Every entity needs to present the cash flow statement as part of its Annual Accounts/Reports. The Cash Flow Statement consists of three sub-statements. And these are Cash Flows from Financing Activities, Cash Flow from Operational Activities, and Cash Flow from Investing Activities. So Cash Flow from Financing Activities is an important part (or a line item) of the cash flow statement. It primarily reveals the sources and uses of cash for an entity. In other words, it conveys therefrom all the cash is coming in and where are all those cash is going out of the business during a given period.

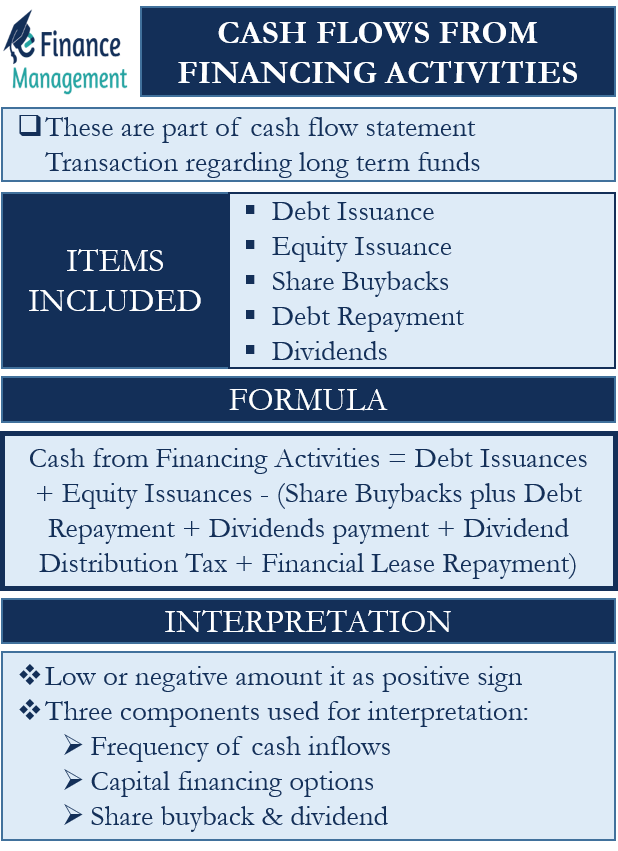

It includes entities’ transactions with the owners and lenders regarding the long-term funds they give to the business or business returning such funds to the owners or lenders. In the case of a non-profit entity, this line item also includes contributions from donors for long-term purposes.

The common items that this line item includes are the issue of shares, repurchase of shares, issue of bonds, repayment of the debt, dividend payment, and more.

A point to note is that small entities with no debt and no dividend payment may not have any financing activities. So, their cash flow statement may not have any transactions from financing activities.

Also Read: Cash Flow Vs. Fund flow

Cash Flows from Financing Activities Includes

Following are the common items that come under cash flows from financing activities:

Debt Issuance

Debt is a form of external borrowings repayable as per the agreed terms. Such debt could be from owners, friends, family and business associates or banks, institutions, or even the general public. Such funds come with an obligation to pay regular interest and repayment of the principal amount as per the redemption date. Debt Issuance is a cash inflow for the entity.

Equity Issuance

It means raising money by issuing new shares (ordinary and preference shares) to the investors. Equity Issuance is also a cash inflow for the entity.

Share Buybacks

It means buying back own shares that were issued earlier to the investors, from the open market. Repurchasing shares helps to reduce the total number of shares in circulation. A share buyback is a cash outflow as the company needs to pay for these purchases.

Debt Repayment

It is the opposite of debt issuance, meaning an entity pays back the due debt on maturity. Note that taking on more debt and repaying debt comes under financing activities, but not the interest on the debt. However, we do see the impact of interest payment in the cash flow statement. The interest expenses come in the income statement, which is the starting line item of the cash flow statement. Debt repayment is a cash outflow.

Dividends

It means making cash payments to the equity shareholders. A dividend payment is a cash outflow.

Apart from these, there could be more cash outflows in the financing activities, including repaying financial lease commitments and dividend distribution tax.

How to Calculate?

To calculate cash flows from financing activities, one needs to look at the items (discussed above) in the balance sheet. We need to determine the changes in these items from the prior period.

For instance, if there is a rise in the equity balance, it would mean the issue of more shares or cash inflow. And, if the equity balance drops, it would mean share buyback or cash outflow.

Similarly, if the long-term or short-term debt balance drops, it would mean repayment of the debt or a cash outflow. And, if the debt balance rises, it would mean the entity is taking on more debt, and it will be a cash inflow.

A point to note is that the financing activities do not consider the changes in retained earnings. This is because there is no direct relation between retained earnings and financing activities.

Apart from the balance sheet, one also needs to look at some income statement items to calculate the financing activities’ cash flows. For instance, dividends on preference shares (not common stock) that an entity pays in a period will be used for calculating financing activities cash flows.

Formula

So, after identifying all these items/transactions, we need to place all these into a formula to prepare the Statement.

Cash Flow from Financing Activities = Debt Issuances plus Equity Issuances less (Share Buybacks plus Debt Repayment plus Dividends payment plus Dividend Distribution Tax plus Financial Lease Repayment).

Example

Let us try to understand the calculation with a simple example:

In a year, Company A buybacks $1,000,000 of stock, take $3,000,000 of long-term debt, pays back $500,000 of long-term debt, and pays $400,000 in dividends. In this, there is only one cash inflow (long-term debt), and all others are cash outflow.

So, the cash flow from financing activity in this case will be: $3,000,000 – ($1,000,000 + $500,000 + $400,000), or $1,100,000.

Interpreting Cash Flows from Financing Activities

There is no set number or parameter that one can use to tell if the cash balance or flow from financing activities is healthy. However, to determine the health of financing activities, one should compare an entity’s financing and investing activities against operating activities.

Still, if the financing activities have a low or negative amount, then we could view it as a positive sign. This could mean that an entity is paying its debt. One can also analyze the health of financing activities by looking at the net borrowings. This item shows the total funds that an entity borrows in a period less the funds that an entity pays back.

One can also use the trend of the financing activities this is over the past three or four years to determine the financial health of an entity. For instance, if the positive cash flow of recent years is largely due to the loans, then it is not a good sign. Ideally, the cash flow from operating activities should result in a positive cash flow balance. And, the financing activities’ cash flows should support the growth (or operating activities).

Additionally, we can interpret the financing activities by breaking them down into the following three components:

Frequency of Cash Inflows

In this, we need to group the cash inflows across several periods. For instance, if an entity regularly issues new shares or takes more debt, it could mean that it is unable to generate enough earnings to fund its operations. So, in such a case, positive cash flows could be a negative sign.

Capital Financing Options

The financing options that an entity selects also give a hint about its financial health. For instance, if an entity regularly goes for share issuance, it would dilute ownership for existing shareholders. And this could result in a drop in the share price. On the other hand, the use of more debt increases the fixed obligations for an entity. And this could prove ominous if the entity’s operating income keeps dropping.

Share Buyback and Dividend

If an entity’s net income is rising and it is going for buyback, it suggests a good thing for investors. This shows that an entity is confident about its shares. And, if an entity is buying back shares even when its net income is dropping, it is a serious red flag. It could mean that an entity is trying to push up its share price to hide its dropping net income.

Final Words

Cash Flows from Financing Activities are a critical indicator of an entity’s financial health. One can use the above-discussed points (under the heading ‘Health’) to properly interpret the financing activities. It is, however, advisable to use the financing activities analysis in combination with other metrics, such as ratio and financial statement analysis, to get a better financial picture of an entity.