Forward Rate Agreement or FRA’s are very similar to the forward contracts. In FRA, one user agrees to lend or borrow to another a specific amount of money at a future date and a fixed rate. These agreements are good for investors who want protection against unfavorable interest rate movements.

Basically, in the FRA, the parties agree on a specific interest rate starting from a future date for a specific period. The buyer enters into an FRA to get protection from any future rise in the interest rate. The seller enters into FRA to get protection from dropping interest rates.

Assume there are two parties, Mr. A and Mr. B, who forge an agreement. A agrees to lend a sum of $10,000 to B after 1 month for 2 months at an interest rate of 2%. In this case, the settlement date is after 1 month. This is because only after 1 month A would give money to B.

FRA’s are generally quoted on the basis of the settlement date and the interest period. Our above example indicates the settlement date is 1 month forward. The contract, however, would end after 3 months (1 month + 2 months). So, this FRA will be called 1*3 FRA.

Forward Rate Agreements are OTC contracts (over-the-counter). This means the parties can customize it as per their requirements. Generally, an FRA depends on the LIBOR rate.

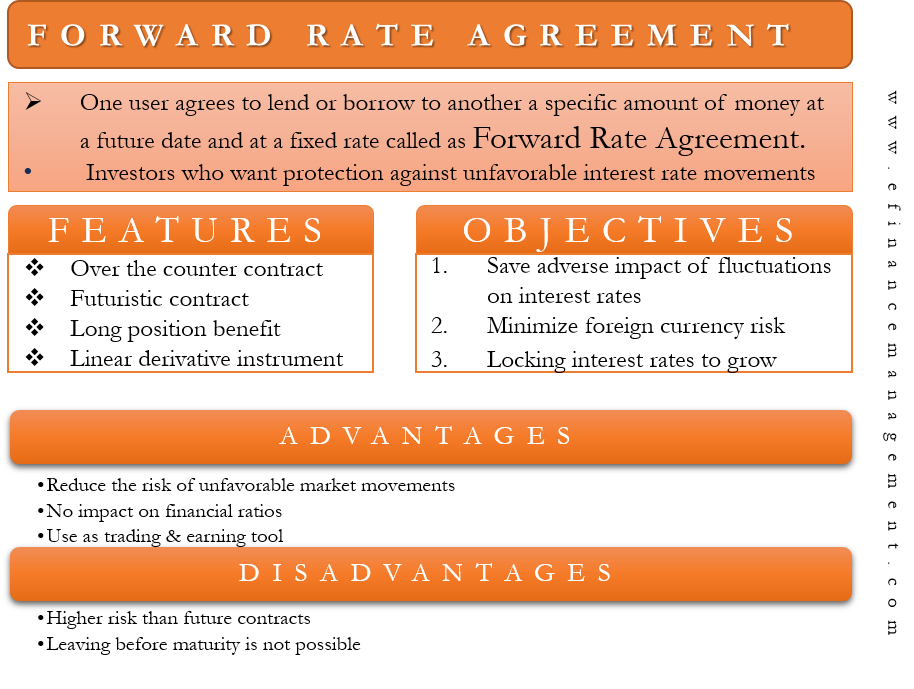

Features of Forward Rate Agreement

Following are the unique features of the forward rate agreements:

- These are OTC contracts, and this is what makes them different from the futures

- Since these are futuristic contracts (all transactions happen on the future date), the contracts remain notional. And that is why there is no exchange of principal at the due date.

- The long (or borrower) position benefits when the rates go up. At the same time, the short position is beneficial to the lender when the interest rates are on a downward trend.

- They are Linear Derivative Instruments. Or, we can say that they derive value from the underlying security.

Forward Rate Agreement – How it Works?

In FRA, the user lending an amount has a short position, while the borrower has a long position. An important thing about the FRA contract is that the settlement is in cash. This means the users do not actually lend or borrow the amount. Instead, the interest rate in the FRA is compared with the ongoing LIBOR rate.

If the FRA rate is more than the LIBOR rate, then the borrower has to pay the lender for the difference in the interest rate. And, if the FRA rate is less than the LIBOR rate, then the borrower could effectively get money at less than the market rate. A point to note is that the payment eventually compensates only for the changes in the interest rate after the contract date. There is no involvement of the principal amount.

Objective of Forward Rate Agreements

The primary motive behind entering into an FRA is to lock in the interest rate for the future and save the adverse impact of fluctuations in the interest rate. For example, a commercial bank plans to come up with CDs (certificates of deposit). The bank, however, expects the rate to go up. So, to minimize the risk, it can lock the current rate by entering into a forward rate agreement.

Also Read: Forward Contract

In case the interest rate does rise, then the bank would get the payment through FRA that compensates for the higher interest.

Apart from locking the interest rates, one can also use FRA to lock in the price of short-term security. One can do it in the following ways:

- If you are making an investment, then you sell the FRA to protect against the risk of a drop in interest rates. This would eventually raise the price of your investment.

- If you are selling an investment, then you need to buy the FRA to protect yourself from the risk of a rise in interest rates.

Also, one can use it to minimize foreign currency risks. For example, a businessman is expecting a foreign currency payment within a month from now. So, to protect himself from the risk of currency fluctuation, the businessman can lock the present currency rate by going for FRA.

Example and Calculation

Let us consider a simple example to know payment calculations in the FRA.

Assume there is a 2*5 (2 months after for a period of 3 months) FRA on a notional amount of $50,000 at a 5% interest rate. In this, the settlement date is after 2 months on the basis of 60-day LIBOR.

Now suppose on the settlement date, the actual 60-day LIBOR rate is 7%. This means the borrower would be able to get the money at 5%, or 2% less than the market rate.

The total saving in this case would – $50,000 * 2% * 90/360 or $250.

The borrower would save $250 by entering into an FRA. However, we need to make one more adjustment to get the accurate value. The settlement in FRA is on a cash basis, and settlement takes place on a pre-decided date. But, the saving above is after the duration of the loan (in the above example, after 3 months).

So, the present value of the expected savings needs to be calculated to determine the accurate quantum of savings. We can take the ongoing LIBOR rate as the discount rate.

The present value would be $250/ (1+0.07)^(90/360) = $245.8069

Advantages and Disadvantages of Forward Rate Agreement

Following are the advantages of FRA:

- It helps the parties to reduce their risk of any borrowing and lending in the future from unfavorable market movements.

- One can also use FRA for trading and earning on the basis of interest rate expectations.

- They are off-Balance Sheet items. Thus, they have no impact on financial ratios.

Following are the disadvantages of FRA’s:

- As FRA’s are OTC contracts, they carry a higher amount of risk than futures contracts.

- In case a party wants to close the contract before maturity, then it may be difficult to find another party if the original party isn’t willing to do that.

Common Questions About FRA’s

Following are some common questions (with answers) that users’ have about FRA’s:

How much does an FRA cost?

As such, there is no direct cost with the forward rate agreement. We can say that the cost is basically the interest rate at which the parties agree. This FRA rate depends on the terms of the FRA.

What if I change my mind after entering into FRA?

After you enter into FRA, your expectation of the interest rate change, then you have two options.

The first option is you can suspend the FRA agreement. In this case, there would be a need to calculate the residual value, which you have to pay to the other party, or the other party should pay you. This value is on the basis of the interest rate at the time of termination of the contract.

Another option is you need to enter into an opposite FRA carrying the same terms. This would cancel the original FRA. Here also, the party would have to pay the residual value.