Methods of Cash Flow Statement

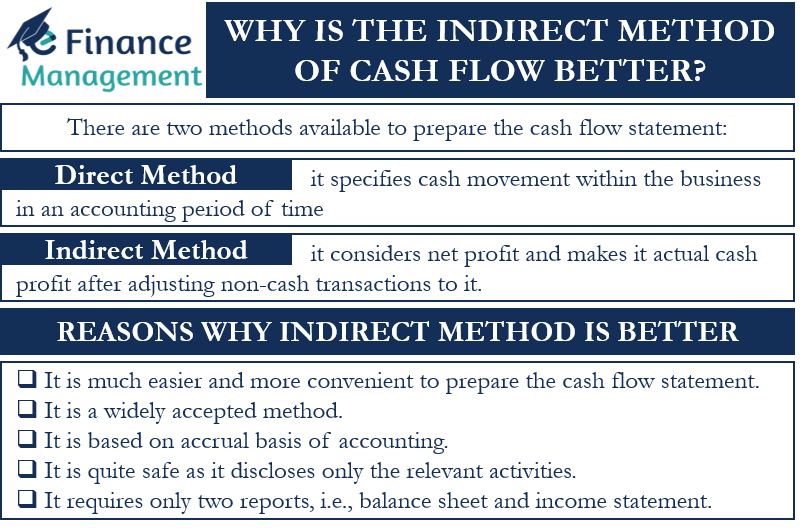

There are two methods available to prepare the cash flow statement of an organization. These are the direct method and the indirect method of cash flow statement.

The direct cash flow method specifies the cash movement within the business in an accounting period of time. Under this method, we subtract all the cash payments from the cash receipts. While the indirect method takes you to the same numbers and figures, it primarily considers net profit and makes it actual cash profit after adjusting non-cash transactions to it. This is due to the fact that net profit is calculated following the accrual concept of accounting but cash flow follows cash-based accounting, the non-cash transactions are added and subtracted.

In this article, we will learn why the indirect method of cash flow statement is better than the direct method. But before moving to that, let us first take an example.

Example

The following is the profit and loss statement of ABC Ltd.

| Particulars | ($) | Particulars | ($) |

|---|---|---|---|

| To Salary (includes 50,000 as outstanding salary) | 100,000 | By Gross profit | 1,000,000 |

| To Depreciation | 50,000 | By Dividend | 200,000 |

| To Interest | 50,000 | By Miscellaneous Income | 50,000 |

| To Miscellaneous Expenses | 50,000 | By Discount | 10,000 |

| To Net Profit | 1,015,000 | By Interest Accrued | 5,000 |

| 1,265,000 | 1,265,000 |

Now, let us prepare cash flow from operating activities using the indirect method:

| Particulars | ($) | ($) |

|---|---|---|

| Net Profit | 1,015,000 | |

| Depreciation | +50,000 | |

| Outstanding Salary | +50,000 | |

| Accrued Interest | -5,000 | |

| Cash Flow from Operating Activities | 1,110,000 |

What we actually did?

- Depreciation was added back since there was no movement of cash.

- Outstanding salary has been added back since cash is yet to be paid

- Accrued interest has not been received yet, therefore deducted from the cash flow.

This way, we have arrived at the cash profit from the net profit.

How is the Indirect Method of Cash Flow Better?

There are many reasons why the indirect method of cash flow is preferred over the direct one. They are:

- It is much easier and more convenient to prepare the cash flow statement following the indirect method as businesses maintain their records on an accrual basis and it becomes a piece of cake to prepare the cash and non-cash activities. On the other hand, under the direct method, the entire cash flow is prepared using bank statements, invoices, and other documents which makes it a tedious job.

- The two reports used to prepare the cash flow through the indirect method are the balance sheet and the income statement. Therefore, it makes the statement much more accessible and accurate. The direct method uses all the documents which were used throughout the year making it a difficult task.

- It is a widely accepted method of preparing the cash flow statement, familiar to the stakeholders, and is preferable for big businesses with complex structures. The direct method of cash flow is not preferred because the investors and stakeholders are not confident in the approach followed under this method.

- It is quite safe as it discloses only the relevant activities, unlike the direct method under which there is an open record. This could be used by the competitors to get an insight into the company’s financial workings.

Conclusion

TO sum up, both methods of preparing cash flow statements take you to the same result but the difference lies in the preparation of cash flow from operating activities. The treatment of investing cash flows and financing activities remains the same in both cases. The reason why people consider the indirect method better is that it is an easier and safer approach. Moreover, it is widely accepted and accurate.