What are Financial Decisions?

Financial decisions are the decisions that managers take with regard to the finances of a company. These are crucial decisions for the financial well-being of the company. These decisions can be in terms of acquisition of assets, financing and raising funds, day-to-day capital and expenditure management, etc. Financial decisions, therefore, affect both the assets and liabilities of a company. They can lead to profits, revenue generation, and receipt of funds and assets for the company. They can also be in terms of expenditure, the creation of liabilities, and an exodus of funds for a company.

And of course, all these financial decisions can be both for the long-term and short-term. Long-term financial decisions are decisions that are taken for a period of more than a year or more. These may include capital budgeting and investment decisions, as well as the raising of long-term capital and loans, which may run for 5-10 years.

Short-term financial decisions are decisions that are taken for a short period of time, usually less than a year. These decisions pertain to working capital management, arranging short-term funds and credits, the provision of dividends, etc.

Financial Management

Financial management is the stream of management that is associated with financial decisions. Professional managers plan and set goals, organize and manage financial activities to achieve these goals, and eventually perform the control function to review and, if necessary, correct these plans. They ensure that the liquidity position of the company is satisfactory and that the company remains in a sound financial position. These managers are professionals and specialize in making and executing financial plans and decisions for the company.

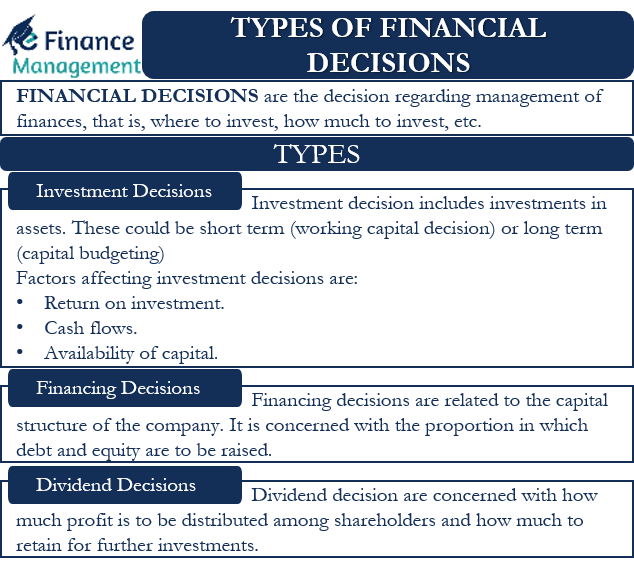

Key Financial Decisions

We will discuss below the most important financial decisions that these professional managers usually make:

- Investment Decisions

- Financing Decisions

- Dividend Decisions

Investment Decisions

Investment decisions are decisions that relate to the investment in different types of assets, instruments, securities, etc. Managers decide how to invest the company’s funds in different asset classes, depending on the needs of the organization. Assets can be both short-term and long-term. As each company has scarce financial resources, it is crucial to decide which asset to invest in first. Managers must make the tough call of postponing investing in some assets that are not strictly necessary at present, or that may not give the desired return.

Long-Term Investment Decisions

Capital budgeting decisions are decisions to invest in long-term assets to improve the overall production/servicing capacity of the organization. They often require heavy capital expenditure and are always for a longer term. Therefore Capex decisions need to be made very wisely. Any commitment to such assets is irreversible and leads to the blockage of a significant amount of capital. In addition, returns on such investments are very late and can take long periods of time, over a year, before such an investment yields positive returns. These expenditures include the establishment of a new unit or the expansion of an existing unit, the purchase or replacement of new machinery, investments in research and development, etc.

Short-Term Investment Decisions

Short-term investment decisions are decisions regarding the day-to-day operations and management of the company. We may loosely call it the working capital management of the company. Managers must ensure that the company has sufficient liquidity for its day-to-day activities. The managers must ensure that these funds do not dry up and there is no hindrance or bottleneck to the day-to-day activities of the company. They must also decide on the sources of short-term financing and prioritize expenditure according to the availability and urgency of the funds. Short-term investment decisions also concern receivables and payables, as well as the acquisition and use of inventories.

Factors Affecting Investment Decisions

Factors that affect the investment decisions are:

Return on Investment (ROI)

Return on investment is one of the most important factors influencing any investment decision. Managers will invest in projects with a higher ROI and lower risk than other projects.

Also Read: Functions of Financial Management

Cash Flows

Managers will choose to invest in projects with higher positive cash flows, which will keep their liquidity position intact and comfortable.

Availability of Capital

The availability of both short-term and long-term capital in the company influences its investment decisions. Interest rates, repayment period, time of maturity of the project, quantum and start of return, etc., also influence the choice of one project over another.

Apart from investment decisions, managers make the following types of financial decisions:

Financing Decisions

Financing decisions are decisions that are made to ensure the financing of the company. They relate to the raising of equity as well as debt for the company to fund its investment decisions. It is a continuous and ongoing process, as each company regularly needs funding. Because a growing company’s needs do not cease, instead go on increasing to keep pace with the growth.

Capital Structure

Financial managers have to make important decisions to form a proper capital structure. The capital structure of a firm is made up of equity and debt. They have to work out a perfect balance between the two so as to maximize shareholders’ value and the profitability of the firm. Going for higher equity capital reduces the tension of repayment as they become part of the firm’s own capital. But then shareholders must receive higher returns in the form of dividends, which will lead to dilution of ownership and voting rights.

On the other hand, debt includes loans from banks and financial institutions, debentures, etc. Higher debt increases the interest burden and makes the capital structure riskier. Furthermore, the company cannot rely on this source of finance permanently, as lenders can reclaim their money at any time. Any weak period of performance can play spoilsport with the company and put on it under multifold pressure.

Optimal Mix of Debt and Equity

Financial managers have to chalk out an optimal mix of debt and equity. In doing so, they have to take care of various factors such as the cost of financing, the risk involved, the floating cost in case of issuing equity, the company’s cash-flow position in the immediate future, the state of the economy, debt, and equity markets, etc.

Dividend Decision

Under dividend decisions, whenever a company makes a profit, it decides to reward its shareholders in return for their investment, trust, and confidence in the company. This reward is called a dividend. At the same time, managers must decide to retain part of the profit for the future needs of the company. This is known as retained earnings.

Managers have to make the important decision of how many portions of the profit the company should pay out in dividends and what part they should keep with them. Giving away higher dividends makes the stock attractive and increases the market price and the overall market value of the company. But they also have to take into account earnings and their stability, the growth prospects of the company, its cash flow status, dividend taxes, and above all, its own funding requirements, etc.

While reading this post, one thing to note is that financial management is related to other disciplines of a business as well. It cannot be performed in isolation.

Conclusion: Financial Decisions

Financial decisions are the backbone of any organization’s success. The main aim and the key efficiency of the professional managers is the maximization of the financial worth/value of the company and its stakeholders. They have to increase profitability while maintaining sufficient liquidity for the company. And also to minimize the risk level of the company. It is their duty to set goals to achieve them, evaluate alternatives and choose the best possible course of action, effectively implement financial plans, continually revise, update and review those plans, and finally, where necessary, take corrective actions.

Also, read – How Macro Environment affects Financial Management Decision?

Frequently Asked Questions (FAQs)

The three main categories of financial decision-making are investment decisions, financing decisions, and dividend decisions.

Dividend decisions are mainly about how much to distribute as dividends and how much to retain.

Factors that affect investment decisions include:

1. Return on investments (ROI)

2. Cash flows

3. Availability of capital and cost thereof.