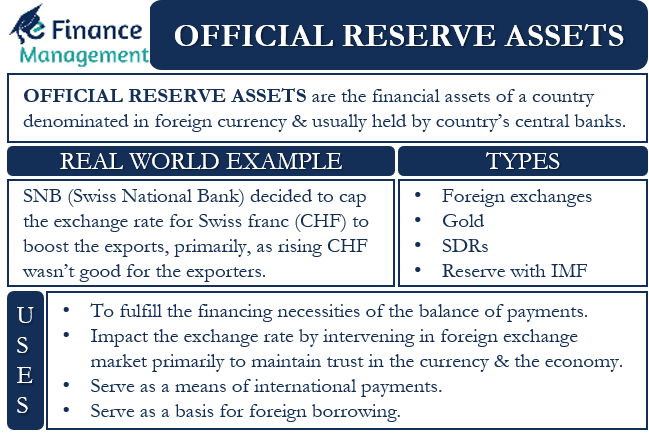

Official Reserve Assets are the financial assets of a country. These assets are denominated in foreign currency and are usually held by the country’s central banks. The central banks use these assets to fulfill the financing necessities of the Balance of Payments (BOP).

Or, we can say these are the assets that a nation can use as international means of payment. The central bank can also use these assets to influence the currencies exchange rate and meeting other similar policy objectives.

Before the Bretton Woods agreement in 1971, gold was the reserve asset for most countries. Now, along with gold, countries keep other assets in reserves as well. Reserve assets usually include currencies, commodities, and other financial capital. These assets are readily available to a country’s monetary authorities and are easily transferable.

The official reserve assets of the U.S. have been fluctuating since the start of this century. For instance, the reserve assets were $128.4 billion in 2000, $527.37 billion in 2012, and $407.22 billion in 2016.

Types of Official Reserve Assets

Official Reserve Assets include foreign exchanges, gold, SDRs (special drawing rights), and reserves with the IMF. These are assets that can be readily converted and used for payments.

Among these, foreign exchanges usually account for a chunk of the reserve assets. It is important that foreign exchange reserves include tradable currencies, such as USD, euro, and others. The Malaysian ringgit is non-tradable. A tradable currency is one that you can buy and sell in any country. China holds the largest foreign exchange reserves globally. USD is the most popular currency; thus, most central banks hold a significant amount of USD in reserve.

The gold includes gold bullion, as well as unallocated gold accounts. The practice is to value these gold assets and prevailing market prices.

Talking about the reserves with the IMF, this includes the reserves a country has with the IMF, loans to IMF, the reserve tranche, and more.

SDRs (Special Drawing Rights) are an international reserve asset from the IMF. These SDRs of a country are in addition to, or they add to the reserve asset of the country. Therefore, SDRs supplement the reserve assets. Through SDRs, the member countries can receive a foreign exchange or other reserve assets in exchange for those SDRs in times of need. IMF has decided on a quota of SDRs amongst the member countries, and the allocation happens in line with that proportion.

Also Read: International Money Market

Official Reserve Assets may also include financial derivatives. These are the financial securities that are related to another specific financial security. Such assets basically help to manage the risk of other reserve assets.

Uses of Official Reserve Assets

The central bank or other authorities can use these assets for:

- To fulfill the financing necessities of the balance of payments.

- To maintain the trust in the currency and the economy of the country. At certain times it is used to influence the prevailing foreign exchange rate. This is done by the government or the central bank, or monetary authorities by forced intervention in the foreign exchange market. For example, if the USD is too strong, the FED might sell USD to bring down its value. However, using Official Reserve Assets is very rare as central banks leave the determination of exchange rate to the market forces.

- These assets also serve as a means of international payments.

- These assets also serve as a basis for foreign borrowing.

Real-World Example

During 2011 and 2015, the SNB (Swiss National Bank) decided to cap the exchange rate for the Swiss franc (CHF). This was done primarily to boost the exports as rising CHF wasn’t’ good for the exporters.

For this, SNB took to printing more francs. Thereafter through those francs, purchases happened for the euro and other foreign currencies. This led to a drop in the value of the franc, but the SNB’s reserves ballooned by $64 billion in comparison to the earlier year. Later, the bank ended intervention in the exchange market, resulting in a sharp rise in the value of CHF.

Final Words

Official Reserve Assets are very crucial for an economy. In a way, the amount of reserve assets a country has speaks a lot about its financial clout. Or, the more reserve assets a country has, the richer it is.

Also read – Official Reserve Account

Quiz on Official Reserve Assets

Let’s take a quick test on the topic you have read here.

RELATED POSTS

- International Monetary System: Meaning, Evolution, Advantages, Criticisms and More

- What are the Characteristics of the International Money Market?

- Cash Reserves – Meaning, Importance And How To Calculate It

- Hard Currency – Meaning, Importance, Key Hard Currencies, and Qualification

- Fixed Exchange Rate – Meaning, Pros, Cons Examples, and More

- Current Account Balance of Payments