As the name indicates, a multi-step income statement shows multiple steps in Income Statement. To understand this concept in a better way, we have to first understand what is an income statement and a single-step income statement. Let us see more about Multi-Step Income Statement and Single-Step Income Statement.

What is an Income Statement?

- It is a Financial statement. And it reflects profit earned during a reporting period.

- Moreover, the reporting period could be monthly, quarterly, or yearly.

- However, the company can define a reporting period based on project duration in a very rare occurrence.

- The statement is divided into top and bottom numbers

- The top number indicates the total revenue accrued during the period.

- Whereas the bottom number is the profit earned or accrued.

- And, Profit = Revenue – Expenses

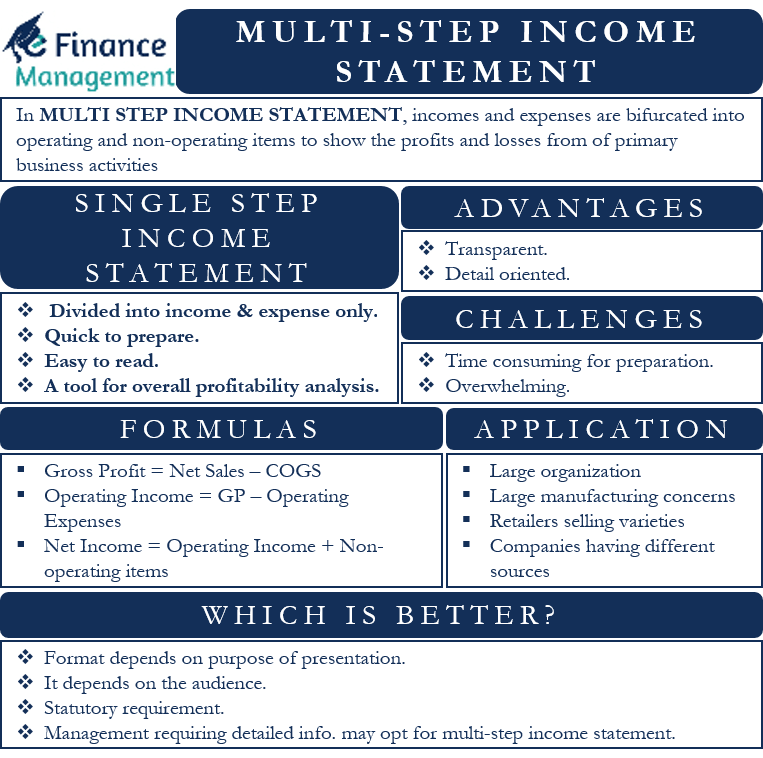

Single Step Income Statement

- It is a direct, simple statement and has no categories. It is divided into two parts only, i.e., income and expenses.

- Advantages of Single Step income statement

- Can be prepared quickly

- Easy to Read

- Fast to comprehend

- From the above discussions, we can conclude

- The single-step method is simple, and

- It is an excellent tool for overall profitability analysis

Example

| Particulars | $ |

| Revenues & Gains | |

| Revenue from operations | 80,000 |

| Interest revenue | 1,200 |

| Profit on sale of assets | 4,500 |

| Total | 85,700 |

| Expenses & Losses | |

| Cost of goods sold | 60,000 |

| Commission | 700 |

| Office supplies expenses | 1,500 |

| Advertisement expense | 2,000 |

| Loss from sale of investment | 1,000 |

| Interest | 2,500 |

| Total | 67,700 |

| Net Income | 18,000 |

Multi-Step Income Statement

A Multi-Step Income Statement is a detailed statement reflecting profits or losses from an organization’s operating and non-operating activities for a specific reporting period. It differentiates the operating and non-operating incomes and expenses, which ultimately shows earnings from main business activities as compared to non-essential activities.

- As discussed earlier, a multi-step income statement categorizes the Income Statement.

- The first item in FS is Revenue: The revenue is classified into two

- Operating Revenue = Related to the Business, and

- Non-operating Revenue = Anything that does not pertain to the main business activity

- Example: Interest on Fixed Deposit

- The next item is expenses: The expenses are classified into

- Operational Expenses:

- These are further classified either based on cost center or department

- Moreover, anything that cannot be segregated should be treated as other costs

- Operational Expenses:

- The first item in FS is Revenue: The revenue is classified into two

- In this method, we use different formulae to arrive at the profitability

Advantages

- Transparency

- Detail Oriented

Challenges

- Time-consuming for preparation

- Overwhelming

Example

| Particulars | $ |

| Sales | 80,000 |

| Cost of goods sold | 60,000 |

| Gross Profit | 20,000 |

| Operating expense | |

| Administrative expenses | |

| Office supplies expense | 1,500 |

| Selling expenses | |

| Advertisement expense | 2,000 |

| Commission | 700 |

| Total operating expense | 4,200 |

| Operating income | 15,800 |

| Non-operating items | |

| Interest revenue | 1,200 |

| Profit on sale of assets | 4,500 |

| Loss from sale of investment | -1,000 |

| Interest | -2,500 |

| Total non-operating items | 2,200 |

| Net Income | 18,000 |

Formats of Reporting

- The main purpose of any income statement is to show the profit

- But a single step arrives at a profit with basic information

- Whereas a multi-step approach groups the information in a better format.

Formulas

Formulas for calculating incomes in a multi-step income statement are:

Gross Profit = Net Sales – Cost of Goods Sold

Operating income = Gross Profit – Operating Expenses

Net Income = Operating income + Non-Operating items

Application of Multi-Step Income Statement

Large and complex organizations generally use multi-step income statements. Companies having different sources of revenue should create multi-step income statements. This would include large manufacturing concerns and retailers selling a wide variety of products. Public companies also maintain multi-step income statements for disclosure requirements under laws.

Which is better?

- Firstly, the format depends upon the purpose of the presentation of Financial Statements.

- Secondly, it depends upon the audience.

- Thirdly, for statutory reporting, the formats are preset. However, for management reporting,

- If the management wishes to go into detail, a Multi-step Income statement is beneficial.

- Otherwise, we can go with the single-step income statement

- If accurate, reliable data is available, the multi-step approach is advisable,

- Sometimes time and gathering data could be a constraint, then a single-step approach is more advisable.