What is a Three Statement Model?

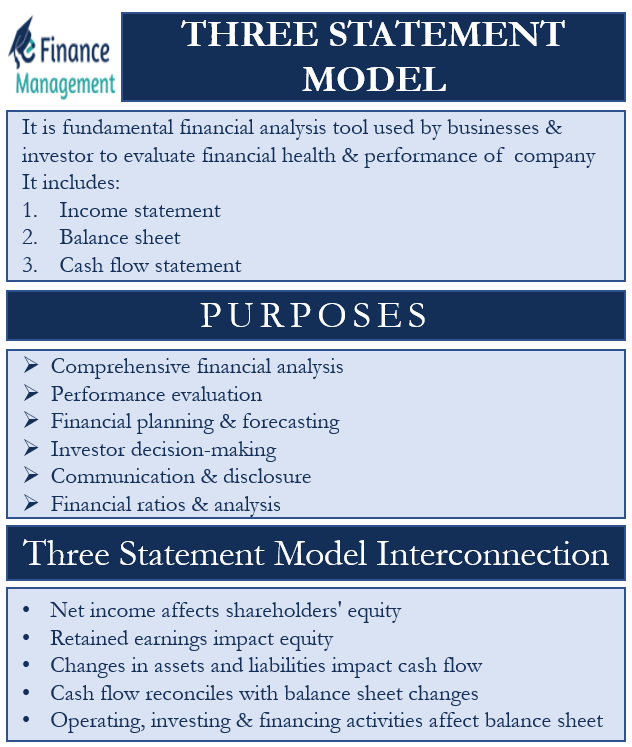

The three-statement model is a fundamental financial analysis tool used by businesses and investors to evaluate the financial health and performance of a company. This model comprises three key financial statements: the income statement, the balance sheet, and the cash flow statement. By integrating these statements, the three-statement model provides a holistic view of a company’s operations, profitability, liquidity, and overall financial position. In this article, we will delve into each component of the three-statement model and explore its significance in financial analysis.

This model boils down the vast operations and various functions of the entity to a matter of a few spreadsheets. Thus, this enables the management to obtain a bird’s eye view of the workings of their company at a quick glance. It informs the management of exactly how much they need to know- nothing less, nothing more. Thus, sparing the busy executives from losing precious time in going through the redundant nitty-gritty. Therefore, a three-statement model is a proactive strategic tool that streamlines the effort of management.

Income Statement

The income statement, also known as the profit and loss statement (P&L), summarizes a company’s revenues, expenses, and net income over a specific period. It illustrates the company’s ability to generate profits by matching revenues against the corresponding expenses incurred to generate those revenues. Key components of the income statement include revenue, cost of goods sold, operating expenses, interest expenses, taxes, and net income. Analysts closely examine the income statement to evaluate the company’s profitability, growth trends, and efficiency of operations.

Balance Sheet

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It outlines the company’s assets, liabilities, and shareholders’ equity. Assets represent what the company owns, such as cash, inventory, property, and investments. Liabilities represent the company’s obligations, including loans, accounts payable, and accrued expenses. Shareholders’ equity reflects the residual interest in the company’s assets after deducting liabilities. The balance sheet is a critical tool for assessing a company’s liquidity, solvency, and overall financial stability.

Also Read: Types of Financial Statements

Cash Flow Statement

The cash flow statement tracks the inflows and outflows of cash during a given period. It provides insights into a company’s ability to generate cash from its core operations, as well as its investment and financing activities. The cash flow statement consists of three sections: operating activities, investing activities, and financing activities. Operating activities include cash generated from day-to-day business operations while investing activities cover cash flows from investments in assets or other companies. Financing activities involve cash flows from debt issuances, equity offerings, or dividend payments. The cash flow statement is crucial for evaluating a company’s ability to generate and manage cash, assess its liquidity position, and understand its capital allocation strategies.

Purpose of Three Statement Model

The three-statement model serves several important purposes in financial analysis and decision-making. Its primary objectives are as follows:

Comprehensive Financial Analysis

The three-statement model provides a holistic view of a company’s financial performance, position, and prospects. By analyzing the income statement, balance sheet, and cash flow statement together, analysts gain a deeper understanding of the company’s operational efficiency, profitability, liquidity, and financial stability. It allows for a comprehensive evaluation of key financial metrics and trends.

