Call and Put Spreads are popular options strategies. Under these strategies, an investor buys and sells an equal number of calls or puts option to make a profit. Both the strategies (call spread and put spread) share the same characteristics, such as they are less risky. But, they offer lower rewards as well (these options are cheaper as well). The basic difference between the call spread vs put spread is how the two strategies eventually work.

In a call spread, an investor buys a call, as well as sells another call of the same expiry but on a higher strike price level. Similarly, an investor buys a put and sells another put of the same expiry but at a lower strike price level in a put spread.

An investor should normally go with either of the two strategies if they believe the price of the underlying security would move in one specific direction. In such a case, these strategies could help investors lower their initial outlay if their expectations go wrong.

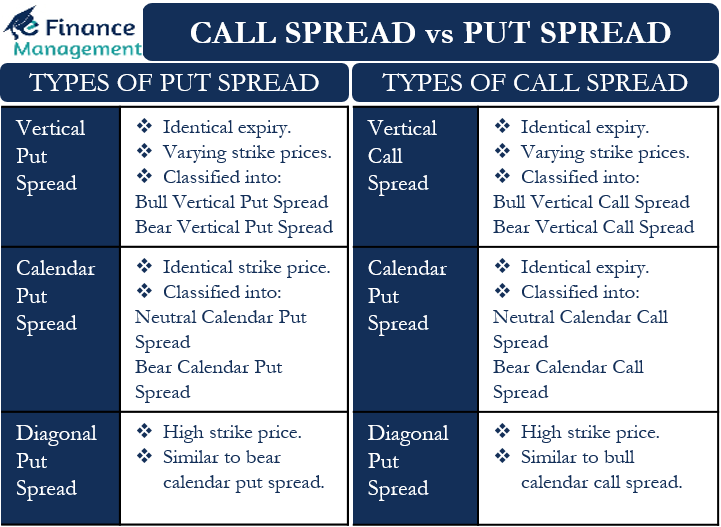

To better understand the difference between the call spread vs put spread, it is important that we know the types of a call spread and put spread.

Also Read: Vertical Spread – All You Need To Know

Types of Put Spread

As said above, an investor buys and sells the same number of put options in this. In the put buying strategy, the profit that an investor can make has no limit. But, the profit potential in a put spread is limited. They are, however, less expensive to execute.

Also, only bearish investors can go for buying the put options. On the other hand, investors can use the put spreads in the bull, bear, or neutral market.

Following are the types of put spread:

Vertical Put Spread

It is the simplest put spread. In this, an investor buys and sells a Put of identical expiration but with varying strike prices. We can further classify Vertical Put Spread into:

Bull Vertical Put Spread – an investor goes for this strategy if they believe the price of the security will go up before the expiry. We also call this strategy just ‘bull put spread.’

Bear Vertical Put Spread – an investor employs such a strategy if they expect the price of the underlying security to drop before the expiry. We also call this strategy just ‘bear put spread.’

Calendar (Horizontal) Put Spread

In this strategy, an investor buys a long-term put option and sells a near-term put option. Both options have identical strike prices. We can further classify this strategy into:

Neutral Calendar Put Spread

If an investor has a neutral near-term outlook, then they can deploy this strategy. In this, an investor uses at-the-money put options. The main aim and objective of deploying this strategy are to gain or earn from the reduction in the value of near-term options premium due to the passage of time or time expiration.

Bear Calendar Put Spread

This strategy is of use when the investors have a bearish view about the underlying security price in the long run. Hence, to gain in this scenario, the investor sells the near-term puts and continues to enjoy the long-term puts at a lesser price. Investors use the out-of-the-money put options for this strategy.

Diagonal Put Spread

Under this strategy, an investor buys a long-term put option and sells near-term put options with a higher strike price. This strategy work similarly to the bear calendar put spread. The only difference being the near-term outlook in the diagonal spread is a little more bearish.

Types of Call Spread

As said above, in a Call Spread, a trader buys and sells the same number of call options. Unlike the call strategy, which offers massive profit opportunities, the call spread offers limited profit opportunities. However, call spread is relatively cheaper to execute.

Also, only bullish investors use call options. On the other hand, one can execute a call spread in a bull, bear, or neutral market.

Following are the types of call spread:

Vertical Call Spread

It is the most fundamental call spread strategy. In this, the short and long calls have varying strike prices but the same expiry. We can further classify this spread into bullish or bearish:

Bull Vertical Call Spread – a trader uses this strategy when they expect the rate of the underlying security will move up before the expiry. We also call this strategy just ‘bull call spread.’

Bear Vertical Call Spread – a trader employs such a strategy if it expects the price of the underlying security to drop before the expiry. We also call this strategy just ‘bear call spread.’

Calendar (Horizontal) Call Spread

In this, an investor buys a long-term call option and sells a near-term call option having identical expiry. We can further classify this strategy into neutral or bull on the basis of near term outlook:

Neutral Calendar Call Spread

If a trader has a neutral near-term outlook, then he can use at-the-money call options to implement this spread. The main aim behind deploying this strategy is to benefit from the time-lapse of the options premium.

Bull Calendar Call Spread

Traders use this strategy if they are bullish on the underlying security price. In this, traders sell the near-term call and use out-of-the-money call options to execute this spread.

Diagonal Call Spread

A trader buys long-term call options and sells near-term call options with more strike prices. This strategy is very similar to the bull calendar call spread. The only difference between the two is that the diagonal call spread is relatively more bullish in the near term.

Continue reading – Credit Spread vs Debit Spread.