Social Cost-Benefit Analysis in Project Management: Introduction

Cost-benefit analysis is a process of deciding whether to go with a business decision or not on the basis of the net benefits from it. We first assess the benefits or rewards from a business decision. Then we deduct the costs that we will incur in order to implement that decision or idea. If the result is positive, we can go ahead with the plan. We should shelve the idea and look for other alternatives in case of a negative result. However, there are some projects in which we may not benefit financially, but still, companies and governments go ahead with them. Such projects have social implications or benefits. In order to gauge the social or socio-economic benefits of a project, we do a social cost-benefit analysis in project management.

The most common investments that have social benefits are infrastructure projects like building roads, dams, railway tracks, bridges, electricity generation, etc. Social cost-benefit analysis in project management is a tool to assess the viability of such projects. Apart from taking into account the financial costs that we incur in a project, we also consider the social impact of the project on the people, environment, and society as a whole. Such impacts include pollution effect, safety, and security, the effect on the lives of people, etc. We assess the benefits of a project by attaching a price to the social effects that they cause. We deduct the social costs from the social benefits derived from a project to arrive at the net social benefits to the society.

Features of SCBA

Following are the features (and uses) of SCBA:

- Assess the viability of a project for the public and not for shareholders.

- Identifying the economic as well as social cost and benefits of a project and investment.

- Measuring the economic as well as social cost and benefits of a project and investment.

- Identifying and measuring the impact of risk and uncertainty.

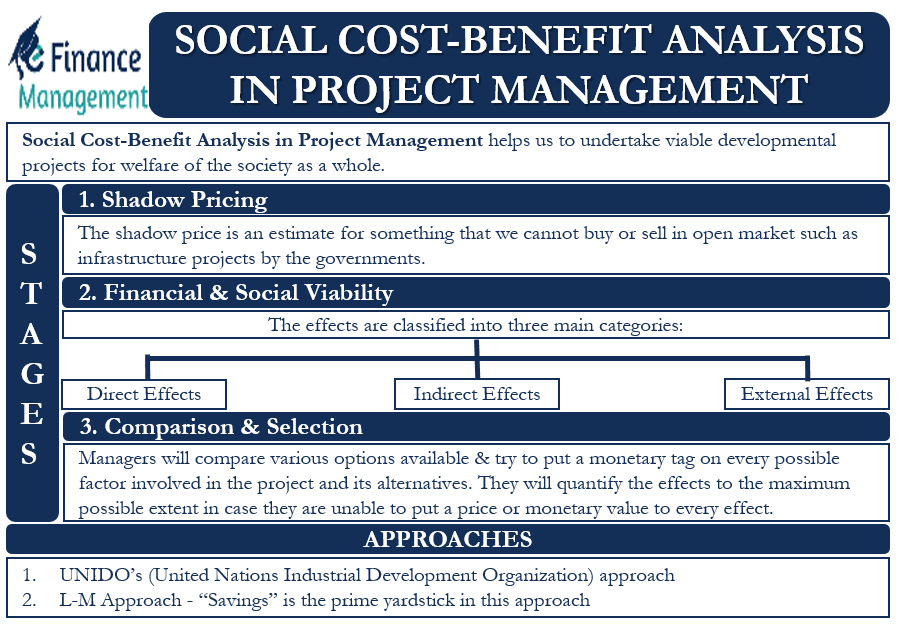

Main Stages of Social Cost-Benefit Analysis in Project Management

Shadow Pricing

The first stage in the process of social cost-benefit analysis is to ascertain the shadow price of the inputs as well as the outputs of the product or service that the project purposes to deliver. The shadow price is an estimate for something that we cannot buy or sell in the open market, such as government infrastructure projects. For example, in the case of the construction of a bridge, we cannot put a definite price tag on the bridge because we don’t buy or sell it in the open market. Instead, we will put a shadow price on it to assess its construction benefits.

This price will help the managers understand the project’s benefits and cost. Sometimes this price may prove inaccurate and unreliable. There is no absolute data to back it up, it is based on assumptions, and it may even be subjective in nature.

Also Read: Estimation of Project Cost

Financial and Social Viability

Once managers have the shadow pricing in place, they can move ahead to judge the financial and social viability of the project. The managers need to identify and measure the costs and benefits of the project. Every project for society will have a positive impact in the form of social benefits as well as a negative impact in the form of social cost. We can classify the effects of a project into three main categories:

Direct Effects

These are the effects of a project on the direct or immediate users. Managers already know the costs of the project. They can use shadow pricing to measure the benefits to the users of a particular project, such as a road or a highway.

