Meaning of Semi-Strong Form of Market Efficiency

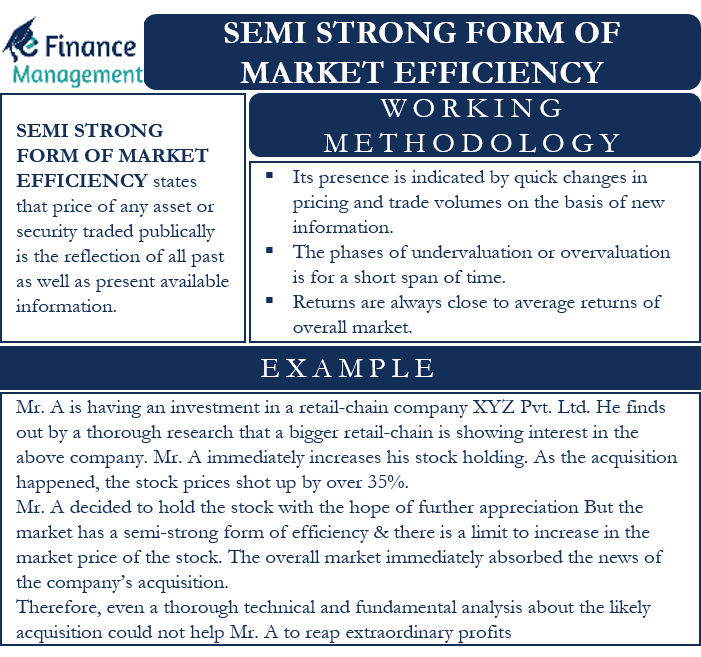

The Efficient Market Hypothesis (EMH) has three forms, Strong, Semi-Strong, and Weak. The Semi strong form of market efficiency falls in between. And it is a mid path between the weak and strong form of the Efficient Market Hypothesis (EMH). According to the theory, the price of any asset or security that we trade publicly is the reflection of all the past information as well as the present information that is available to the general public. Hence, there is no scope for making any excessive profits for an investor in the long run. This is so because the prices automatically adjust to any form of information that is available. The prices always attain fair market value levels. Also, there is a presence of numerous or many buyers and sellers.

A semi-strong form of market efficiency renders both technical and fundamental analysis irrelevant. An investor cannot make excessive long-run profits by the study of past information and historical charts. Also, the prediction of the future price and volume movements of a security or stock is of no use. Technical analysis is thus also becoming useless. All the results are out in the open for each and every investor. The previous pricing patterns cannot be of use to make future extraordinary gains.

Similarly, an investor cannot make excessive profits in the long term by the fundamental analysis of the company. The financial statements and results of every company are also available publicly. Other factors such as interest rates, competition, production capacity, return generation capacity, etc., are also known to each and every investor. However, there is some possibility of making extraordinary gains. This can be done by making use of non-public information or insider information.

What is the working methodology of such a form of market efficiency?

A semi-strong form of market efficiency reflects price and volume variations in response to any specific information. A quick change in the pricing and trade volumes on the basis of new information indicates the presence of a semi-strong form of market efficiency. New information can relate to a number of events such as a change in the management and control of the company, dividends and bonus issues, merger or acquisition by another company, change in rules and regulations, government change, legal changes, etc.

Also Read: Weak Form of Market Efficiency

According to this theory, stocks and securities see the phases of undervaluation or overvaluation only for a very short span of time. Such stages are temporary, and markets efficiently react to such a situation. The prices again go back to the fair market value. Thus, returns are always close to the average returns of the overall market. There is a presence of outliers- those who make extraordinary gains and also those who suffer extraordinary losses. But the overall return is in the mid-level or market average level.

Also, read how weak-form of market is different from semi-strong form markets.

Example

Mr.A has an investment in the stock of a retail-chain company XYZ Pvt. Ltd. The company has strong financials, and the numbers show a consistent rise in its profits every quarter since the last two years. Mr. A also does thorough research on the company’s management, and it promises a good potential for future growth.

A bigger retail-chain giant starts showing interest in the above company. Mr. A immediately increases his stock holding in the company with the expectation of substantial appreciation of the company’s stock price in case of an acquisition. The acquisition happens very soon, and the stock prices shoot up by over 35%.

Mr. A decides to hold the stock with the hope of further appreciation of the stock value of the company. But the market has a semi-strong form of efficiency. There is a limit to an increase in the stock’s market price, and it is non-sustainable. The overall market immediately absorbs the news of the company’s acquisition. The price of the stock again falls back to its average levels, and any chances of making extraordinary gains are over.

Also Read: Strong Form of Market Efficiency

Mr. A is surprised as the stock price gets back to its fair market value or its average price. He misses out on the opportunity of selling the stock at a high price and making a quick short-term profit from the situation. Therefore, even a thorough technical and fundamental analysis coupled with advance information about the likely acquisition could not help Mr. A to reap extraordinary profits from the investment in the long run. A semi-strong form of market efficiency immediately wipes out such chances and brings back the price at market median levels.

Read factors affecting efficiency in the financial market.