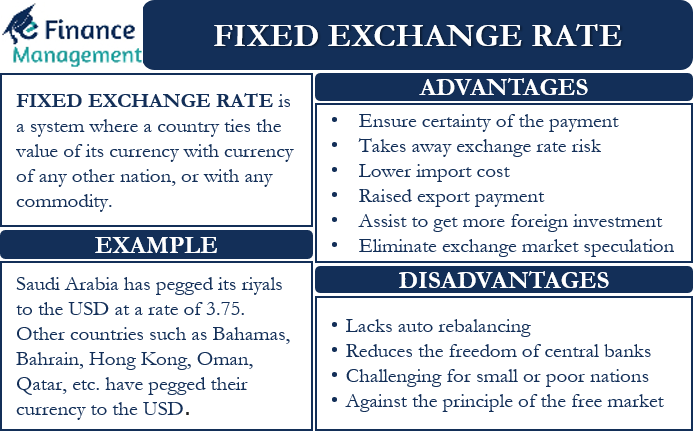

A Fixed Exchange Rate is a system where a country ties the value of its currency (or the exchange rate) with the currency of any other nation or with any commodity. A country primarily adopts such a currency system to steady the value of its currency. We may also call such an exchange rate system a pegged exchange rate.

The other country’s currency to which a country ties its currency is usually the one that is most popular or widely used. Some countries also tie their countries to the currency of their biggest trading nation or the country with which it does the most business. And, if a country ties the currency to a commodity, then it is usually the most traded commodity, such as gold or oil.

The central bank of a country, which pegs its currency to another currency, will buy and sell its currency in the global exchange market, to maintain the supply and demand. However, one pre-requisite of this practice is that the central bank of that country must hold a sufficiently large chunk of reserves of that currency to which its currency is pegged or linked.

Fixed Exchange Rate – Brief History

Initially, the currencies were pegged to gold. But after the 1944 Bretton Woods Agreement, there was a consensus among nations to tie their currencies to the USD. The U.S., in return, would redeem their currency for dollars, not gold.

Also Read: Pegged Exchange Rates

Why do the countries choose the U.S. dollar and not any other currency? This was because, at the time, the U.S. had about three-fourths of the world’s gold. No other nation had enough yellow metal to support its own currency. This was the primary reason why the USD grew in comparison to other currencies.

However, President Nixon, to curb the recession, took the dollar off of the gold standard. This led to the popularity of floating rates. Yet, many nations continue to tie their currency to the USD.

Advantages of Fixed Exchange Rate

Following are the advantages of a fixed exchange rate:

- If a country ties its currency with its trading partner, then it helps to ensure certainty of the payment amount. Both importers and exporters will know the exact amount they will have to pay and the money they will get. Or, we can say, such an exchange rate system takes away the exchange rate risk element from the business and contracts.

- Small nations usually peg their currency against bigger nations like the U.S. and EU. This helps them to lower their import cost. And at the same time, it helps them to raise the export value. Further, this, in turn, also helps to improve the balance of trade.

- Such an exchange system also assures a smooth flow of money from one nation to another.

- This system also assists small and less developed countries get more foreign investment.

- Another advantage is that it allows small countries to prevent devaluation and keep a check on the inflation rate. This is because if their currency appreciates, the imports get expensive, resulting in inflation.

- This exchange rate system helps to eliminate speculation in the exchange market. Since people expect the exchange rate to remain stable for a long time, it takes speculation out of the question.

- It helps prevent the depreciation of the currency of developing nations. If a country faces a BOP crisis, then regular changes in the exchange rate could make BOP crises more severe. So, a stable exchange rate prevents this to some extent.

- Such an exchange rate system allows the government to bypass using reckless macro-economic policies, such as currency devaluation. In contrast, it allows the government to use deflationary policies to keep a check on the BOP deficit.

Disadvantages of Fixed Exchange Rate System

Following are the disadvantages of the fixed exchange rate system:

- Such an exchange rate lacks auto rebalancing like with the floating exchange rate. In case of a rise in the trade account deficit for a country that practices a floating exchange rate, it needs to borrow funds in the foreign currency. This pushes the foreign currency prices up and, in turn, the price of the foreign products in the local market. This, in turn, lowers the demand for foreign products and thus, reduces the trade deficit. Such a rebalancing system is not available if a country uses a fixed exchange rate.

- This exchange rate system reduces the freedom of the central banks to make changes to the interest rates.

- To ensure that a fixed exchange rate system is effective, it is crucial that a country has adequate foreign exchange reserves. However, it is usually challenging for small or poor nations to maintain an adequate amount of reserves. And this becomes the biggest bottleneck in the fixed exchange rate system.

- Such an exchange rate system is against the principle of the free market. In a free market, the demand and supply of the currency or commodity determine the price. However, since the exchange rate is fixed, the demand-supply play is purposely blocked. Hence, we can also say that such an exchange rate system is against the international competitive environment.

- Such a system may give rise to speculation; thus, speculators may short the currency. This would theoretically bring down the value of the currency. In such a situation, the central bank of the country needs to intervene in the market to stabilize the currency. And, if the bank does not have enough currency reserves, it would have to push the interest rates up. This, in turn, may lead to recession. A similar situation arose in 1992 with the British pound, when GBP was part of the European Exchange Rate Mechanism (ERM). At the time, George Soros shorted the pound until the central bank allowed the currency to withdraw from the European ERM agreement and float freely.

- If the exchange rate is unreal, then it may result in the creation of an unofficial exchange rate. Such a situation could make it very challenging for the central bank to manage the exchange rate.

Examples

Saudi Arabia has pegged its riyals to the USD at a rate of 3.75. This means one dollar equals 3.75 Saudi riyals. Saudi Arabia did so because oil price (and most commodities contracts) is priced in terms of USD. Since the riyal is tied to the USD, so if the USD gains 10% against the euro, then the riyal will also gain 10% against the euro.

A few more countries that use a fixed exchange rate system are the Bahamas, Bahrain, Hong Kong, Oman, Qatar, Saudi Arabia, UAE, and more. All these countries have pegged their currency to the USD.

Also Read: Types of Exchange Rates

China is also a good example of a country with a fixed exchange rate. However, the Asian nation is now loosening its control on the currency. China pegs its currency to a basket of currencies, including the USD. In 2015, however, the country let go of its currency to vary based on the last day’s closing rate. Still, China keeps control over the value of the Yuan, restricting it to a 2% trading range. International authorities have been pressurizing China to remove all restrictions on its currency.

Singapore and Vietnam are two more countries that follow similar restrictions on the currency, like China.

Final Words

Though the Fixed Exchange Rate system has its advantages, it is now less popular nowadays. The majority of the industrialized counties have now moved from a fixed-rate exchange system and now follow the floating exchange rate systems, where the market forces determine the currency value. However, many small and developing nations still use fixed-rate systems to benefit from the trade.

RELATED POSTS

- Dirty Float

- Real vs Nominal Exchange Rate – All You Need to Know

- International Monetary System: Meaning, Evolution, Advantages, Criticisms and More

- Hard Currency – Meaning, Importance, Key Hard Currencies, and Qualification

- Foreign Exchange

- Cross Currency Rate – Meaning, Importance, Calculation, and Example