Gross vs net income is a topic you must often have come across. Understanding the difference between the two is important for both businesses and individuals or employees (from the tax point of view). Gross Income is the amount of money that a business makes by selling the product or service. For individuals or employees, it is the income without deducting the expenses. Net Income, on the other hand, is gross income – total expenses.

Gross Income: Definition

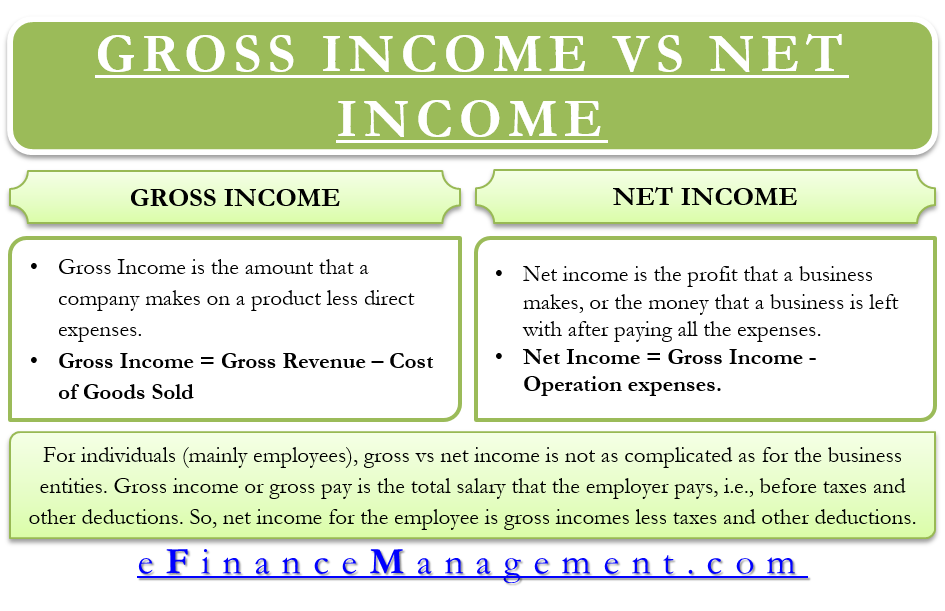

Gross income is the income that a business earns over a period of time. Basically, it is the amount a company makes on a product, less direct expenses. Another term for this is gross profit. Here, the profit before other expenses is taken into account. It is important to mention that one gets gross income by subtracting the Cost of Goods Sold (COGS) from Gross revenue.

Gross Income = Gross Revenue – Cost of Goods Sold.

Cost of Goods Sold is the sum of all the expenses that a company incurs in producing the goods. COGS include items such as Supply Costs, Raw materials, Packaging and shipping, Equipment and machinery, and Direct Labor costs.

For example, a business has sales of $100,000, Cost of goods sold of $50,000, Selling expenses of $10,000, Administrative expenses of $15,000, and Taxes of $5,000. In this case, Gross Profit is ($100,000 – $50,000) $50,000.

Also Read: Gross Income

Net Income: Definition

Net income is the profit that a business makes or the money that a business is left with after paying all the expenses. Business entities arrive at net income towards the end of the year by deducting operating expenses from the gross profit. Net Income is usually the last item in the income statement and thus, is popularly known as the bottom line.

To arrive at net income, we deduct other expenses from gross income. These other expenses include selling expenses, salaries, benefits for employees, travel expenses, advertising and marketing expenses, and more.

Taking the same example as above, the net income will be ($500,000 – $10,000 – $15,000 – $5,000) $20,000.

Definition of Revenue under GAAP and IFRS

To achieve gross income, one needs revenue. Thus it is important to know what constitutes revenue under both GAAP and IFRS.

- Revenue under GAAP – Para 78 of FASB concepts statement No.6, Elements of Financial Statements defines revenue as “inflows or other enhancements of assets of an entity or settlements of its liabilities (or a combination of both) from delivering or producing goods, rendering services, or other activities that constitute the entity’s ongoing major or central operations.”

- Revenue under IFRS – Paragraph 74 of the IASB Framework states that revenue is an income that a company earns from regular business activities. Moreover, revenue can be in any form, such as dividends, rent, interest, sales, fees, and royalties.

Paragraph 7 of IAS 18 defines revenue as the gross inflow of economic benefits from regular business activities. Further, the definition says these inflows result in an increase in equity.

Gross and Net Income: Importance

For a business, gross income signifies how well the company is performing on the revenue front. On the other hand, net income talks about an increase or decrease in the expense. If the expenses have risen while the gross income is constant, then net income would decline. Moreover, calculating gross and net income helps a company identify major expenses in a business. Knowing such expenses help companies manage their operations efficiently.

Also Read: Net Income

Understanding the difference between gross vs net income allows a company to track the income sources, and how well the company is doing to earn that income, and which items the company needs to focus on.

Also, studying net profit can help a business make a useful business decision. For instance, if sales are growing slowly, but the fixed cost is increasing relatively faster, then there will be a drop in the net profit. A business can address such an issue by increasing sales faster and making efforts to limit fixed costs.

Gross vs Net Income – Differences

| Gross Income | Net Income |

| Gross Income is net sales less COGS | Net Income is gross income less operational expenses, interest, and taxes. |

| Gross Income tells the income of the company after direct costs | Net Income talks about the amount that a firm can re-invest or use it pay a dividend to the shareholders |

| Gross Income does not rely on net income | Net Income relies on the computation of gross income |

| The only expense deducted is COGS | Both operational and non-operational cost is deducted |

| Gross Income is the immediate income that a company makes from the sale of goods | Net Income includes income from operations and income from other sources |

| It is always more than the net income | It is always less than the gross income |

Gross vs Net Income for Employees

For individuals (mainly employees), gross vs net income is not as complicated as for business entities. Gross income or gross pay is the total salary that the employer pays, i.e., before taxes and other deductions. A point to note is that gross income is not the amount an employee takes back home. Instead, it is what the employee costs to the employer. So, net income for the employee is gross income less taxes and other deductions.

For instance, an employee has a gross income of $50000, taxes are $1000, while other employee benefits are $3000. In this case, net income is $50000 less $1000 less $3000 = $46000.

Final Words

Though gross and net income is different things, they are part of the same income statement. Both parameters play a crucial role in analyzing the performance of a company. One can use both gross and net income to calculate other vital metrics. Dividing gross income by total sales gives us a gross profit margin while dividing net income by total sales gives a net profit margin.