Indirect Effects

Indirect effects are the effects that indirectly affect people from a particular project. For example, the price of real estate may go up if it is located near a proposed highway project. The managers need to ascertain the costs and benefits from the perspective of the indirect effects too.

External Effects

These are again usually in the form of effects of a project on the external environment. It measures the effects due to changes in pollution levels, safety, security, etc., because of a project or otherwise.

Also Read: Budgeting in Project Management

The managers will thoroughly evaluate the above three effects of a project. In case the benefits outnumber the costs, the project is viable and vice-versa.

Comparison and Selection

The managers will then compare various options available in the form of inputs, resources, or similar other projects. They will try to put a monetary tag on every possible factor involved in the project and its alternatives. They will describe or try to quantify the effects to the maximum possible extent in case they are unable to put a price or monetary value to every effect.

The decision-makers also consider all the possible uncertainties and risks that can arise out of a project. They then finally make a calculated and informed decision. They will choose the best alternative among the various options that are available.

Approaches to Social Cost-Benefit Analysis in Project Management

The following are the two different approaches to social cost-benefit analysis-

UNIDO’s Approach

UNIDO stands for United Nations Industrial Development Organization. In this approach, we first assess the financial profitability of a project by measuring it at market prices. Usually, the Net Present Value (NPV) of the project is found. We value the inputs or costs and the output or benefits from the project at market price. However, in the case of projects with social benefits, we will have to determine the net benefits of the project by using the shadow prices of both inputs and outputs.

We then calculate the impact of the project on the savings and investment of different income groups. We will adjust this impact to the net present value. The next step is to calculate and adjust the impact of the project on the income distribution. We will calculate the value of the effect that a project creates on the distribution of income between the poor and the rich and between different regions.

There is a possibility that the economic benefits from a project will be more than its social benefits. The result can be vice-versa too. Managers will use an adjustment factor to make up for the difference. Then they will calculate the correct NPV of the project.

L-M Approach

This approach propagates the use of shadow prices in order to find out the true value of a project to society. “Savings” is the prime yardstick in this approach. We can convert them into investments anytime in the future.

This approach makes use of “border” prices or international prices. It is so because of the present era of globalization and international trade. We calculate the shadow prices of wages, the goods we trade, and the non-traded goods too. We then find out the “Accounting rate of return” and use it for discounting social profits. The resulting projects that are mutually compatible with positive present social value are worthy of being undertaken.

Limitations of SCBA

Following are the limitations of SCBA:

- Sometimes it gets very challenging to quantify the social costs and benefits of a project or investment. This is because many costs and benefits are intangible.

- It could get difficult to compare the social costs and benefits of one project with another.

- The inputs and outputs of projects and their impact on the ecology and people would vary from case to case.

Conclusion

Social cost-benefit analysis in project management helps us to undertake viable developmental projects for the welfare of society as a whole. Managers can make an informed decision after comparing several options and choosing the best one. The analysis also provides an insight into the social costs or harmful impact of any project, too, and not just the financial or social benefits.

However, managers sometimes fail to have a balanced outlook. They may just go for projects that provide maximum profitability. The social cost-benefit analysis sometimes overstates the significance of social benefits. Also, the concept of shadow prices and the conversion of social costs and benefits into monetary units is an area of subjectivity and approach. It is based on the judgment and understanding of the project managers, and they can be wrong. Hence, managers should take a cautious approach while using this analysis.

Frequently Asked Questions (FAQs)

The 2 approaches to the social cost-benefit analysis are:

1. UNIDO’s approach

2. L-M approach

Shadow pricing is estimating a value for something that we cannot buy or sell in the open market, such as infrastructure projects by the governments. Sometimes this may prove inaccurate and unreliable. There is no absolute data to back it up, it is based on assumptions, and it may even be subjective in nature.

A comparison is made on various options available in the form of inputs, resources, or similar other projects. Every factor involved in the project and its alternatives are described in monetary terms by the managers. They will describe or try to quantify the effects to the maximum possible extent in case they are unable to put a price or monetary value to every effect. All the possible uncertainties and risks that can arise out of a project are taken into consideration. And finally, the best alternative among the various options that are available is selected.