What is Carrying Cost?

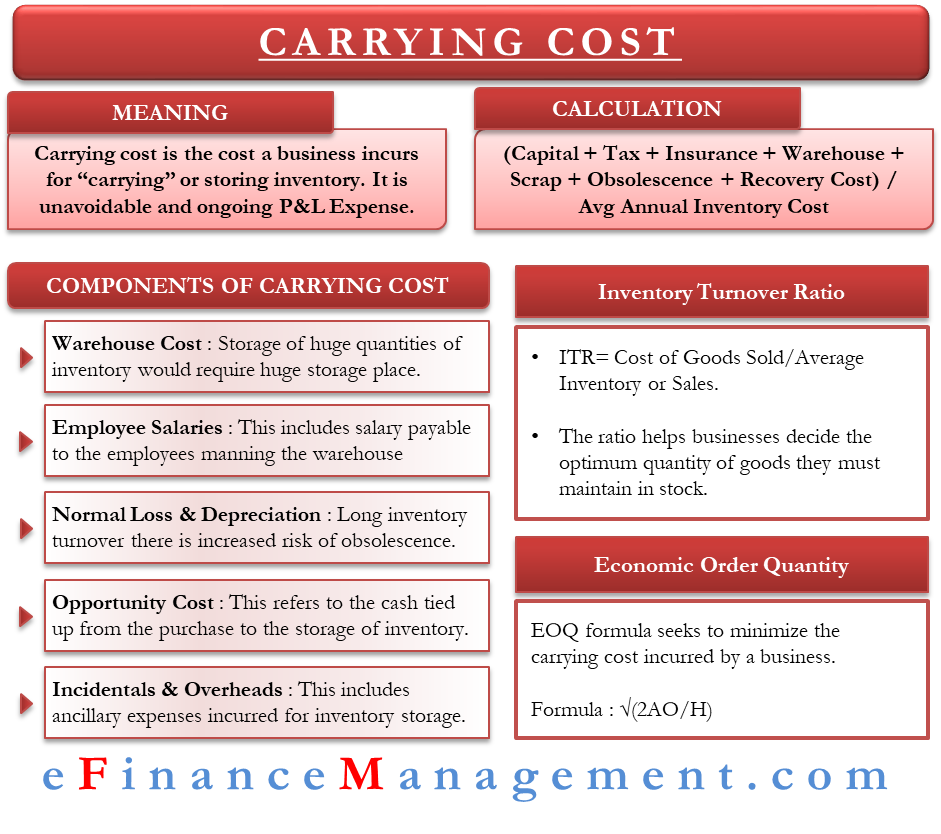

A carrying cost is a cost a business incurs for “carrying” or storing inventory. Any business is required to maintain a minimum quantity of goods on standby. Being a manufacturer is not as simple as producing goods for straightaway sales. Therefore, a business must always have a significant stock of its produce. Consequently, this stock comes in handy in the face of contingencies. For instance,

- damage to an existing order,

- fulfilling ad-hoc emergent orders,

- interruption in production and

- above all to maintain a safe margin of stock.

On average, carrying costs constitute nearly 20 to 30% of the total inventory value. Furthermore, the carrying cost is an unavoidable and ongoing P&L expense. Therefore, owing to the significance of the value involved, careful planning and consideration are required to ensure the optimality of the spend.

Components of Carrying Cost

Broadly speaking, carrying cost covers the expenses of storage and internal handling of goods. The goods in question may refer to raw materials and stores in the pre-production stage and finished goods post-production.

Below mentioned are the major and basic carrying costs almost every business must incur.

Warehouse Cost

Inventory is a tangible asset occupying space. Therefore, it is obvious that the storage of huge quantities of inventory would require a considerable storage place. For this reason, businesses must incur warehouse costs. A warehouse becomes an essential expense since, in addition to being a dedicated space for storage, it also provides the necessary safekeeping and enables proper maintenance of goods. Warehouse rent and overheads such as electricity cover warehousing costs.

Employee Salaries

This refers to the salary payable to the employees manning the warehouse for day-to-day care. Additionally, there may also be a need to employ certain skilled staff and workers in case goods require expert handling for their effective storage. For example, full-time technicians may be required in an electronic products warehouse. Or likewise a quality assurance expert in a food factory.

Normal Loss & Depreciation

Commonly speaking, normal wear and tear lead to an anticipated fall in the value of goods. However, in the case of long cycles of inventory turnover where the goods remain in storage for an extended period, there is an increased risk of obsolescence. Goods may run past their expiry date or may no longer be fit for consumption. Moreover, the longer the goods sit in storage, the more prone they become to damage by pests, natural calamity, or just petty employee theft. Most noteworthy is to point out the importance of optimal inventory turnover cycles to avoid such losses.

Opportunity Cost

This refers to the cash tied up from the purchase to the storage of inventory. In so far as the goods remain unsold, the potential cash sales remain unrealized. This unrealized cash is an opportunity cost the business incurs for the storage of goods. Such cash could, therefore, be translated to generate additional interest income or invested in a way to generate higher returns. Therefore, it is always a crucial decision for a business to balance the carrying cost and opportunity costs such that the latter does not outweigh the former.

Incidentals & Overheads

This bracket of carrying cost includes ancillary expenses incurred for inventory storage. For example, the insurance premium on stock, statutory taxes, and subscription to management information systems for effective inventory management.

Also Read: Inventory Costing

Computation of Carrying Cost

Direct Method

The below formula covers all the major components of carrying cost and can be used to give a quick estimate of the same.

(C + T + I + W + (S – R1) + (O – R2)) / Average annual inventory costs

C = Capital

T = Taxes

I = Insurance

W = Warehouse cost

S = Scrap

O = Obsolescence

R = Recovery costs

Relevant Accounting Ratios

Inventory Turnover Ratio (ITR)

The formula for ITR is as follows:

Inventory Turnover Ratio = Cost of Goods Sold/Average Inventory or Sales.

Resultant is a number denoting a period of time, generally the number of days.

For instance, the total cost of goods sold in a year is $500,000. Let the average cost of stock in storage held at any point be $12,500.

Therefore, the ITR= $(500,000/12,500) = 40 days.

Thus, on average, it takes 40 days for the business to convert its inventory to cash sales.

The ratio helps businesses decide the optimum quantity of goods they must maintain in stock. Therefore, an overestimation of this ratio may make the stored goods prone to obsolescence and damage. At the same time, an underestimation may lead to the short stocking of goods rendering businesses incapable of meeting the market demand.

Economic Order Quantity- EOQ

EOQ formula seeks to minimize the carrying cost incurred by a business. The rationale behind EOQ relies on striking the right balance between the number of purchase orders and the actual carrying cost that incurs once goods reach the co. storage.

√(2AO/H)

A = Annual Demand in Units

O = Ordering Cost per Order

H = Holding Cost per Unit Per Year

EOQ is an important cash flow tool. Most importantly, it helps businesses decide the exact number of orders and the quantity of stock that they should maintain. It releases significant cash back into the business. For the lack of it, enterprises would continue to mismanage their inventory levels and overheads, thus leading to reduced operational efficiency and the loss of revenue.

Also, read Holding cost vs. Ordering cost.

RELATED POSTS

- Types of Costing

- Distribution Cost – Meaning, Accounting, and More

- Merchandise Inventory – Meaning, Accounting and More

- When does the cost of the inventory become an expense?

- Classification of Costs based on Functions / Activities

- Material, Labor and Expenses – Classification Based on Nature of Costs