Systematic risk occurs due to macroeconomic factors. It is also called market risk or non-diversifiable or volatility risk as it is beyond the control of a specific company or individual and hence, can’t be diversified. All investments and securities suffer from such a type of risk. One can’t eliminate such a risk by holding more number of shares.

This risk includes all the unforeseen events that happen in everyday life, thus, making it beyond the control of the investors. Systematic risk impacts the entire industry rather than a single company or security.

Systematic Risk Example

For example, inflation and interest rate changes affect the entire market. So, one can only avoid it by not investing in any risky assets. More examples of systematic risk are changes to laws, tax reforms, interest rate hikes, natural disasters, political instability, foreign policy changes, currency value changes, failure of banks, and economic recessions.

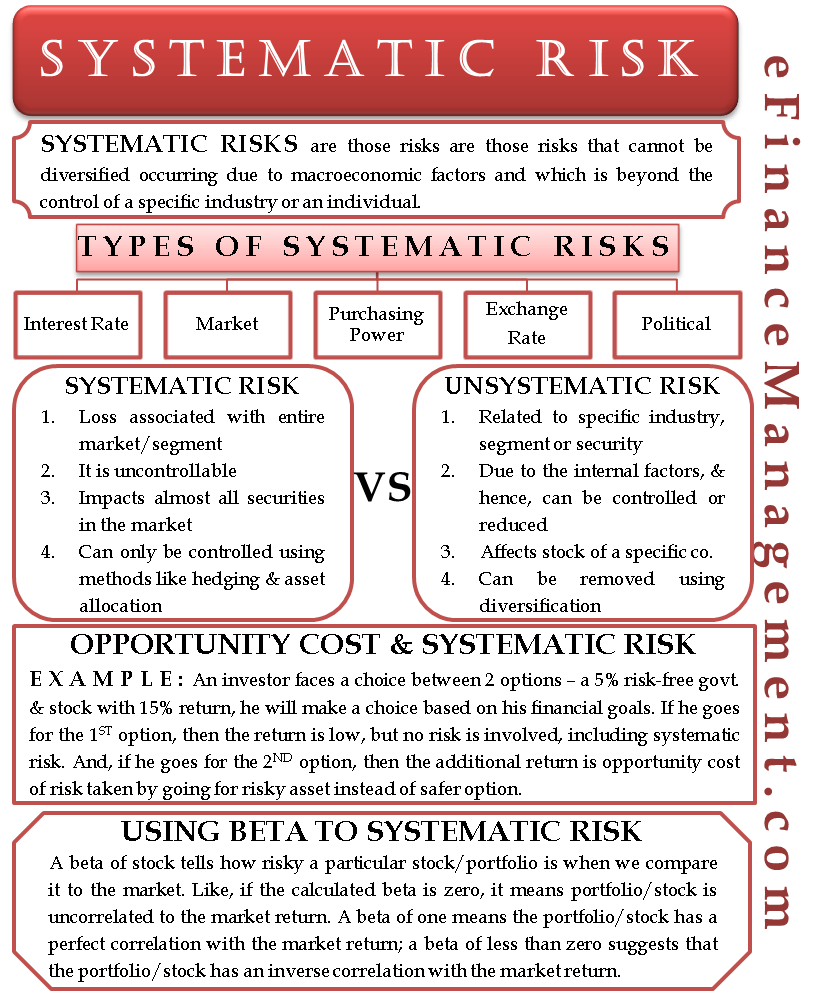

Difference between Systematic and Unsystematic Risk

To get a more thorough understanding, we need to understand the difference between systematic and unsystematic risk. Unsystematic or “Specific Risk” or “Diversifiable Risk” or “Residual Risk” are primarily the industry or firm-specific risks that are there in every investment. Such risks are also unpredictable and can occur at any time. Like, if workers of a manufacturing company go on a strike resulting in a drop in that company’s stock price.

Also Read: Systematic Vs Unsystematic Risks

Following are the differences between the two:

- Unsystematic risk is related to a specific industry, segment, or security, while Systematic risk is the loss associated with the entire market or the segment.

- Unsystematic risk is due to internal factors and can be controlled or reduced. Systematic risk, on the other hand, is uncontrollable.

- Unsystematic risk affects a specific company’s stock, while systematic risks impact almost all securities in the market.

- We can remove unsystematic risk using diversification. However, one can control systematic risks using only hedging and asset allocation methods.

Types of Systematic Risks

Interest Rate Risk

Such kind of risk is the result of a change in the market interest rate. It mainly impacts the fixed income securities as bond prices are inversely related to the interest rate.

Market Risk

It is the result of the general tendency of the investors to move with the market. So, it is basically the tendency of security prices to move collectively. For instance, in a falling market, the stock price of even the best-performing company drops. Usually, market risk accounts for about two-thirds of total systematic risk.

Purchasing Power Risk

Also called the Inflation Risk occurs due to the erosion in the purchasing power of money. Inflation is the rise in the general price level, meaning the same amount of money buys fewer goods and services. So, if the income of the investor fails to keep pace with the rising inflation, then in the real term, he is earning less than before. Similar to the interest rate risk, purchasing power risk also mainly affects the fixed income securities because the income from such securities is fixed.

Exchange Rate Risk

This risk stems from the uncertainty in the changes in the value of the currencies. So, it affects only the companies doing foreign exchange transactions, like export and import companies.

Political Risk

Political risk occurs primarily due to political instability in a country or a region. For instance, if a country is at war, then the companies operating there would be considered risky.

Opportunity Cost and Systematic Risk

Since systematic risk is non-diversifiable, investors demand a premium to make up for this risk factor. For instance, if risk-free government security is giving a 5% return, then an investor expects to make more than that from the equity investment, like 8%. This difference of 3% (or a premium of 3%) is for assuming the systematic risk.

So, systematic risk can also be viewed as the opportunity cost for selecting one security over another. For instance, if an investor faces a choice between two options – a 5% risk-free government and a stock with a 15% return, he will make a choice based on his financial goals. If he goes for the first option, then the return is low, but no risk is involved, including systematic risk. And, if he goes for the second option, then the additional return is the opportunity cost of the risk taken by going for the risky asset instead of the safer option.

Using Beta to Systematic Risk

Another name for systematic risk is volatility risk. And we can measure volatility in security by the sensitivity of a security’s return with respect to the market return. This sensitivity is captured, which is calculated by regressing a security’s return against the market return.

So, a beta of stock tells how risky a particular stock or portfolio is when we compare it to the market. Like, if the calculated beta is zero, it means the portfolio/stock is uncorrelated to the market return; if the beta is greater than zero but less than one, it means the portfolio/stock return has a positive correlation with the market return, but the volatility is lower; if the beta is greater than one, then the portfolio/stock has a positive correlation with the market, but volatility is higher. In this case, if a stock’s beta is 1.2, then it is 20% more volatile than the market.

A beta of one means the portfolio/stock has a perfect correlation with the market return; a beta of less than zero suggests that the portfolio/stock has an inverse correlation with the market return.

Though it is impossible to avoid systematic risk, diversifying investments can reduce its effect. So, if one investment fails, then the return from the others could help compensate for it. Moreover, one can also lessen such risk by efficiently using resources and regularly updating the portfolio based on the overall market scenario.

Continue reading – Systemic Risk vs. Systematic Risk.

This is very important information in Financial Market Sector.