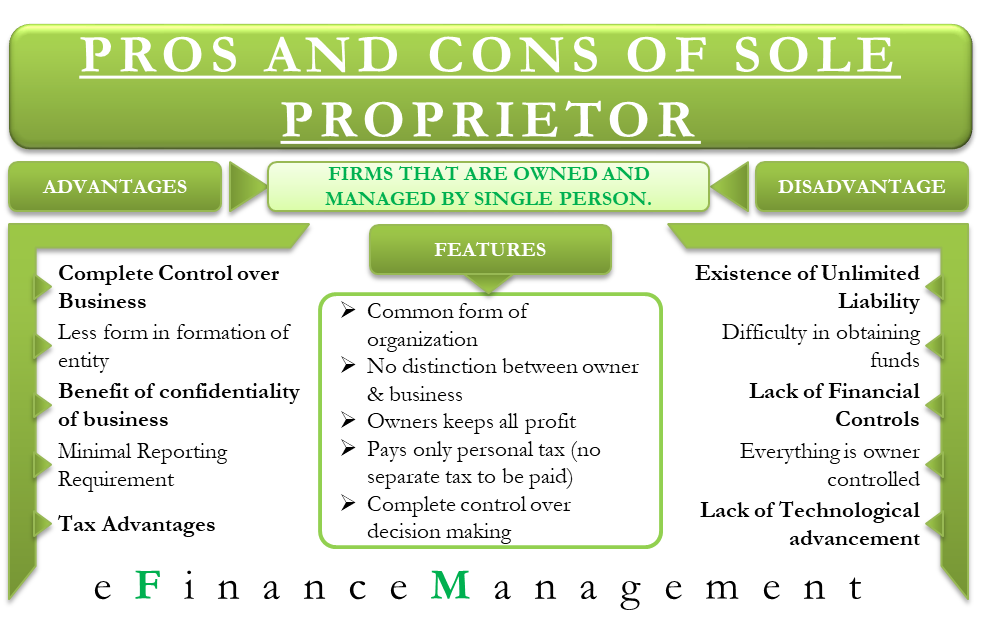

There are many advantages and disadvantages of a sole proprietorship firm. Before getting into them, let’s quickly understand what a sole proprietorship firm is.

A sole proprietorship is the most common form of business organization. Sole proprietorship firms are owned and managed by a single person called the proprietor. Under this type of business, there is no distinction between the owner and the business.

Advantages of Sole Proprietorship

There are several advantages of a sole proprietorship firm. We discuss them in this section.

Easy Establishment

There is an easy establishment procedure in Sole Proprietorship with very fewer formalities. When one wants to start his own business, he can do so after choosing a business name and a business location.

Complete Control Over the Business

Since there is no distinction between the owner and the business in the eyes of the law, the owner has complete control over the business. All the decisions are for the owner to make without seeking approval from a partner (as is the case in Partnerships) or the Board of Directors (in the case of Corporations). This gives the owner the freedom to drive his business in the direction he wishes to go.

Less Costly to Form

While other forms of business organizations need filling out some Federal and State government forms and pay significant fees, to form a sole proprietorship firm, the proprietor has to fill out fairly simple state government forms and pay a very small fee. Hence, for small and medium-sized businesses, sole proprietorship firms tend to be an affordable model to start and maintain.

Also Read: Advantages and Disadvantages of Partnership

No assets bifurcation

There is no asset bifurcation as to business or personal assets. Both can be used in one’s business and are treated as the owner’s assets.

Business Confidentiality

Unlike corporations and some other forms of business, a sole proprietorship firm does not need to file an annual report with federal and state agencies or to publish its periodic results in the public domain. This provides the owner with the benefit of business confidentiality. Confidentiality, e.g., allows the owner of the firm to keep his monthly sales figure, growth rates, cash balance with the firm, etc., secret from the competitors of the firm. Based on this knowledge, competitors may seek this information to compete effectively with the firm.

