Meaning of Financial Modeling

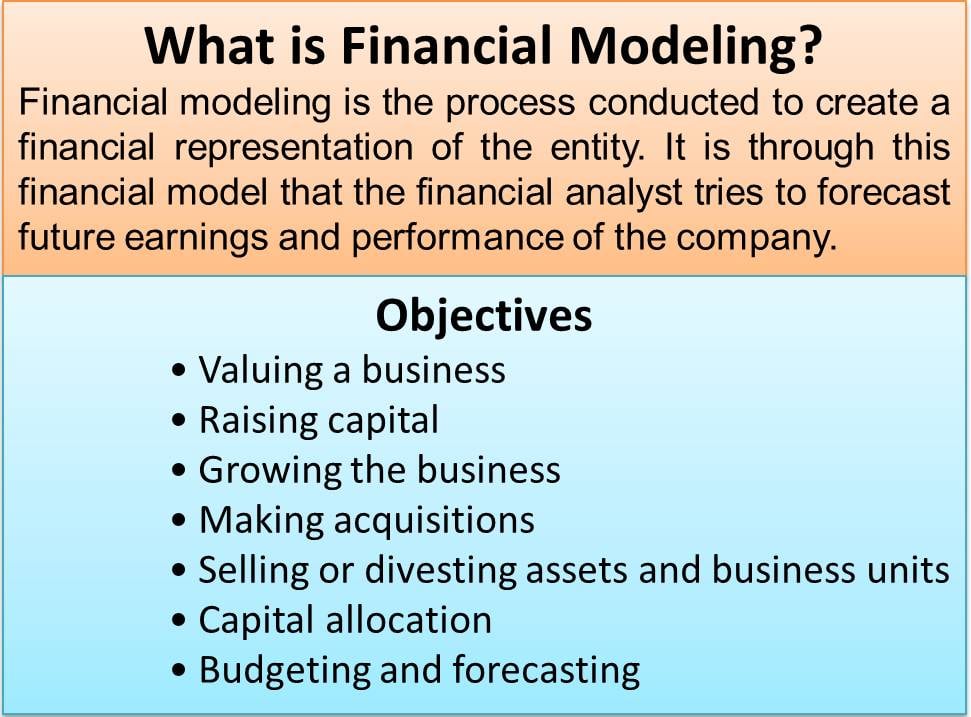

Financial modeling is the process conducted to create a financial representation of the entity. Through this financial model, the financial analyst tries to forecast the future earnings and performance of the company. Analysts use numerous forecast theories and valuations to recreate business operations. The financial model, once completed, displays a mathematical depiction of the business events. The primary tool utilized to create the financial model is the excel spreadsheet.

After knowing the meaning of financial modeling, let us have a look at the objectives for preparing the same.

- Meaning of Financial Modeling

- Objectives of Financial Modelling

- Types of Financial Models

- How To Build A Financial Model?

- Historical Results and Assumptions

- Make Income Statement

- Make Balance Sheet

- Build the Supporting Schedules

- Complete the Income Statement and Balance Sheet

- Build the Cash Flow Statement

- Perform the Discounted Cash Flow Analysis

- Add Sensitivity Analysis and Scenarios

- Build Charts and Graphs

- Stress Test and Audit the Model

- Financial Modelling as a Career

- Conclusion

Objectives of Financial Modelling

Financial modeling assists the management in the decision-making process and in preparing the financial analysis.

The following are the objectives of creating a financial model:

- Valuing a business

- Raising capital

- Growing the business

- Making acquisitions

- Selling or divesting assets and business units

- Capital allocation

- Budgeting and forecasting

After knowing about the objectives of financial modeling, we will look at the types of financial models.

Types of Financial Models

The following are the ten types of financial models:

- Three Statement Model

- Discounted Cash Flow Model

- Merger Model

- Initial Public Offering Model

- Leveraged Buyout Model

- Sum of the Parts Model

- Consolidation Model

- Budget Model

- Forecasting Model

- Option Pricing Model

On gaining a deep insight into the concept of financial modeling, let’s look at the process involved in building the same.

How To Build A Financial Model?

The following is the step by step breakdown of building a financial model:

Historical Results and Assumptions

The first step of building a financial model is to extract the entity’s previous three years’ financial statements. The statements are then converted into excel format. This will serve as a base to frame assumptions for the forecasted period.

Make Income Statement

The forecast assumptions assist in calculating the income statement, including revenue, operating expenses, and gross profit.

Make Balance Sheet

The income statement then helps in the preparation of the balance sheet. Calculations for accounts receivable and accounts payable should be done.

Build the Supporting Schedules

A schedule of debts and interests is prepared. The debt schedule extracts historic data and increases debts, and subtracts payments made. Interest is then calculated on the remaining debt balance.

Complete the Income Statement and Balance Sheet

The income statement and balance sheet can be completed with the information obtained from the schedules. Net income, taxes, and earnings before tax are calculated. Shareholder’s equity is also determined.

Also Read: Three Statement Model

Build the Cash Flow Statement

After completing the balance sheet and income statement, the reconciliation method can now be used to build the cash flow statement.

Perform the Discounted Cash Flow Analysis

The business valuation and free cash flow should be derived on the basis of the three statements. The free cash flow is prepared considering the opportunity cost is borne and the required rate of return for the entity.

Add Sensitivity Analysis and Scenarios

Sensitivity analysis is incorporated into the financial model. This is an essential step in determining the risk involved in the investment or the business planning process.

Build Charts and Graphs

Good financial analysts prepare a clear communication of the results obtained. The executives do not pay much attention to the inner workings of the financial model. Thus charts need to be prepared. The financial model results can be conveyed precisely with the help of various graphs and charts.

Stress Test and Audit the Model

Auditing tools must be used to reassure that the excel formulas are giving accurate results. A stress test can be conducted by developing extreme scenarios and determining if the financial model is functioning as per expectations.

Also Read: Objectives of Financial Statement Analysis

Financial Modelling as a Career

In the corporate era of new and complex businesses, mergers and acquisitions, frequent restructuring in businesses, and financial modeling have played a crucial role in the proper execution of the same. Financial modeling is a promising career path. If you are looking forward to financial modeling as a career, you can learn Financial Modeling and become a Certified Financial Modeller.

Conclusion

Financial modeling is utilized in a number of stages in the operations of the entities. It combines finance, accounting, and business metrics to create a mathematical representation of the entity. Financial modeling is a highly valued tool and benefits the entity in numerous ways.

You made a good point that charts will be very helpful in communicating in formation when making a financial plan. I’m thinking about quitting my job soon in order to venture into entrepreneurship and build my own business. I think I’m going to need a financial model portfolio building service in order to make sure that everything goes exactly according to plan.