Understanding International Monetary Market

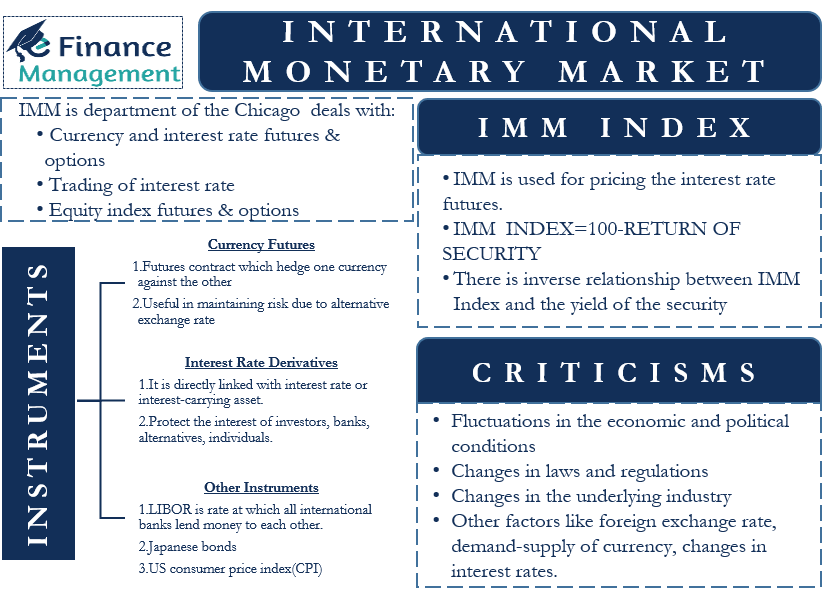

International Monetary Market (IMM) is one of the four departments of the Chicago Mercantile Exchange (CME), which deals with currency and interest rate futures & options. It is a division of CME, where trading of various currencies like US Dollar, Canadian Dollar, British Pound, Euro, Swiss Franc, etc., takes place. Apart from trading of these currencies, trading of interest rates and equity index futures & options (F & O) also takes place in IMM.

International Monetary Market was established in the year 1972 by Chicago Mercantile Exchange. The main purpose of the establishment of IMM was to provide the customers of the Chicago Mercantile Exchange with a marketplace for trading in the international futures market. The functioning of IMM started with trading in currency futures. Eventually, it has expanded by trading in interest rate derivatives, stock indexes, London Interbank Offer Rate (LIBOR), US Consumer Price Index (CPI), and 10-year Japanese Bonds.

International Monetary Market is the biggest futures exchange in the USA, which is regulated by the US Commodity Futures Trading Commission.

IMM Index

IMM index, which is developed by International Money Market, is used for pricing the interest rate futures. The computation of the IMM Index takes place by subtracting the return (yield) of the security in percentage form from the par value, mostly 100. The IMM Index and the yield of the security have opposite relationships. If the yield of the security increases, then the IMM Index decreases, and if the yield decreases, then the IMM index increases. The other name of the IMM Index is IMM Quote Convention.

Let’s understand this with an example:-

ICE LIBOR rate for 6 months (yield) = 0.60%

IMM Index = 100 – yield

International Monetary Market Index = 100 – 0.60

IMM Index = 99.4

In the above case, the IMM Index of the ICE LIBOR rate for 6 months period is 99.4.

IMM Date

IMM Date is the date at which the futures and options contract have their termination or maturity. These maturity dates are mostly fixed in nature and terminate or mature after every quarter. This maturity or termination mostly occurs on the third Wednesday of every quarter. Trading of the security stops on Monday, just before the third Wednesday. These four-quarter ending months are mostly March, June, September, and December. Not only Chicago Mercantile Exchange but many other Over-the-Counter (OTC) Exchanges also functions on IMM dates.

Instruments of International Monetary Market

Following are a few financial instruments whose trading takes place in the International Monetary Market:-

Currency Futures

Currency Futures are the most popular financial instrument whose trading takes place on IMM Exchange. These are futures contracts that hedge one currency against the other. Currency Futures are often useful in mitigating the risk due to alterations in the exchange rate. These contracts project price in one currency, and buying or selling of the same takes place in some other currency on a future date. The rate of these futures contracts is dependent on the spot rates of the currency set (like USD/EUR). The functioning of the International Monetary Market started with this financial instrument only.

Interest Rate Derivatives

Interest Rate Derivatives are the second most popular instrument in the IMM Exchange. It is a financial instrument directly linked to an interest rate/s or some interest-carrying asset. This instrument is useful in minimizing the risk occurring due to interest rate alterations. It is a hedging instrument to protect the interest of investors, banks, corporate, individuals, or any other party. These derivatives can be in the form of swaps, futures, or even options.

Other Instruments

Apart from Currency Futures and Interest Rate Derivatives, there are other instruments whose trading takes place in the International Monetary Market. They are as follows:-

LIBOR stands for London Interbank Offer Rate. This is the rate at which all international banks lend money to each other in the international banking industry. IMM deals with LIBOR and LIBOR based instruments

Also Read: International Money Market

Similarly, there are futures and options contracts linked with the US Consumer Price Index (CPI), which are traded in IMM. Trading of 10-year Japanese Bonds also takes place in the IMM.

These financial instruments are non-exhaustive in nature.

Criticisms of International Monetary Market

There are a few criticisms of the International Monetary Market; they are as follows:-

- Fluctuations in the economic and political conditions directly influence the instruments trading in the International Monetary Market. These external factors impose a high risk on this market.

- Other fluctuations like changes in laws and regulations might also impact negatively. The IMM has to abide by regulatory authorities.

- International Monetary Market is a derivatives market. As a result of this, the demand and supply of such commodities impact this market.

- Changes in the underlying industry or the financial market hamper the IMM.

- Other factors like price levels of commodities, foreign exchange rate, supply-demand of currency, changes in interest rates, etc., directly impact the instruments in this market.

These criticisms are non-exhaustive in nature.

International Monetary Market in General Sense

In a general sense, International Monetary Market (the other name is Forex Market) is a marketplace where countries exchange currencies with one another. Banks are the major players in Forex Market, which are actively trading on currencies. Major Banks currently actively working in this market are the Deutsche Bank, UBS Group AG, Merrill Lynch, Citigroup, JP Morgan Chase, etc. Often this market is useful to determine the exchange rates by making pairs of currencies. Like, USD/JPY depicts the exchange rate between US Dollars and Japanese Yen. Similarly, USD/EUR depicts the exchange rate between US Dollars and Euro.

Irrespective of all this, the biggest risk of this market is the volatility of currencies. Soft currencies, mostly from developing countries, are highly volatile in nature and throw the biggest risk on this market.

To learn about its system, visit our article International Monetary System.

Conclusion

International Monetary Market (IMM) is the biggest futures exchange in the USA. IMM gave a marketplace to all the investors to conduct trading in the derivatives market. Irrespective of a few criticisms regarding the industry and the exchange, IMM plays a crucial role in the Finance Industry.