What is Revaluation Surplus?

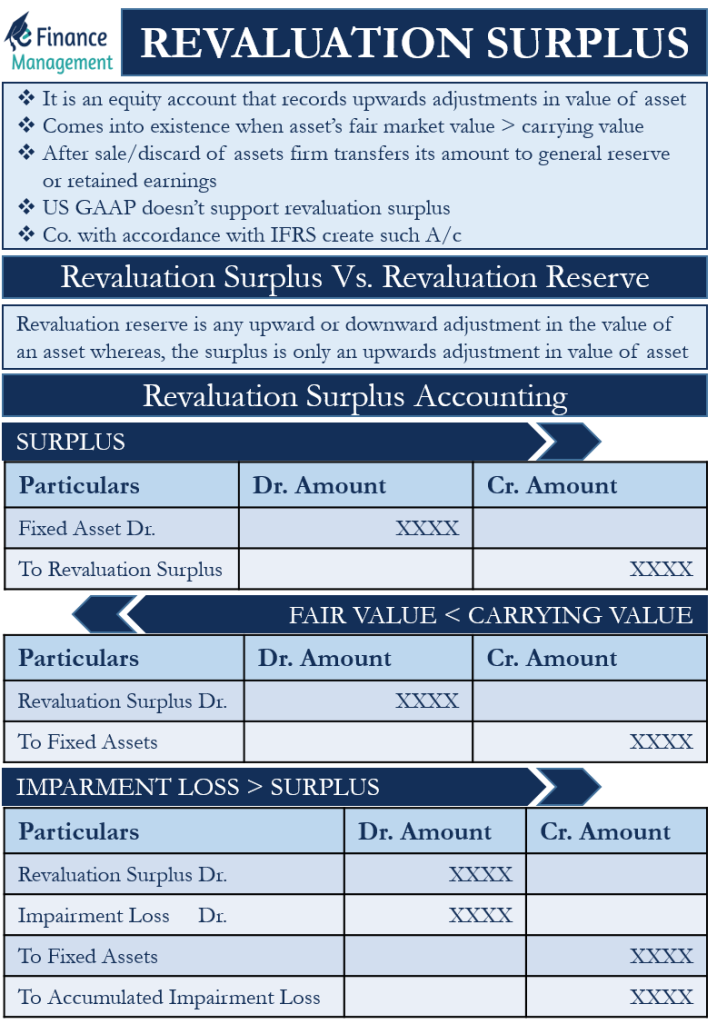

Revaluation Surplus is an equity account where all upwards adjustments in the value of a company’s assets are systematically recorded. Some companies revalue their assets to determine the recent market value of their assets. This surplus comes into existence when the fair market value of the asset is more than the carrying value appearing in the books of account.

Read more: Revaluation Surplus – Meaning, Journal Entries, and ExampleAfter a firm retires, discards, or sells an asset, the accountant transfers the balance in the revaluation surplus to the retained earnings account or the general reserve.

In a revaluation model, any upward movement in the asset’s fair value is not an income straight away. And therefore the difference in the increased value is not taken to the income statement or the profit and loss account. Instead, companies recognize and record this as a reserve in the balance sheet. They do this because there is always a possibility that the value of the asset may drop in the future, just like the way it has increased over the years.

A point to note is that the US GAAP does not support revaluation surplus. But companies making their accounts by IFRS can create such an account.

Revaluation Surplus vs. Revaluation Reserve

We need to keep in mind that Revaluation Surplus and Revaluation Reserve are two different concepts and both are not the same. A revaluation reserve is any upward or downward adjustment in the value of an asset. But, the surplus is only an upwards adjustment in the value of the asset.

Revaluation Surplus Accounting Treatment

This surplus account is a reserve account that comes in the equity section of the balance sheet. Normally, the balance of this account is on the credit side.

The journal entry in case of a surplus is:

| Particulars | Dr. Amount | Cr. Amount |

|---|---|---|

| Fixed Asset Dr. | XXXX | |

| To Revaluation Surplus | XXXX |

Thus, in the case of the revaluation (upward adjustment) of an asset, both the asset and equity (liability) sides increase by the same amount.

Now, if the fair value of the asset goes down (due to the impairment), an accountant needs to pass a reversal journal entry. The entry will be:

| Particulars | Dr. Amount | Cr. Amount |

|---|---|---|

| Revaluation Surplus Dr. | XXXX | |

| To Fixed Assets | XXXX |

This entry reduces the balance of both accounts. Such a journal entry, however, is done only when the impairment loss is less than the revaluation surplus. But if the impairment loss is more than the surplus, the journal entry will differ. The journal entry will be:

Also Read: Revaluation of Fixed Assets

| Particulars | Dr. Amount | Cr. Amount |

|---|---|---|

| Revaluation Surplus Dr. | XXXX | |

| Impairment Loss Dr. | XXXX | |

| To Fixed Assets | XXXX | |

| To Accumulated Impairment Loss | XXXX |

Revaluation Surplus Example

Company A has two years old machinery costing $100,000. It uses a straight-line method for depreciation at 20%. So, the accumulated depreciation currently is $40,000, and thus, the carrying value is $60,000.

Now assume that Company A revalues the machinery and finds its market value to be worth $80,000. In this case, the surplus will be $20,000 (Carrying value less market value).

The journal entry for this will be:

| Particulars | Dr. Amount | Cr. Amount |

|---|---|---|

| Machinery Dr. | $20,000 | |

| To Revaluation Surplus | $20,000 |

Now, suppose a year later, due to the market conditions, the value of the machinery drops to $40,000. The carrying value currently is $64,000 ($80,000 less 20% depreciation). Now, the drop in the fair value is $24,000 ($64,000 less $40,000).

Since the balance in the surplus account was $20,000, the excess drop of $4,000 ($24,000 less $20,000) will come into the impairment loss account. So, the journal entry, in this case, will be:

| Particulars | Dr. Amount | Cr. Amount |

|---|---|---|

| Revaluation Surplus Dr. | $20,000 | |

| Impairment Loss Dr. | $4,000 | |

| To Fixed Assets | $20,000 | |

| To Accumulated Impairment Loss | $4,000 |

RELATED POSTS

- Revaluation of Long-Lived Assets

- Allowance for Doubtful Accounts – Meaning, Accounting, Methods And More

- Accrual vs Deferral – Meaning and Differences

- Adjusting Entries – Meaning, Types, Importance And More

- Changes in Accounting Policies – Reason, Disclosure, Exemption and Example

- Accumulated Depreciation – Meaning, Accounting and More