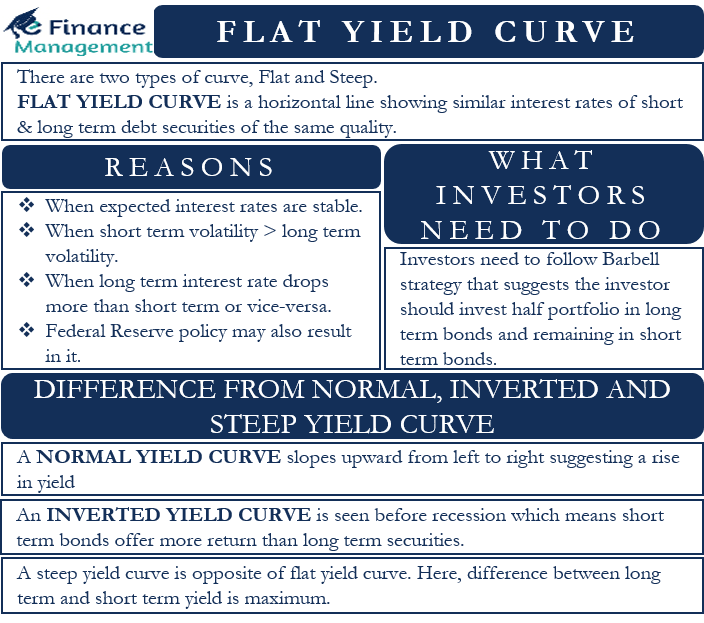

A yield curve is a graphical presentation of the yield of bonds or securities of the same credit quality at various maturity levels. And these yield curves are of two types, Flat and Steep. A Flat Yield Curve, as the word suggests, is a relatively flat curve of a yield. It implies that there is little difference between yields for bonds of different maturities. Or, we can say it is essentially a horizontal line showing similar interest rates of short and long-term debt securities of the same quality. Such a curve also conveys that there is a minimum difference between the short and long-term interest rates of a bond or security.

For example, a bond with a maturity of 20 years will have the same yield as a five-year bond of the same credit quality.

Flat Yield Curve – What it Means for Investor, Market, and Lenders?

For an investor, a flat yield curve suggests that there is little difference in yields between short-term and long-term bonds. For investors, this implies that they may not receive significantly higher returns for taking on the additional risk associated with longer-term investments. It could lead investors to consider alternative investment strategies or adjust their asset allocation. They may also interpret a flat yield curve as a sign of economic uncertainty or a potential slowdown, which could impact their investment decisions.

For the market, a flat yield curve can affect the overall functioning of the financial market. A flat yield curve can make it harder for banks to make money through traditional lending practices, as the spread between short-term borrowing rates and long-term lending rates is reduced. This can affect how much they can lend to people and businesses. It can also affect the prices of things like mortgages and corporate bonds because those prices are often based on interest rates.

The lender, including banks and other financial institutions, can be affected by a flat yield curve. When the difference between short-term and long-term interest rates is small, it’s called a flat yield curve. This makes it less profitable for lenders to give out loans, especially long-term ones. The money they earn from the interest may not be enough to cover the risks and expenses involved in lending. Lenders may become more cautious in extending credit and may adjust their lending criteria to manage their risk exposure.

Reasons for Flat Yield Curve

Federal Reserve policies may also result in such a curve. The Federal Reserve is a group that makes decisions to help fix problems in the economy. One way they do this is by changing the rate that banks charge each other to borrow money overnight. When the Fed changes this rate, it can make other banks change the interest rates they charge people.

Such a change in the interest rates may impact the yield curve as well, and it may start to get flat. Some investors may see it as a warning sign of a recession. But, this was a result of Fed policy that may or may not lead to recession. Still, it is better for investors to remain cautious when the yield curve starts to flatten, for whatever reason.

The reasons for such a curve could be:

Expectations of Economic Slowdown

A flat yield curve may indicate that investors have a more pessimistic outlook on the economy. If investors anticipate a potential economic slowdown or recession, they may be more inclined to invest in longer-term bonds, which are considered safer and provide a more stable return. This increased demand for longer-term bonds can drive their yields down, resulting in a flatter yield curve.

Monetary Policy Expectations

The actions and expectations regarding monetary policy can also influence the shape of the yield curve. If investors anticipate that central banks will maintain a relatively stable interest rate environment, it can contribute to a flat yield curve. When short-term interest rates are expected to remain low or stable, the yields on shorter-term bonds may not differ significantly from those of longer-term bonds, resulting in a flat yield curve.

Market Uncertainty & Risk Aversion

A flat yield curve can be a reflection of market uncertainty and risk aversion. When investors become more risk-averse and seek safer investments, such as longer-term bonds, it can lead to increased demand and lower yields for those bonds. This can flatten the yield curve as the yield differentials between short-term and long-term bonds narrow.

How it is Different from the Normal, Inverted, and Steep Yield Curve?

We generally see a flattening curve when an economy shifts from a normal to an inverted state. A normal yield curve slopes upward and, as the word suggests, shows normal behavior. It slopes upward from left to right, suggesting a rise in yield with an increase in the duration to compensate for the longer-duration investment risks.

We usually see an inverted yield curve before the recession. Such a curve means that short-term bonds offer more return to investors than long-term securities. Though this is an inverse of a normal scenario, it is logical.

When there is low economic growth, investors go for long-term assets to ensure the safety of their funds. As more and more investors go for long-term assets, this results in more demand and, eventually, a drop in the yield. A drop in yield, in turn, signifies slower economic growth.

The steep yield curve is the opposite of the flat yield curve. Or, in this situation, the difference between the short and long-term yields is the maximum. We usually see such a curve at the start of the economic expansion or at the end of the recession.

Generally, whenever there is a steep yield curve, the short-term interest rates remain very low. The Central bank would have reduced them to tackle the recession. A steep yield curve suggests that investors expect inflation to rise and economic growth to pick up.

The Barbell Strategy: What do Investors Need to Do?

In a situation when the short and long terms interest rates are similar, it becomes very confusing for investors to choose their investment strategy. One tested strategy in such a scenario is the barbell strategy. This strategy is useful for investing in fixed-income instruments and trading. The strategy is very simple and effective. It suggests that the investor should invest half of their portfolio in long-term bonds and the remaining portfolio in short-term bonds.

For example, if an investor expects the curve to get flat, then he may allocate half of the funds to a 10-year bond and another half to a 2-year bond. Such a portfolio would allow investors to react quickly to market changes.

However, the barbell strategy could result in losses at the time of a steep yield curve. Or when there is a significant rise in the long-term interest rates.

Final Words

A flat yield curve is often seen as a sign of economic uncertainty or a potential slowdown. It can have implications for banks and other financial institutions, as their profitability may be affected since their business model relies on borrowing at short-term rates and lending at long-term rates. A flat yield curve can also impact investors’ decisions regarding asset allocation and investment strategies.