Soft Money Vs Hard Money: All You Need to Know

The significance and relevance of the terms soft money and hard money vary from one context to another. As a result, Soft Money Vs Hard Money consideration and defining is the biggest question in place. In the Economics context or in the General context, soft money ( the other name is non-federal money) is a paper currency, and hard money is a coin currency. In this context, the classification and categorization go by the texture of the currency. Metallic coins are made up of hard substances. At the same time, paper currency is made up of soft paper with a promise to pay the designated amount by the Fed.

Understanding Soft Money Vs Hard Money

In the financial services sector, the terms soft money and hard money have an altogether different meanings. In the financial services industry, the direct payment of fees and commission by the client to the services provider is a hard money payment. Similarly, indirect payments by the clients to the financial service providers are soft money payments. These soft money payments are mostly under the table in nature. Mostly the disclosure of soft money payments does not occur in front of regulatory authority and/or the stakeholders at large.

In the lending industry, the terms hard money and soft money have different contextual meanings. Mostly the money rose through hard money loans, and soft money loans are useful for buying or renovating real estate properties. In simple words, hard money loans are short-term bridge loans that Private Lenders finances. And Soft Money loans are conventional long-term loans, mostly issued by Merchant Banks or Financial Institutions. Both types of loans do rigorous scrutiny of the borrower’s financial history before sanctioning the loan. Collateral and the down payment amount also play a crucial role while issuing soft money loans and hard money loans.

Sometimes the usage of the term hard money takes place at the time of government funding. When a government or a government agency releases a series of funds to a legal entity or an individual in the form of subsidies or grants, it is hard money funding. Mostly these payments are not one-time grants and are a continuous flow of funds.

Soft Money Vs Hard Money: Political Significance

Soft Money and Hard Money also have relevance and significance in political terms. When an individual or artificial individual directly and openly contributes to a particular candidate belonging to a particular political party, then it is a Hard Money contribution. In another sense, if an individual or an artificial individual is indirectly contributing to a political party or political committee, then it is a Soft Money contribution. The regulations for political contribution through soft money and hard money vary from one another. Political contributions through Hard Money have a threshold limit. The total contribution for a particular candidate or a particular party should not exceed that limit. Conversely, the contribution made through Soft Money mostly does not have any threshold limit. Soft Money political contributions can be unlimited in nature.

Soft Money Vs Hard Money – Major Differences

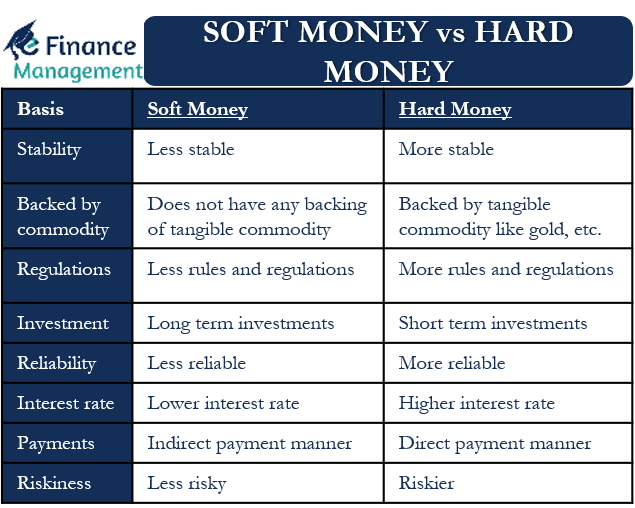

Hard Money and Soft Money have many points of difference in every context. Some of the major differences are as follows:-

Backed by Valuable Commodity

In an Economic context, hard money is a more stable currency than soft money. According to economists, hard money mostly has the backing of tangible commodities like gold and silver. In contrast to it, soft money does not have any backing from tangible commodity. And it is simply the printing of currency by the Federal Bank/Central Bank or any such authority of the country.

