Contango and backwardation are the terms used in the futures market to describe two different situations. In both cases, the situations pertaining to the prices of a security or a commodity in the futures market. In the below discussions, we will attempt to appreciate and understand the differences between contango vs backwardation. But for better clarity, in the next paragraph, let us first define the common terminologies used in the futures market.

The spot price of a commodity or security is the price at which the commodity or security is available for immediate purchase and delivery. In other words, the prevailing market price of the security or commodity is the spot price. On the other hand, the futures price is the price at which the commodity is trading in the futures market for its actual delivery on a future date (can be a year, six months, etc.).

So, when you buy or sell something at the futures price, you just make an agreement to conduct the transaction on that future date. The futures market is thus the expectation of the difference between the current price and the futures price of a commodity or security. And that is the basis for all the futures contracts. Here the participants would expect to earn money by predicting this difference in their favor. So, if the futures price is higher and the spot price is lower, the basis will be negative.

What is Backwardation?

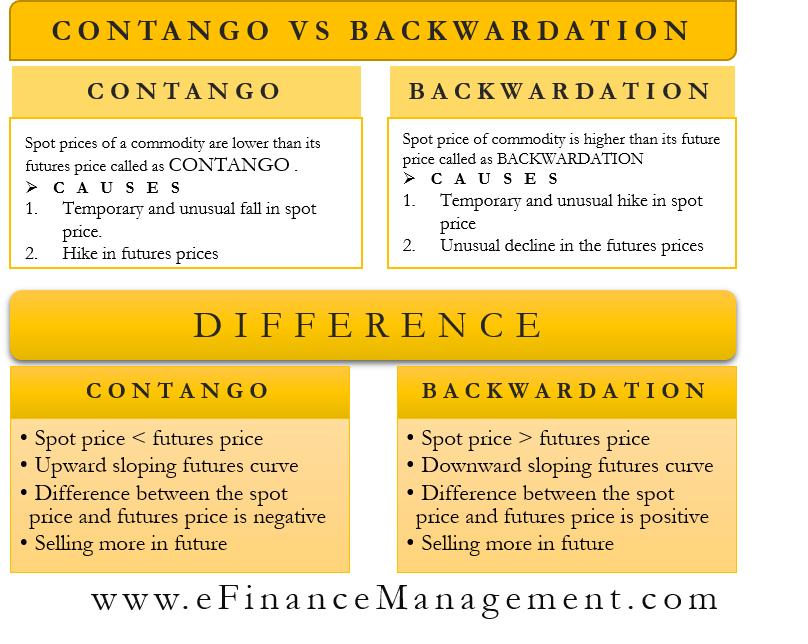

Backwardation is when the spot prices of a commodity are higher than its futures price. So, for example, if the spot price of gold today is $1500/oz and its futures price is $1400/oz, we have the situation of backwardation. Backwardation can be a result of two kinds of movements in commodity prices.

Also Read: Backwardation

- Backwardation can occur because of a temporary and unusual hike in the spot prices. This unusual hike in prices can be due to a temporary shortage in the supply of the commodity. This shortage, the traders expect, will balance back in the future. For example, a natural disaster like a flood may wipe out most of the supply of a commodity. Or, it can be because of a temporary or seasonal hike in demand. This, again, the traders expect will come down and normalize in the future.

- Another cause of backwardation can be an unusual decline in the futures prices. This unusual decline in futures prices can be due to an oversupply of a commodity on its way. For example, the government will import a large quantity of a particular commodity. If the demand remains stable and the supply gets excessive, traders know that the prices will dive down. Or, the unusual decline in futures prices may come out of a heavy demand projection for the future.

What is Contango?

Contango is actually the opposite of backwardation. In contango, the spot prices of a commodity are lower than its futures price. So, for example, if the spot price of gold today is $1500/oz and its futures price is $1700/oz, we have the situation of contango. Contango can be a result of two kinds of movements in commodity prices.

- Contango can occur because of a temporary and unusual fall in the spot price of a commodity. This unusual fall can be a result of a temporary oversupply of some commodities in the market. For example, in 2015, when the world discovered some new sources of crude oil supply, crude oil prices fell sharply. After a time, the traders expect that the market will absorb this excess supply, and the supply and demand will balance back, bringing back the prices to normal levels. Or, this unusual fall can be because of the temporary decrease in demand for the commodity. This temporary fall can be because of some seasonal variables which will restore going forwards.

- Another cause of contango can be a hike in future prices. This hike may be usual or unusual, depending upon the situation. For example, gold and crude oil prices ‘usually’ keep moving upwards. So, for these kinds of commodities, contango is a very normal scenario. Or, this hike in prices can be because of some unusual demand. An example of unusual demand can be Warren Buffet saying that he sees prices of gold moving upwards in the futures market. More and more investors will then invest in gold futures, taking the price upwards. This can also happen when the central banks of the various countries start buying and accumulating gold from the market.

Contango vs Backwardation: Key Differences

- In contango, the spot price is lesser than the futures price. At the same time, backwardation is just the opposite of this, a scenario where the spot prices are higher than the futures price.

- Since the futures price is higher in contango, we get an upward sloping futures curve. Whereas in backwardation, since the futures prices are diving down, we get a downward sloping futures curve.

- In contango, the basis (the difference between the spot price and futures price) is negative since the spot price is lower and the futures price is higher. On the other hand, in backwardation, this basis is positive since the spot price is higher compared to the futures price.

- In contango, investors typically react by selling more in futures, as the commodity is selling at a premium considering the lower spot prices. In backwardation, investors typically react by buying more in the future since the commodity is available at a discount.

How to Traders use Contango and Backwardation to their Advantage

During Contango

Traders obviously know how to benefit from both situations in the market. It is just the approach that must change in order to enter into successful contracts in both situations. So, in contango, the spot prices are lower and the futures prices are higher. Knowing this, traders start purchasing the commodity at the spot price and enter into a futures contract. Since the futures price of the commodity is higher, the trader will benefit upon maturity of the futures contract when he is selling the commodity at this higher price.

Investors, however, know, that there is a cost of carry involved in this strategy. So, in a contango situation, when you purchase the commodity at its spot price and enter into a futures contract maturing in one year, you will have to keep the commodity in good shape. This means, that you might have to rent a godown (warehouse) to keep the physical inventory. Additionally, you need to get insurance cover for your stock, another cost. Apart from these two, you will not be able to invest the same money in any other investment opportunity, at least bank interest, for one year. Investors take all these costs into consideration before investing their money.

During Backwardation

In backwardation, on the other hand, spot prices are higher and the futures prices are lower. If the traders expect that the spot price of a commodity will go down in the future, they will enter into a futures contract. Expecting that the spot price will fall down from the current high, they think they will purchase the commodity at the lower spot price to make the delivery. Here, they are running the risk of spot prices not going down or going even higher, because of some unexpected event. If this happens, the trader will have to purchase the commodity at an even higher price to make the delivery.