What is the Statement of Retained Earnings?

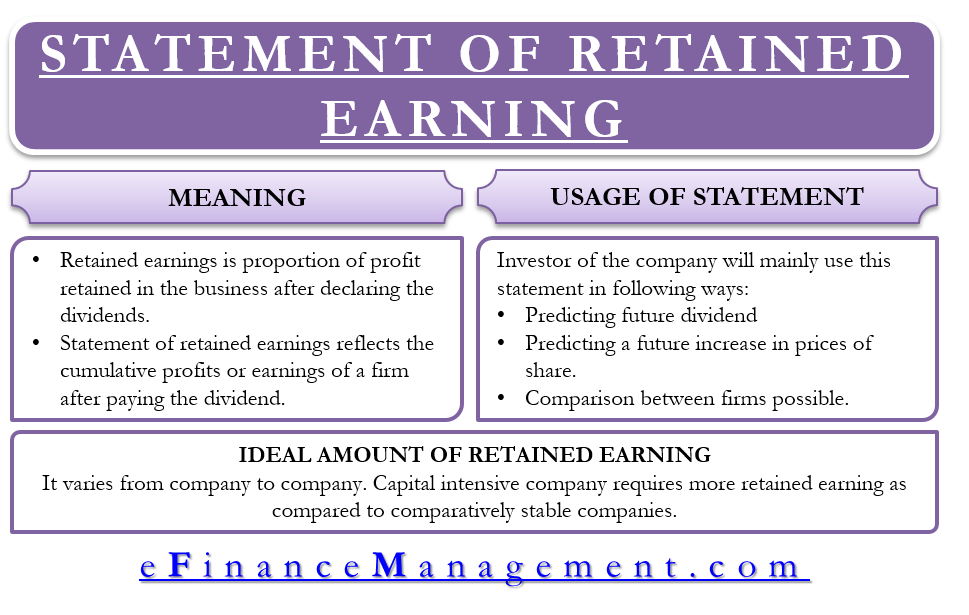

A statement of Retained earnings is an important financial statement that discloses the amount of retained earnings. Retained earnings here is the proportion of profit retained in the business after declaring the dividends. This proportion of profits is plowed back into the company, and it generates returns. Thus, this statement reflects the cumulative profits or earnings of a firm after paying the dividend. After having a good amount of profits, the company, at the discretion of the board of directors, pays a dividend from it and preserves the remaining amount as retained earnings.

It is a financial statement depicting any changes in the retained earnings for a specific accounting year. The statement reconciles the starting and ending retained earnings prepared from another financial statement, namely the income statement. Companies follow Generally accepted accounting principles (GAAP) while preparing this statement.

The main aim of any company retaining the profit is to earn higher returns on it. So, it is more advisable to retain the profits rather than borrowing from outside at a higher cost. This statement is also known as retained earnings statement, or Statement of Shareholder’s equity, statement of owner’s equity, or equity statement.

Formula of Statement of Retained Earnings

Beginning retained earnings + Net income – Dividends = Ending retained earnings

Format of Statement of Retained Earnings

| Retained earnings at the beginning of the period | |

| Statement of Retained Earnings | |

| For the year ended MM/DD/YYYY | |

| Retained earnings at the end of the period | $ XXX |

| Add: Net Income from Income Statement) | $ XXX |

| Less: Net Loss from Income Statement (if any) | $ XXX |

| Less: Dividends declared | $ XXX |

| Retained earnings at the end of the period | $ XXX |

Read How To Calculate Retained Earnings for more.

Uses

The main aim of preparing the statement of retained earnings is to show the amount of profit reinvested in the business. It helps in increasing the confidence of investors in the company.

Who Uses It?

Investors of a company are the main users of this statement. They can make out from this statement about how much amount of profit is declared as a dividend and how much is retained in the business. In general, a firm that is in the maturity stage will pay a regular dividend. And a growing firm retains more in the business to meet the growing funds’ requirement.

Thus, this statement can assist an investor in the following ways:

Dividend Payment Track Record

Investors who prioritize dividend income can use the statement of retained earnings to evaluate a company’s dividend payment track record. The statement shows any dividends declared and paid during the reporting period, allowing investors to assess the consistency, growth, and stability of dividend distributions over time. This information can help investors make informed decisions regarding income-focused investments.

Capital Allocation Strategy

The statement of retained earnings reveals how a company allocates its earnings between dividend distributions and retained earnings. By examining the proportion of earnings retained, investors can gain insights into management’s capital allocation strategy. A higher retention rate may indicate that the company is reinvesting earnings to fund growth opportunities or strengthen its financial position, whereas a lower retention rate may suggest a greater focus on returning value to shareholders through dividends.

Ideal Amount of Retained Earnings

The amount of retained earnings varies from company to company. A company that belongs to a capital-intensive sector will require more amount of retained earnings. While a stable company requiring less capital will have fewer amounts of retained earnings.

Also Read: Retained Earnings Calculator

How to Prepare Statement of Retained Earnings?

For preparing this statement, we make use of other financial statements. Let’s see how.

- The previous period’s Balance Sheet reflects the opening balance of retained earnings statement under the heading of Owner’s Equity.

- The net income figure is taken from the current period’s Income Statement

- Payment of dividends on preference shares and ordinary shares is considered from cash flow

- The closing balance of retained earnings is reflected in the current Balance Sheet under the owner’s equity

Also read – Difference Between Retained Earnings and Reserves.

Example

The following example portrays this statement in a simplified format.

Krishna Plywood Company’s Statement of Retained Earnings for the year ended 2018:

| Particulars | Amount |

| Retained earnings at 31st December 2017 | $ 50,000 |

| Retained earnings on 31st December 2017 | $ 7,500 |

| Less: Dividends declared | (-$1,500) |

| Total Retained Earnings (Carried forward to the Balance sheet) | $ 56,000 |

If the company has net loss instead of net income, then the following statement will be prepared

Krishna Plywood Company’s Statement of Retained Earnings for the year ended 2018:

| Particulars | Amount |

| Retained earnings at 31st December 2017 | $ 50,000 |

| Add: Net Income from Income Statement for the year ended 31st December 2018 | (-$7,500) |

| Less: Dividend paid to equity shareholders | (-$1,500) |

| Total Retained Earnings (Carried forward to the Balance sheet) | $ 41,000 |

Conclusion

In conclusion, to recapitulate the statement of retained earnings is a summary. Thus, It reflects the amount retained from profits over the number of years after paying shareholders their dividends. So, this statement gives details of retained earnings at the beginning, net income or net loss generated in the current year, the dividend paid in the current year, and at the end. Hence, it also shows the resultant amount of retained earnings carried forward to the balance sheet.

Refer to Retained Earnings Calculator for a quick calculation.

RELATED POSTS

- Difference Between Retained Earnings and Reserves

- Statement of Stockholders Equity – Format, Example and More

- Retention Ratio – Definition, Calculation, Interpretation, Factors, and Limitation

- Difference between Income Statement and Statement of Comprehensive Income

- Profit and Loss Statement

- Types of Financial Statements