Regulations

When it comes to rules and regulations, hard money transactions have more regulations than soft money transactions. In the Financial Service sector, the hard money payments come under the regulations and are direct in nature. At the same time, soft money payments have almost no or minimal regulations. Similarly, in the political context, all hard money contributions come under the regulations with a threshold limit for the contribution. All soft money contributions to the political party or political candidate do not have any regulations and limits for the contribution.

Long-Term Investments or Short-Term Investments

The money raised through hard money is mostly useful for making short-term investments in real estate properties. Conversely, the money rose through soft money is useful in making long-term investments in real estate properties.

Reliability

When it comes to the political scenarios, mostly the hard money contributions are more reliable than soft-money contributions. Hard money contributions are open to the public and should not exceed a particular amount. Opposite to the same, all soft-money contributions are not publicly open and have no limit. Because of this feature, hard money contributions become more reliable than soft-money contributions. There are high chances that the political party might channelize their funds in a different direction if it is a soft-money contribution.

Flexibility and Interest Rates

In the lending industry, the structuring of hard money loans and soft money loans are different from one another. Soft money loans are structured in a standardized way, and hard money loans are structured according to the requirements. Thus hard money loans are flexible in nature. According to the requirements, the structuring of loans can vary in hard money loans.

When it comes to interest rates, Hard Money loans tend to charge higher interest rates from the borrower in comparison to soft money loans.

Direct or Indirect Payments

In Financial Services Industry, all the payments of brokerage and commission to the financial services provider can be either in the form of hard money payments or soft money payments. All kinds of payments in a direct manner by the clients to the service provider are hard money payments. At the same time, all the payments made by the clients to the financial service provider in an indirect manner are soft money payments.

Soft Money Vs Hard Money: Riskiness

When it comes to riskiness, hard money loans are riskier than soft money loans. Issuance of Hard money loans is purely done on the basis of the valuation of the property to be purchased. Mostly under the hard money loans, the credit score of the borrower is secondary. In the case of issuing soft money loans, the credit scores of the borrower are the primary criteria for sanctioning the loan.

Disclosure

Mostly all hard money transactions in any industry are disclosed to the general public at large. Hard money transactions are mostly open in nature. In contrast to this, mostly all soft money transactions are not disclosed to the stakeholders or the general public. Be it any industry or sector, in most cases, disclosure of soft money transactions does not take place.

Threshold Limit

In the political scenario, all hard money contributions for a particular party or a candidate come up with a threshold limit. The regulatory authority keeps a check on the total amount contributed and makes sure; it doesn’t exceed a particular threshold limit. All the soft-money contribution for political party or candidate does not have such a threshold limit. The amount of soft money contribution has a less regulatory binding with no threshold limit.

Party Building or not

In the political scenario, the funds channelized through soft money and/or hard money are used for election campaign promotion and party building. There exists a major point of difference between soft money and hard money while directing the funds. Mostly soft money funds are channelized for encouraging election in-country rather than promoting a specific party or candidate. Similarly, hard money funds are channelized for party-building activities and encouraging a specific candidate or a specific political party.

These were non-exhaustive differences between soft money and hard money.

Soft Money Vs Hard Money: Conclusion

In conclusion, both soft money and hard money fund are useful in various industries. In a general sense, soft money cash flows do not come under any government regulation and are indirect in nature. And at the same time are always fluctuating. Hard money cash flows, in a general sense, have regulations and are mostly direct in nature. Both soft money and hard money serve different purposes. It is not possible to conclude that one of them is the superior and most important type of money. They both have their equal relevance and existence.

RELATED POSTS

- Hard Currency – Meaning, Importance, Key Hard Currencies, and Qualification

- Advantages and Disadvantages of Bank Loans

- Letter of Credit Vs. Line of Credit

- Tangible Assets – Meaning, Importance, Accounting and More

- Types of Accounting Transactions – Explanation and Examples

- Bank Rate vs Repo Rate – All You Need To Know