Meaning of Physical obsolesces:

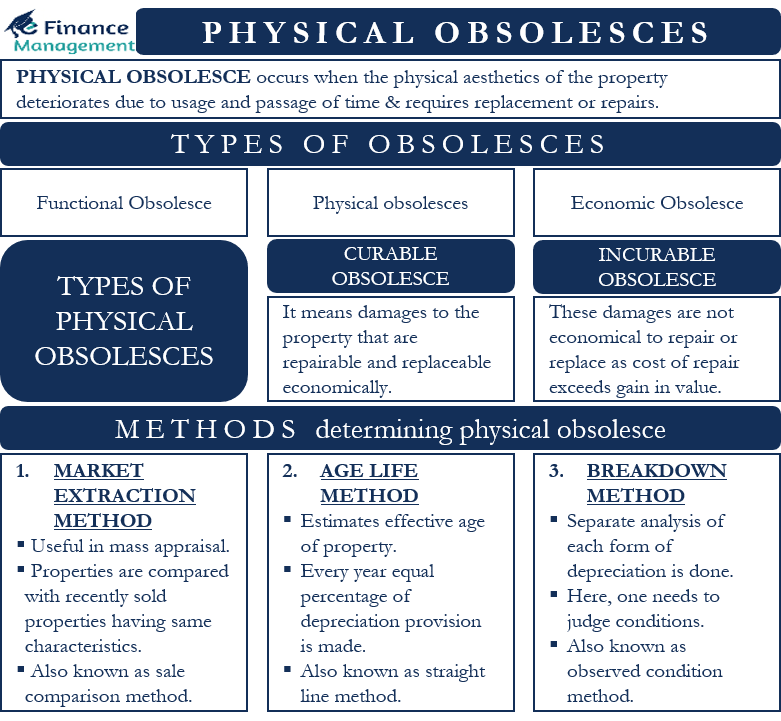

Obsolesces negatively affect the value of the property. In other words, it reduces the value of the property. Further, obsolesces are of three types in real estate property. And these are Physical, functional, and external (Locational or economical) obsolesces. However, in this article, we will discuss physical obsolesces in detail.

Physical obsolesces mean loss or decline in value of the property by usage and passage of time. In other words, physical obsolesces occur when the physical aesthetics of the property deteriorates and requires replacement or repairs. Hence, physical obsolescence generally relates to the property’s age and its use.

With the passage of time and usage, every property requires regular maintenance. However, if regular maintenance is not undertaken, it affects the property’s durability and longevity rapidly. Moreover, there are many factors that can relate to physical obsolesces like normal wear and tear, improper design of construction, inappropriate materials and components used in the construction of the property, lack of proper maintenance by the owner, etc. Like sunlight, fire, wind, storms, floods, and earthquakes are natural factors causing damage to the property. In simple words, physical obsolesces are those damages to the property that are visible and can be identifiable. And this can be in control by regular maintenance, proper planning, and the right choice of material and construction method.

Types of Obsolesces

In this article, our focus is on the physical obsolesces of real estate/ property. However, let us at least understand the definition of other types of obsolesces too. And these are:

Functional Obsolesces:

It occurs when a property loses its value due to its design, architecture, style, inadequate or outdated amenities, size, etc. Hence, we can say it is because of the internal factors of the property.

Economic Obsolesces:

It happens when the price of the property deteriorates due to external factors. And these factors could be the changes in the local traffic pattern, the creation or coming up of public nuisance utilities and noisy surroundings, construction of sewage plants, powerhouses, jails, etc.

Types of physical obsolesces:

Physical obsolesces can be classified into two categories,

- Curable obsolesces

- Non curable iobsolesces

Curable Obsolesces:

Curable obsolesces mean damages to the property that is repairable and replaceable economically. The cost to repair the damaged component or part of the property does not exceed the loss in value. In other words, the gains on the value of asset/property resulting from the repair will offset the cost to repair. Hence, the cost of repair, increase in the value of and the economic life of the property are the main factors to consider for making decisions with regard to curable obsolesces.

Curable obsolesces include repainting, doors, and window replacement, carpet replacement, broken tiles, leakages or plumbing fixtures, wall proofing, roof repairs, deferred maintenance, etc.

Incurable Obsolesces:

Incurable obsolesces are not economical to repair or replace as the cost to repair exceeds the gain in value.

