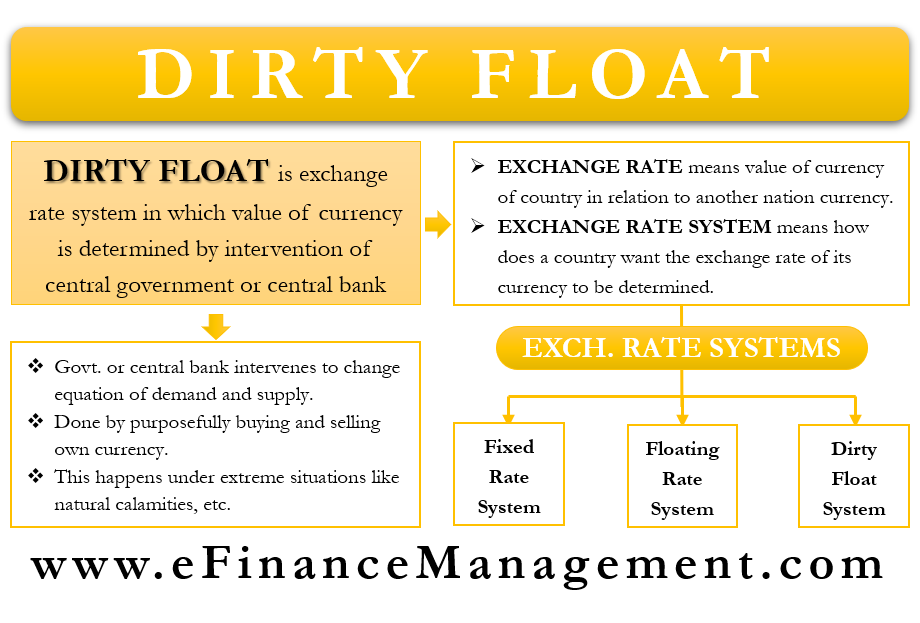

Dirty float, also known as the managed float, is an exchange rate system in which the value of a currency is determined not only by the forces of demand and supply but also through some form of intervention by the central government or central banking regulator of that country. Let’s break this down for a more complete understanding.

What is an Exchange Rate?

Every country has an exchange rate system in place. An exchange rate is nothing but the value of one country’s currency in relation to another country’s currency. These exchange rates determine how many dollars a US resident has to pay to get one Japanese Yen. If you are going outside of the US for a vacation or you want to purchase goods from an online seller of some foreign country, you will want to understand the exchange rates to understand the deal value/transaction cost. This is why exchange rates exist: to facilitate business between any two countries or between two currencies.

- What is an Exchange Rate?

- What is an Exchange Rate System?

- What are the Forces of Demand and Supply?

- How do Demand and Supply Affect the Exchange Rate

- How do Governments Interfere in Dirty Float?

- The Need for Government Intervention

- Using Dirty Float to Advance Economic Interests

- Under Dirty Float, is it Devaluation or Depreciation?

- Frequently Asked Questions (FAQs)

What is an Exchange Rate System?

An exchange rate system then means how does a country want the exchange rate of its currency to be determined. There are majorly three exchange rate systems countries use to determine their currency’s exchange rate. Let’s briefly talk about them.

- Fixed exchange rate. Under this system, the central bank or the government fixes the value of its currency in relation to another country’s currency or in relation to gold. For example, the value of the Danish Krone is fixed in relation to the European Union’s Euro at a (fixed)rate of 746.038 kroner per 100 euros.

- Floating exchange rate. Under this system, the exchange rate of a particular currency is determined completely by the forces of demand and supply.

- Dirty float is a system in which the exchange rate is determined primarily by the forces of demand and supply. But sometimes, the government or the central bank interferes in the exchange rate system by purposefully buying or selling a large volume of its currency to influence its exchange rate.

What are the Forces of Demand and Supply?

Under floating exchange and dirty float, the forces of demand and supply determine the exchange rate of a currency. Let us understand how and why the demand and supply of a specific country’s currency generate in the first place? Demand for our currency generates when the tourists want to visit our country, or when a foreign company wants to purchase raw materials from our country, etc. Tourists will need our currency to stay here. Similarly, the foreign company will need our currency to make payments for the raw material. Likewise, supply for our currency generates when we give our currency in exchange for our foreign currency requirements. The more we need foreign currency, the more we will have to give away our currency in exchange. The more we give away our currency in exchange, the more its supply will result.

