When a company decides to terminate an operation, it liquidates all its assets. These assets include not just inventory but also machines, buildings, and other financial assets it has. The objective of the company is to accumulate funds by liquidating all the assets to pay all its debts and use the remaining assets/distribute the available funds to pay a dividend to the shareholders in the form of a liquidating dividend.

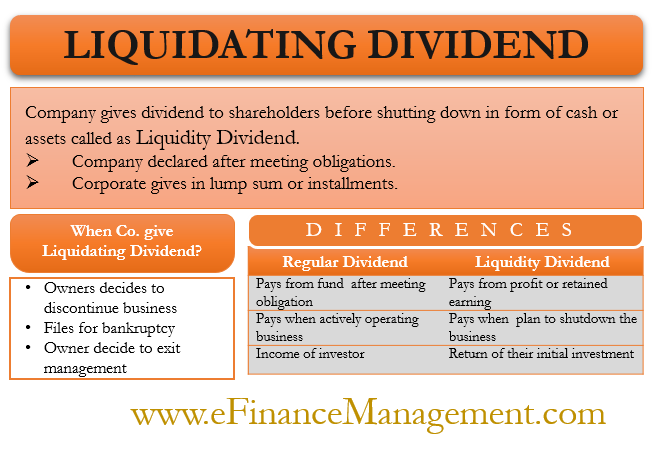

So, liquidating dividends (or liquidating distributions) is the type of dividend, either in cash or assets, that a company gives to its shareholders before fully shutting down. A company pays this dividend in excess of its accumulated earnings.

A company gives such a dividend only after meeting its other obligations, such as creditors and other debts. So, we can say that providing such a dividend is one of the last activities that a company performs before shuttering down.

A corporation may give this dividend to the shareholders in one lump sum or installments. In the U.S., a company paying such a dividend would issue Form 1099-DIV to the shareholders. This form carries the information about the dividend and their treatment.

Also Read: Cash Dividend

When do Companies Give Liquidating Dividend?

A company pays such a dividend if it believes that it is no longer viable to continue its operations. Also, it may be the case that the current owners don’t want to run the business and thus, want to close the business. Usually, there are two scenarios in which a company can pay liquidating distributions to the shareholders:

- When a company files for bankruptcy and believes it is the best course of action.

- When the owners decide to exit the management and sell it to another firm.

Basically, by giving liquidating dividends, the company tries to return the original capital of the shareholders back. This dividend could be more or less than the shareholders’ original capital.

Liquidating Dividend vs. Regular Dividend

Liquidating dividend is very different from the regular dividend that a company pays to its shareholders. Following are the differences between the two:

- A company pays a regular dividend from its profits or retained earnings. On the other hand, the company pays liquidating distributions from the funds it is left with after meeting its entire obligations assuming a complete closure. Usually, a company pays this dividend from its capital or from the investment by the shareholders.

- A company pays a regular dividend when it is actively operating business and plans to continue business for the foreseeable future. On the other hand, a company pays liquidating distributions when it plans to shut down the business.

- The regular dividends are a source of income for the investors, while the liquidating dividend is the return on their initial investment.

- There is a difference in the tax treatment of both dividends as well. The regular dividends are taxable, while the other dividend is not. This is because the liquidating distributions are a return of the initial investment to the shareholders. If investors do not get their full investment back, they will have to show it as a reduction of their investment value. On the other hand, if they get more than their initial investment, then the excess would be the capital gain. Investors will have to treat it as a short or long-term capital gain depending on if they held the shares for more than a year or not.

| Basis | Regular Dividend | Liquidating Dividend |

|---|---|---|

Source |

Profits or retained earnings | Funds left after meeting other obligations |

Continuity of Operations |

Paid when the company is actively operating business | Paid when the company plans to shut down the business |

Income |

Source of regular income | Return on an initial investment |

Taxability |

Taxable | Non-taxable |

Example

Let’s consider a simple example to better understand the concept of liquidating dividends.

Company A has retained earnings of $300,000, while it has a paid-up capital of $10,000,00. The company is going out of business and declares a dividend of $3 per share. Company A has 300,000 outstanding shares.

In this case, the total dividend will be – $3 * 300,000 shares = $900,000

Company A will first use its retained earnings and the balance from its capital base to pay this dividend. So, Company A will use all $300,000 of its retained earnings and the remaining $600,000 ($900,000 less $300,000) from its capital base.

The $3 dividend is not a wholly liquidating dividend. Instead, it includes a regular dividend as well. As said above, the liquidating distribution is in excess of the accumulated earnings. This means the dividend that Company A pays from the retained earnings is the regular dividend, and the rest is the liquidating distribution.

So, the regular dividend will be = $300,000 retained earnings / 300,000 shares = $1.

Thus, in this case, $1 is the regular dividend, and the remaining $2 ($3 less $1) is the liquidating dividend.

Quiz on Liquidating Dividend

This quiz will help you to take a quick test of what you have read here.