Performance Evaluation

The model enables the assessment of a company’s past performance and its ability to generate profits and cash flows. By examining the income statement, analysts can evaluate revenue growth, gross margins, operating expenses, and net income. The balance sheet provides insights into asset utilization, liabilities, and shareholders’ equity. The cash flow statement indicates the company’s cash generation from operating activities, investing activities, and financing activities. These evaluations help assess a company’s financial health and compare its performance against industry benchmarks.

Financial Planning and Forecasting

The three-statement model plays a crucial role in financial planning and forecasting. It serves as a foundation for building financial projections by projecting future revenues, expenses, asset investments, and financing activities. By understanding historical trends and the impact of various factors on financial statements, companies can make informed forecasts for budgeting, investment decisions, and strategic planning.

Also Read: Financial Modeling

Investor Decision-Making

Investors rely on the three-statement model to assess the financial viability and attractiveness of investment opportunities. The model provides insights into a company’s profitability, growth potential, cash flow generation, and financial risks. Investors can analyze the financial statements to understand a company’s ability to generate returns, manage debt, and distribute dividends. The model helps in evaluating investment risks and making informed investment decisions.

Communication and Disclosure

The three-statement model serves as a standardized format for financial reporting, enabling consistent and transparent communication between companies and stakeholders. It helps companies present their financial performance and position in a structured manner, facilitating better understanding and comparability among investors, lenders, analysts, and regulatory bodies. The model ensures the disclosure of essential financial information, supporting financial transparency and accountability.

Financial Ratios and Analysis

The three-statement model serves as a basis for calculating various financial ratios that aid in financial analysis. These ratios, such as profitability ratios, liquidity ratios, and solvency ratios, provide insights into a company’s operational efficiency, liquidity position, leverage, and overall financial health. Financial ratio analysis helps identify trends, benchmark performance, and assess the strengths and weaknesses of a company.

How is Three Statement Model Interconnected?

These three financial statements are interconnected, and changes in one statement can impact the others. Let’s explore the interconnections between these statements:

Net Income and Shareholders’ Equity

The net income reported in the income statement directly affects the shareholders’ equity in the balance sheet. Net income represents the company’s profit after deducting all expenses and taxes. It increases shareholders’ equity, reflecting the retained earnings of the company. Therefore, a higher net income will lead to an increase in shareholders’ equity on the balance sheet.

Retained Earnings and Equity

Retained earnings, which are a component of shareholders’ equity, represent the accumulated net income not distributed as dividends. The retained earnings from the income statement are added to the beginning balance of retained earnings on the balance sheet. Any dividends paid to shareholders reduce the retained earnings, and this reduction reflects in the balance sheet.

Changes in Assets and Liabilities

The balance sheet captures the company’s assets, liabilities, and shareholders’ equity. Changes in certain assets and liabilities directly impact the cash flow statement.

- Accounts Receivable: An increase in accounts receivable on the balance sheet indicates that the company is extending credit to customers and has not received cash for the sales. This increase is reflected as a decrease in cash from operating activities on the cash flow statement.

- Inventory: An increase in inventory on the balance sheet indicates that the company has invested cash to purchase or produce goods. This increase is reflected as a decrease in cash from operating activities on the cash flow statement.

- Accounts Payable: An increase in accounts payable on the balance sheet indicates that the company has received goods or services but has not yet paid cash for them. This increase is reflected as an increase in cash from operating activities on the cash flow statement.

Cash Flow and Balance Sheet Changes

The cash flow statement bridges the gap between the income statement and the balance sheet by providing insights into the sources and uses of cash. The net cash flow from operating activities reported in the cash flow statement is reconciled with the changes in cash and cash equivalents on the balance sheet.

- Operating Activities: Cash generated or used in day-to-day operations affects both the income statement and the balance sheet. The net income from the income statement is adjusted for non-cash items and changes in working capital to arrive at the cash flow from operating activities. This cash flow directly impacts the cash balance on the balance sheet.

- Investing Activities: Cash flows from investing activities, such as the purchase or sale of property, plant, and equipment or investments in other companies, impact the balance sheet by changing the asset and investment balances.

- Financing Activities: Cash flows from financing activities, including debt issuance, equity offerings, or dividend payments, impact the balance sheet by changing the liabilities and shareholders’ equity balances.

Great and clear