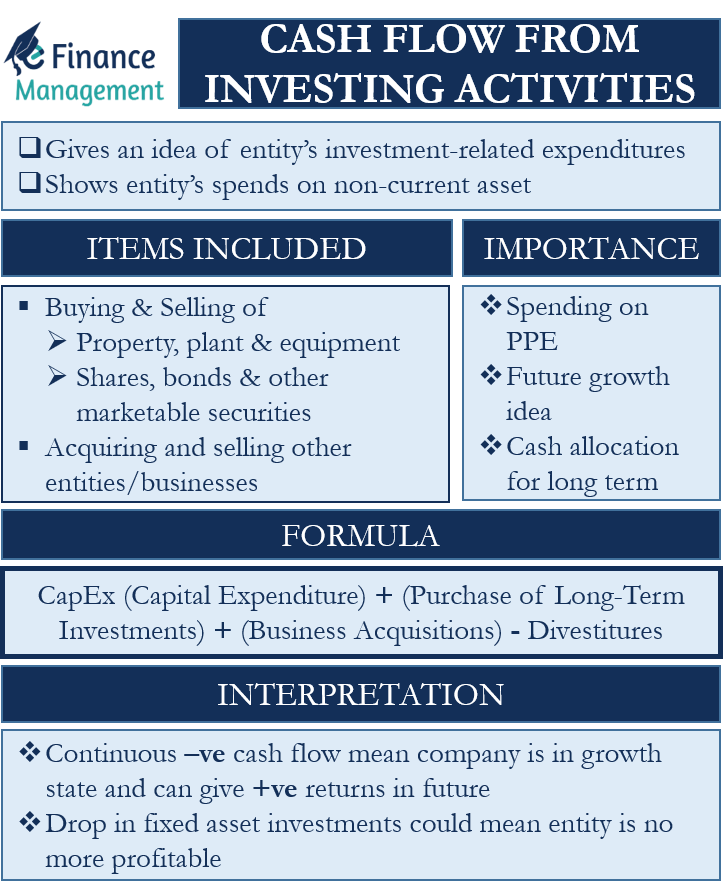

Every entity needs to present the cash flow statement as part of its Annual Accounts/Reports. And this Cash Flow Statement has three sub-statements. And these are Cash Flows from Financing Activities, Cash Flow from Operational Activities, and Cash Flow from Investing Activities. Further, Cash flows from investing activities are one of the line items in the cash flow statement. Moreover, the cash flow from investing activities gives an idea of an entity’s investment-related deployment of funds. Or, it shows how an entity spends on non-current assets to brighten or improve its prospects.

Investing activities include all new investments that an entity makes, like transactions related to sales of assets, and investment gains or losses. And the common items that come under investing activities are the purchase and sale of fixed assets, purchase and sale of shares and bonds, payments for mergers & acquisitions, etc.

What does it Include and Doesn’t Include?

Investing activities include the following items:

- Buying property, plant, and equipment (cash outflow).

- Money from the sale of property, plant, and equipment (cash inflow).

- Acquiring other entities or businesses (cash outflow).

- Proceeds from selling other entities (cash inflow).

- Buying shares, bonds, and other marketable securities (cash outflow).

- Proceeds from selling shares, bonds, and other marketable securities (cash inflow).

There could be more items under the investment activities depending on the types of company and industry. One easy way to know what’s to include and not to include in investing activities is to compare the differences between non-current assets over two periods. So, any change in the amounts of long-term assets (not depreciation) should come under the investing activities.

However, the Investing activities do not include the following items:

- Interest payments and dividends.

- Taking on more debt, issuing new equity, and other sources of capital.

- Depreciation of assets.

- All other transactions (income and expenses) in normal business operations.

Cash Flow from Investing Activities – Formula

Now that we know what items come under investing activities let us look at its calculation formula. There is no one formula to know the investing activities balance, but the below formula is the most popular one.

Also Read: Cash Flow Statement – Definition and Meaning

Cash Flow from Investing Activities = CapEx (Capital Expenditure) plus (Purchase of Long-Term Investments) plus (Business Acquisitions) less Divestitures.

CapEx, Purchase of Long-Term Investments, and Business Acquisitions are usually the biggest cash outflows; divesting or disposing of the assets leads to cash inflows.

Usually, cash flow from investing activities is negative. The CapEx and other investments are more frequent (and bigger) than divestitures/disposals. However, a negative balance in no way is bad. A negative balance suggests that an entity is investing in long-term growth.

Example

Let us take an example to understand the calculation of cash flows from investing activities:

Company A buys a new plant for $800 million in year 1. The company sells its old facility at a loss of $10 million, and the closing written down value of the old facility was $150 million. The company spends $20 million on the construction of the facility. Also, Company A is selling its stake in a sister entity for $50 million. It also got a dividend payment of $5 million.

The following items will come for the calculation of cash flows from investing activities:

Payment to set up the new plant: $800 million

Plus: Spending on construction: $20 million

Less: Proceeds from the sale of old facility: $140 million ($150 million less $10 million)

Less: Proceeds from selling a stake in a sister concern: $50 million

So, the cash flow from investing activity will be: -$630 million, and please note that dividends will not come under investing activities.

Importance of Cash Flow from Investing Activities

The below points will help to bring out the importance of cash flow from investing activities:

- A glance at the investing activities easily gives an idea of an entity’s spending on PPE (property, plant, and equipment).

- Looking at the CapEx amount under the investing activities gives a fair idea of the money that an entity is spending on its future growth. Moreover, how consistently such investments are being made.

- Further, it reveals how an entity is allocating cash toward its long-term growth.

Interpreting Cash Flow from Investing Activities

Cash balance from investing activities may prove an important source to offset negative cash flows from operations. Capital-intensive industries require massive investments in fixed assets. If an entity continuously gives negative net cash flows from investing activities due to the purchase of fixed assets, it could indicate that an entity is in a growth phase. So, it is likely that an entity could generate positive returns going ahead. Another way of looking at it is, that if the operational activities do not support or reflect the growth then it could be overcapitalization. And that may lead to a serious cash flow bottleneck and may affect the operations of the company.

Separately, if an entity is continuously reducing investments in fixed assets, it could mean that an entity does not believe there are potential opportunities in its current business. If a drop in investments in fixed assets accompanies distributing dividends to investors, then it may or may not be negative.

Also Read: Cash Flows from Financing Activities

A drop in fixed asset investments could also mean that an entity is no more profitable. And that it does not have enough cash or borrowing capacity to make new investments. In such a case, the income statement would show a low or negative number.

So, it is important to read the information from the investing activities in combination with information from other financial statements.

Final Words

Cash flow from investing activities is a crucial item in an entity’s financial statements. It can easily give an insight into how an entity plans to grow going ahead and where the future revenues would come from. A negative balance does mean that an entity is spending more cash. Instead, it could suggest that the entity is investing in its future growth. The interpretation, however, needs to be taken after considering the operational and financing cash flow statement. Any interpretation or conclusion in isolation may lead to a wrong decision.