Revaluation Reserve: Meaning

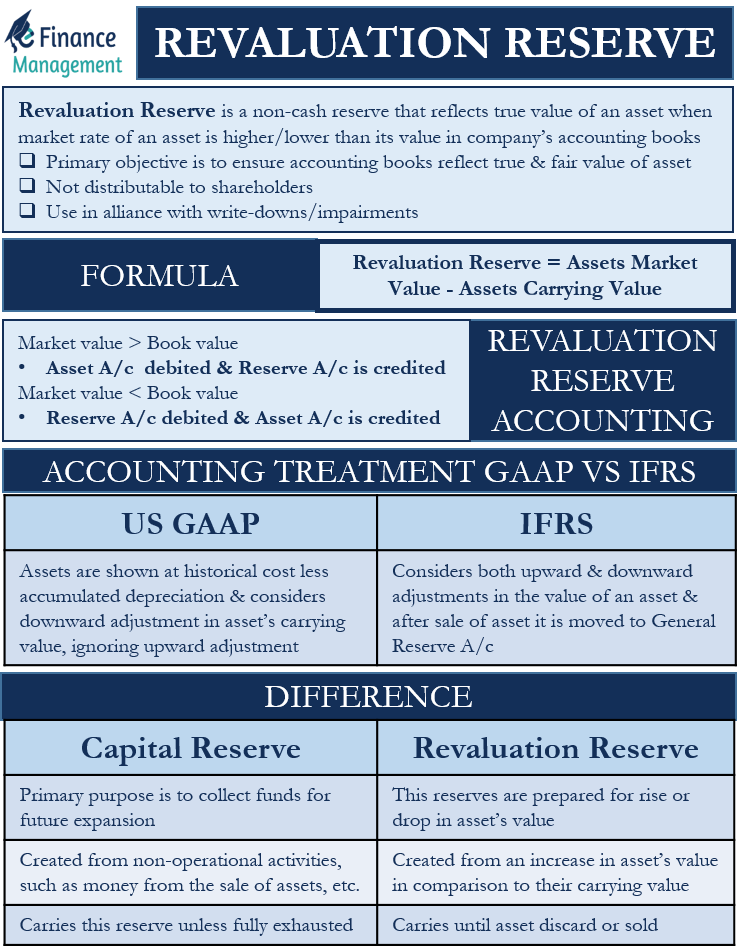

A company creates Revaluation Reserve to reflect an asset’s true value. It is a non-cash reserve that reflects the true value of an asset when the market rate of an asset is higher or lower than its value in the company’s accounting books. If the value is higher, the difference in the value gets credited to the revaluation reserve account. And, if the value is less, the same way we debit the difference value to the account.

Read more: Revaluation Reserve – Meaning, Accounting, Journal Entries, and ExampleThe primary objective of this reserve is to ensure the accounting books reflect the true and fair value of the asset. This reserve is not part of the other reserves, and thus, it is not distributable to the shareholders. Moreover, companies can make adjustments to this reserve throughout the year rather than waiting for the end of the accounting period (monthly, quarterly, or yearly).

- Revaluation Reserve: Meaning

- Revaluation Reserve: When to Create?

- Revaluation Reserve Formula

- Book Value vs. Fair Value

- Accounting of Revaluation Reserve

- Journal Entries: Revaluation Reserve

- Revaluation Reserve Example

- Accounting Treatment: US GAAP vs. IFRS

- How is it Different from Capital Reserve?

- Final Words

A point to note is that a company if it wants, can use such reserves in alliance with the write-downs or impairments.

Revaluation Reserve: When to Create?

For accounting, it is a line item for the balance sheet only. Any change does not go to the income statement or the profit and loss account. And this thus does not make a change in the cash earnings. Of course, the indirect impact is that the depreciation quantum will change due to revaluation. And to that extent, the income statement and the earnings will get affected. A company uses this line item to create a reserve for certain assets. It comes into use when a revaluation assessment finds any change in the value of the asset.

Revaluation Reserve Formula

So, the formula for revaluation reserve = Assets Market Value less Assets Carrying Value.

Creating such reserves is not part of normal business activity. But a business is free to create it if it believes the value of assets could change going ahead. Also, it can create this reserve if it believes that it is vital to monitor the assets’ carrying value due to the market situation—for example, the changes in the value of real estate assets due to changed market conditions. Similar way the changes in the value of foreign assets due to currency fluctuations.

Book Value vs. Fair Value

Before we move ahead, it is important to get a clear understanding of the concept of carrying value. The carrying value is the value shown in the books of accounts net of depreciation charged to date (accumulated depreciation). After the end of the depreciation period, a firm may adjust the carrying value to the fair value.