Also Read: Pegged Exchange Rates

How do Demand and Supply Affect the Exchange Rate

The impact of demand and supply of the currency also follows the universal law of demand and supply. If the demand for a particular currency is higher (by tourists, businesses, etc.) than its supply, its exchange rate will rise. Similarly, if the demand is lower than the supply, the exchange rate of that currency will fall. This rise and fall in the exchange rate are not for one time. It will keep rising or falling as long as the demand and supply do not become equal. And when this happens, the exchange rate will stabilize. It will remain stable till the time the demand and supply do not become unequal again.

How do Governments Interfere in Dirty Float?

Under dirty float, the government or the central bank of a country intervenes to change the equation of demand and supply. They do so by purposefully buying or selling their own currency. This intervention leads to an artificial or controlled change in demand and/or supply of the currency. For example, when the government of a country buys its own currency from the foreign exchange market, it creates additional demand for its currency. Likewise, when the government sells its currency in foreign exchange, it creates an additional supply of its currency.

The Need for Government Intervention

Government intervention becomes necessary under extreme situations. Such as a natural disaster destroying large parts of the country or a major terrorist attack. These situations will call for heavy selling by investors who invest in foreign exchange. As a result of this heavy selling, the value of the currency will fall down sharply. Hence, governments interfere in these times to stop the currency value from falling and to restore it. What if the government does not interfere? Trade and commerce of the country will be impacted in a major way.

For example, if the value of the Chinese currency falls down sharply, Chinese businessmen will need more and more of their currency to exchange it for a unit of US dollars. The same product from the US that China used to import for, say, 100 Renminbi will now cost it, say, 150 Renminbi. Chinese businessmen will make losses as a result, and the economy as a whole will suffer. As a result, government intervention becomes critical to restore the situation and save the economy.

Also Read: Types of Exchange Rates

Using Dirty Float to Advance Economic Interests

Under dirty float, however, the government interferes routinely and not just under extreme situations. It frequently interferes to advance its economic interests. For example, if the US government wants to invite investment from foreign sources, it may sell a huge volume of its currency in the foreign exchange market. As a result, the value of the US currency will fall down, and it will become cheaper for foreign companies to invest in the US. Also, imports from the US will become cheaper for foreign countries, translating into more business for domestic industries. This way, governments use dirty float to advance their economic interests.

Under Dirty Float, is it Devaluation or Depreciation?

We often use Devaluation and Depreciation to describe the loss in the value of a currency. But it is not correct to use them interchangeably. Under dirty float, if a currency loses its value, depreciation is the correct term to use. It is so because depreciation signifies a loss in value because of the forces of supply and demand. Even if the government purposefully depreciates a currency, it does so by changing the equation of demand and supply. Moreover, it may remain a temporary phenomenon till the demand-supply equilibrium gets back to normal.

On the other hand, devaluation is the term appropriate for use in a fixed exchange rate system. It is so because devaluation is done directly by the government. Government devalues by changing the value of the currency in relation to the currency against which it is pegged. We learned that the value of the Danish Krone is fixed in relation to the European Union’s Euro at a (fixed)rate of 746.038 kroner per 100 euros. Now, suppose if the Danish Government wants to devalue its currency, they may fix the exchange rate at 800 kroner per 100 euros.

Of course, both of these happen because of the interference by the Government or the Central Banking Regulator. However, the key difference is the time horizon. Depreciation is a temporary intervention. Whereas Devaluation is a permanent measure used to ease out the economic conditions or to improve economic interests.

Frequently Asked Questions (FAQs)

An exchange rate system in which the value of a currency is determined not only by the forces of demand and supply but also through some form of intervention by the central government or central banking regulator of that country is known as a dirty float.

An exchange rate exists to facilitate business between any two countries or between two currencies.

There are majorly three exchange rate systems countries use to determine their currency’s exchange rate:

1. Fixed exchange rate

2. Floating exchange rate

3. Dirty float