Minimal Reporting Requirements

As stated above, a sole proprietorship firm does not need to publish its period results in the public domain. The documents which the business has to share with regulatory authorities are very few, making it a fairly simple and straightforward type of business organization to run. This allows the owner to invest more time in core business activities and also saves his money.

Tax Advantage

The owner of a sole proprietorship firm does not have to pay taxes two times or ‘double taxes’ as is the case in corporations. In the case of corporations, the profits are first taxed by a flat corporate tax rate, and then the dividends distributed from the profits after tax (PAT) are taxed in the hands of the owners. For a sole proprietorship, however, there is no separate tax for the business, and the owner can take all the profits of the business as his personal income.

Also Read: Sole Proprietorship

Disadvantages of Sole Proprietorship

Sole Proprietorship firms are very easy to form and attract certain advantages that are unique to them. This form of business organization is also the most common form of doing business in the United States. However, there are some big disadvantages that an individual needs to consider before getting into it. These are:

Unlimited Liability

Undoubtedly, one of the greatest disadvantages of a sole proprietorship firm is that the liability of the owner is unlimited. Courts can seize the owner’s personal assets if there is some legal action against the firm. This legal action commonly arises when the owner has tax payments due or when he is not paying back his debts.

Difficulty in Obtaining Funds

In the case of a sole proprietor, the only source of funds in most cases is the owner’s personal savings. A bank loan is another source of funds for sole proprietors, but it is a very difficult task. Banks may not issue funds without some collateral which can be a challenge for many individuals. Also, there is a limit up to which banks give loans. Unlike corporations, a sole proprietor cannot even issue shares to meet his requirement of funds. All these difficulties in obtaining needed funds make the smooth running of the business difficult. Expansion of the business becomes an exceedingly major challenge for sole proprietors because of these reasons.

Owner’s Death is the Business Death

Unless there is clarity from the beginning as to who will continue the business after the owner’s death, the business also dies once the owner dies. This may lead to a loss of goodwill and the good impact created amongst society and the public at large. There is no perpetual existence in this business type like in a company.

Lack of Financial Controls

As per regulations, the sole proprietorship form of business does not have to report or maintain financial statements. This looser structure usually results in the owner getting lax and not preparing the financial statements of the business. Financial control then becomes difficult as the owner does not have proper financial information about his business. E.g., the proprietor may not properly know where (and how much) his business funds are going and from where they are coming to the business.

Everything is Owner Controlled

In a sole proprietorship firm, the owner controls everything. This causes many problems. E.g., if the owner gets sick, his business will remain shut down until he recovers back. Another challenge may be his lack of ability to deal with different situations in the business. If the owner does not know how to deal with a particular issue in the business, let’s say a problematic customer, his business performance may suffer after repeated instances like this.

Competition

If there is sheer competition in his area, he may lag behind due to many reasons. The reasons would include weaker pleasing skills to customers, less capital and stock, an outdated supply of goods, higher prices, low goodwill, etc.

Lack of Technological Advancements

Sole proprietorship firms are usually unable to bring major technological improvements into their business. A simple reason for this is that they cannot afford them most of the time. We have already discussed how difficult it is for such firms to raise funds from the market. This weaker financial muscle translates into a lack of innovations in the process of sole proprietorship firms. Often, when bigger firms (corporations, limited liability companies, etc.) in the same industry come with great technological innovation, sole proprietorship firms get out of their business.

Frequently Asked Question (FAQs)

Yes, establishing a sole proprietorship is relatively easy. It involves minimal formalities, such as choosing a business name and location, and filling out straightforward state government forms.

Unlike other business forms, a sole proprietorship doesn’t typically need to file annual reports or publish results publicly. This ensures that sensitive business information like sales figures, growth rates, and cash balances can remain confidential and undisclosed to competitors.

Sole proprietors can potentially secure funds through bank loans, but this process can be challenging due to collateral requirements and limits. Unlike corporations, sole proprietors cannot issue shares to raise funds.

Sole proprietors might face difficulties in competitive markets due to factors like limited capital, outdated stock, pricing challenges, and lack of technological advancements.