Usually, a firm takes book value (and not fair value) as carrying value when the asset in question is a long-term asset. Since short-term assets are more liquid, they are easy to carry on the balance sheet at fair value. So, for short-term assets, the fair value is the carrying value.

Accounting of Revaluation Reserve

Usually, adjustment to this reserve either raises the liability or lowers the value of assets. In case of a rise in the assets’ value in comparison to the asset’s book value, the reserve would increase and vice versa.

Talking about journal entries, in case of the market value is more than the book value, we need to debit the asset account and credit the reserve account. And, if the market value is less than the book value, then we need to debit the reserve and credit the asset account

Also Read: Revaluation of Fixed Assets

Journal Entries: Revaluation Reserve

Following are the usual journal entries about the revaluation reserve:

- When the market value of an asset is higher than the carrying value:

| Particulars | Dr. Amount | Cr. Amount |

|---|---|---|

| Fixed Asset Dr. | XXXX | |

| To Revaluation Reserve | XXXX |

- When the market value is lesser than the carrying value:

| Particulars | Dr. Amount | Cr. Amount |

|---|---|---|

| Revaluation Reserve Dr. | XXXX | |

| To Fixed Asset | XXXX |

Revaluation Reserve Example

The following example will give a better understanding of the journal entries for this reserve:

Company A records a piece of land on the balance sheet at $20 million. However, it assesses the market rate of the land and founds its value to be $22 million. So, the journal entry for this will be:

| Particulars | Dr. Amount | Cr. Amount |

|---|---|---|

| Fixed Asset Dr. | $2 million | |

| To Revaluation Reserve | $2 million |

Now, assume that a year later, the value of the land drops to $21 million. The journal entry will be:

| Particulars | Dr. Amount | Cr. Amount |

|---|---|---|

| Revaluation Reserve Dr. | $1 million | |

| To Fixed Asset | $1 million |

The revaluation reserve balance will drop when the market value is below the carrying amount. If the market value keeps dropping, the reserve at some point will drop to zero or even negative. As per the accounting standard, we do not record negative revaluation. So, if the assets’ market value drops below the available reserve, then we need to show it as an impairment expense.

Suppose, in the above example, the market value of land drops to $19 million. Since the carrying amount was $21 million, we need to slash $2 million from the land’s value. However, the reserve balance was $1 million ($2 million less $1 million). Thus, we need to show the remaining $1 million as an impairment expense.

The journal entry, in this case, will be:

| Particulars | Dr. Amount | Cr. Amount |

|---|---|---|

| Revaluation Reserve Dr. | $1 million | |

| Impairment Expense Dr. | $1 million | |

| To Fixed Assets | $2 million |

Accounting Treatment: US GAAP vs. IFRS

US GAAP uses the cost model for valuation purposes. This means the assets are shown at historical cost less accumulated depreciation. The US GAAP only takes into consideration downward adjustment in the asset’s carrying value. And it ignores any upward adjustments. Moreover, there is no revaluation reserve account in the US GAAP. So any downward adjustment due to the impairment is used to trim down the value of the asset. The loss due to the downward adjustment comes in the income statement.

IFRS, on the other hand, considers both upward and downward adjustments in the value of an asset. At the time of the sale of the asset, the balance in the revaluation reserve account is moved to the General Reserve account. Once the balance is in the General Reserve account, the company can use it to distribute it as dividends to shareholders.

The amount that a company transfers from reserve to General Reserve are the revaluation surplus. So, we can say that a revaluation surplus comes into existence only after a company discards or sells an asset. So it can be used only upon the actual realization of the money on the sale of assets. The notional increase is of no use for the purpose.

How is it Different from Capital Reserve?

Following are the differences between the capital reserve and revaluation reserve:

- The primary purpose of creating capital reserves is to collect funds for future business expansion or any other future need. But, the other reserve is to account for the rise or drop in the value of assets.

- Companies create capital reserves from non-operational activities, such as the money from the sale of assets, share premium amounts, etc. On the other hand, companies create revaluation reserves from an increase in the asset’s value in comparison to their carrying value.

- Companies carry capital reserve on the balance sheet unless it fully exhausts the reserve. And companies carry revaluation reserve until it sells or discards the underlying asset.

Talking about similarities, the biggest similarity between the two is that companies do not create both reserves from normal business operations. Thus, one can not use these reserves to assess the company’s operational efficiency.

Final Words

The revaluation reserve account works well to show the fair value of the asset, both in downward and upward adjustment. Since the upward and downward adjustment is not a sure gain or loss rather it is an assumed one. Therefore, the adjustment or the differential amount is shown under the Revaluation Reserve account. This ensures that such adjustments do not impact the income statement. Any profit or loss from the sale of an asset will come in the income statement only after adjusting it in the revaluation reserve.