Such obsolesces items include structural frameworks, foundations, or ceiling structures. If the foundation of the property is faulty, it would consider incurable obsolesces. In this situation, tearing down the building and starting from scratch is more feasible rather than to repair.

Also Read: Intangible Assets

The structural frameworks of property deteriorate at different rates based on the length of time they are expected to last. Hence, the appraiser classifies incurable obsolesces on life expectancies of the building components as short-lived incurable obsolesces and Long lived incurable obsolesces.

Short-Lived

Short-lived items whose expected remaining economic life is shorter than the remaining economic life of the entire structure. This includes electrical and mechanical systems, furniture, and fixtures that wear out faster than the rest of the property. This also includes items that are not yet ready to replace.

Long-Lived

Long-lived items whose expected remaining economic life is equal to the remaining economic life of the entire structure. This includes foundation frames, roof and floor structural, etc.

Methods of determining physical obsolesces:

There are three basic methods of calculating physical obsolescence:

- Market extraction method/Sales comparison method

- Age-Life method

- Breakdown method/Observed condition method

A) Market extraction method/Sales comparison method:

This method is particularly useful in mass appraisal. In this method, the appraiser compares the property with other recently sold property having similar characteristics in size, shape, and design and in the same location. The following steps are present in the determination:

- Identify comparable sales

- Establish sale date, sale price, site area, and land value.

- Adjust comparable by adding or deducting value.

- Determine net improvement value by subtracting land value from the total sale price.

In addition certain limitations to the Market extraction method:

- Difficult to find appropriate comparable

- Require ample amount of data

- Less flexible compared to other methods

B) Age-Life method:

This method is also called the straight-line method as in this method effective age of the property is estimated, and every year equal percent of depreciation provision is made. So that at the end of the asset life, the total depreciation provided for is equal to 100% cost of the property.

Similarly, it is used most of the time and easy to determine the physical deterioration. In this method, the ratio of effective life to total economic life will be calculated and multiplied by the replacement cost of the property.

The formula for Age Life Method

The following formula will give us a more clear understanding:

Percentage of depreciation = Effective age ÷ Total economic life

Dollar amount of depreciation= Replacement cost for similar new property × Percentage of depreciation

Total economic life= Effective age + Remaining Economic life

Let’s understand the terminologies used in the above formula:

Effective Age of the property is determined based on the current condition of the property rather than the actual age. In other words, it means how old the property looks. This directly influences with the maintenance of the property. If the property is well maintained, then the effective age will be less compared to the actual age.

Actual Age is the number of years passed from the date of the structure was built.

Economic life refers to the estimated period the property remains useful and contributes to the value of the property. However, the remaining economic life is the difference between economic life and the effective age of the property. Renovation and remodeling can affect the physical life and extend the remaining economic life of the property.

Reproduction or Replacement cost is the cost incurred to construct or replace the existing part or function of the improvements.

Let us understand with example:

Reproduction cost new – $ 100,000

Expected economic life – 50 years

Current effective life – 10 years

Depreciation = $100,000 * 10/50

=$20,000

Limitation of Age/Life method:

- It does not consider curable obsolesces separately.

- It considers the same economic life for both short-lived items and long-lived items.

i) Modified age -Life method:

This method is useful when the building has a major amount of curable physical or functional depreciation.

In this method, curable obsolesce is considered as 100% depreciable and incurable components calculated by age – life method.

The formula for estimating depreciation under the modified age life method is as follows:

Incurable depreciation =

(Replacement/reproduction cost new – cost to cure curable items) ×

Effective age ÷ Total economic life

Total depreciation= Curable depreciation + Incurable depreciation

Limitation of modified age life method:

- Although more accurate but does not allow for individual differences in remaining economic life on different components as it uses a single age/life ratio for every component of improvements.

C)Breakdown method/Observed condition method:

In this method, a separate analysis of each form of depreciation (physical, functional, economical) requires to be done. In using this method, one needs to judge the condition and expected physical life of each component of the building, including short-lived items, long-lived items, curable and incurable.

Steps in Breakdown method:

- Identify curable physical deterioration and the cost to cure these items established

- Estimate curable short-lived physical and functional obsolesces.

- Age and life expectancy of long-lived items identified and incurable physical obsolescence estimated.

- Estimating the impact of external obsolescence

- Add up total depreciation and estimate property value.

Limitation of breakdown method:

- This method is complex and time-consuming, hence not useful in mass appraisal.

- Requires detailed analysis and judgment concerning the condition and life expectancy of each component.