor makes as per their investment. Or, we can say that CML shows the rate of returns on the basis of risk-free rates and the risk level in a portfolio. We also call it a Characteristic Line.

Also Read: SML vs CAL

In simple words, CML depicts a trade-off between the risk and return for efficient portfolios. This line represents the combination of portfolios that include the risk-free rate and risky assets. So, a portfolio on the SML would maximize the performance by optimizing the risk/return relationship.

SML vs CML – Differences

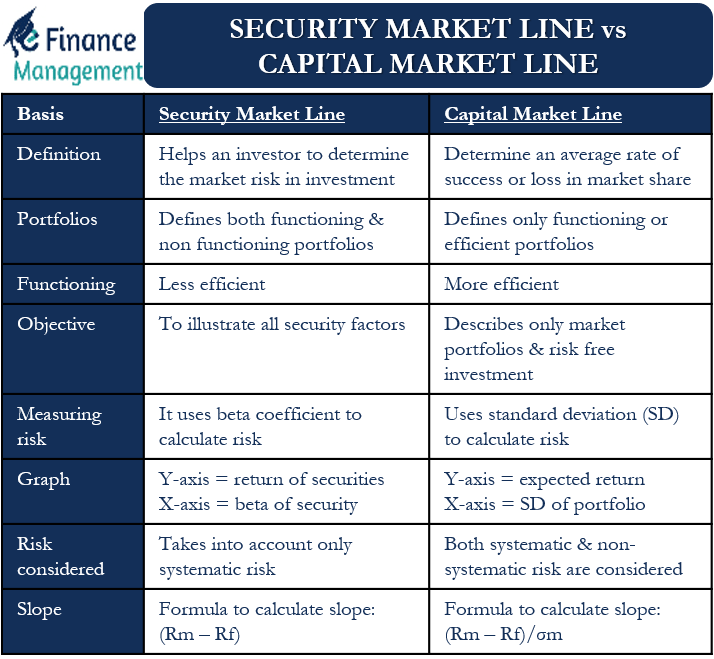

Following are the differences between SML vs CML

Definition

As said above, the SML helps an investor to determine the market risk in their investment. On the other hand, CML enables an investor to determine an average rate of success or loss in the market share.

Portfolios

SML defines both functioning and non-functioning portfolios, or we can say efficient and non-efficient portfolios. CML defines only functioning or efficient portfolios.

Functioning

SML is known to be less efficient than CML.

Objective

SML’s objective is to illustrate all security factors. On the other hand, CML describes only the market portfolios and risk-free investments.

How Risk is Measured?

SML uses the beta coefficient to calculate the risk, which, in turn, assists in determining how much security contributes to the overall risk. CML, on the other hand, uses SD (standard deviation) to calculate the risk.

Graph

In SML, the Y-axis represents the return of securities, while X-axis shows the beta of security. In CML, on the other hand, Y-axis represents the expected return of the portfolio, while the X-axis indicates the standard deviation of the portfolio.

Also Read: Security Market Line

Portfolio or Individual Securities

SML determines only all the security-related factors or the risk or return for individual stocks. On the other hand, CML determines market portfolio and risk-free assets, or the risk or return for efficient portfolios.

Superior

When it comes to measuring the risk factors, CML is superior to SML.

Risk Considered

SML considers only systematic risk, while CML considers both systematic and non-systematic risk.

Slope

In SML, the formula to calculate slope is (Rm – Rf), while the formula in CML is (Rm – Rf) / σm. The slope in SML tells the difference between the required rate of return and the risk-free rate. In CML, the slope tells about the market price of risk for efficient portfolios.

Tradeoff

SML depicts the tradeoff between the non-diversifiable risk and the required rate of return. On the other hand, CML depicts the tradeoff between expected return and total risk.

Final Words

Both CML and SML help investors and analysts to get information on the risk and return. Thus, both are very useful. An investor must refer to these financial tools to make an informed decision on the securities or investment to make.

Detailed enough, I found it useful for my exercise!