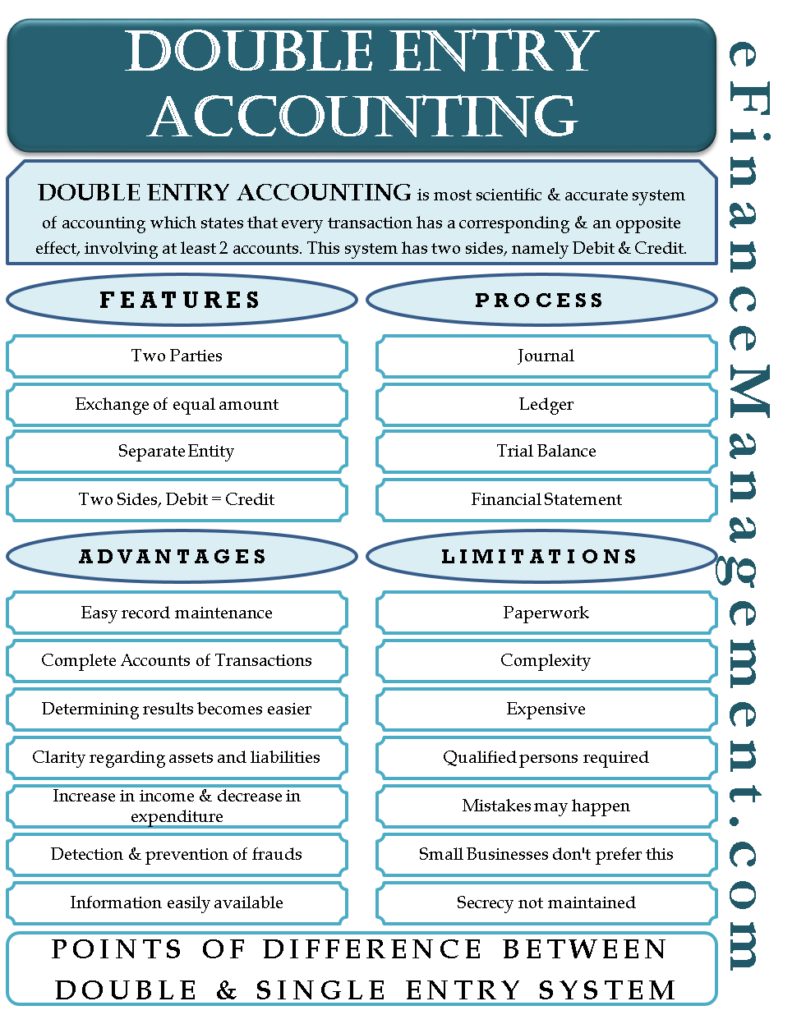

Double Entry Accounting under the double-entry system of bookkeeping is the scientific, self-sufficient, and accurate system of accounting which states that every transaction has a corresponding and an opposite effect on at least two accounts, namely Debit and Credit. To record the financial transaction of the business, it is necessary to use a well-defined structure or system. That is the reason why it is used in most businesses.

In this methodical system, every transaction has two impacts, i.e., Debit and Credit. As there are two sides, there are two effects, one on the debit side and another on the credit side. And the rule states that “for every debit, there is credit, and for every credit, there is debit.” Since the debit account offsets the credit account and vice-versa, the total of both sides becomes equal at the time of preparation of the financial statements.

- Definition of Double Entry System

- Features of Double Entry Accounting

- Rules on Double Entry System

- How Double-Entry System Works?

- Process of Bookkeeping under Double Entry Accounting

- Example

- Some special Terms in Accounting

- Advantages of Double Entry Accounting

- Disadvantages of Double Entry Accounting

- Double Entry Accounting Vs. Single Entry Accounting

It is based on the formula “Assets = Liabilities + Equity (Capital)” or conversely on the formula “Equity= Assets – Liabilities,” as explained in detail in our article Accounting Equation.

Definition of Double Entry System

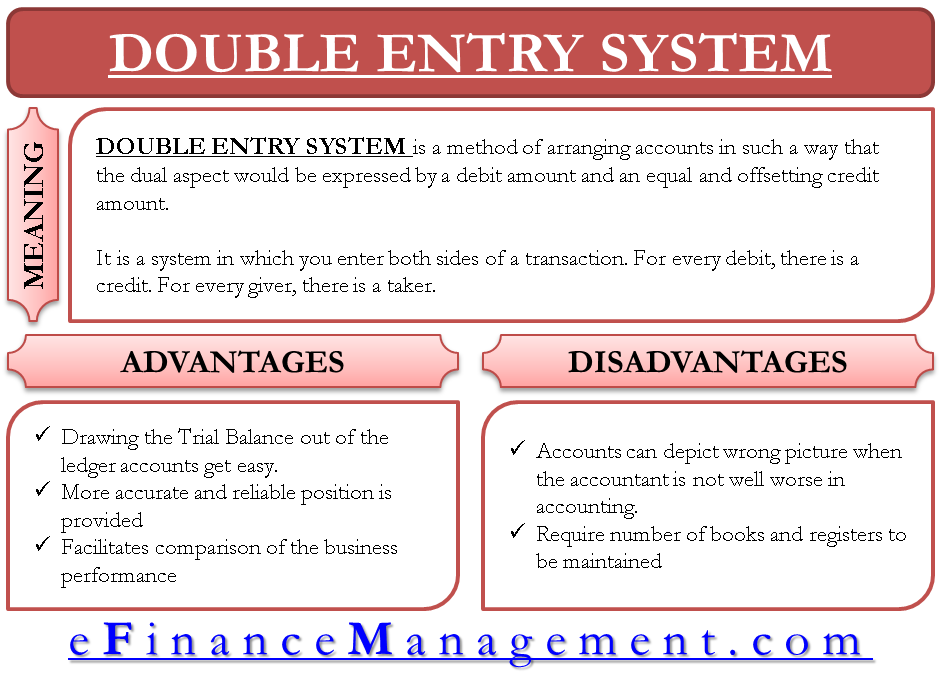

In the words of Luca Friar Pacioli, “Double Entry System is a method of arranging accounts in such a way that the dual aspect would be expressed by a debit amount and an equal and offsetting credit amount.”

Also Read: What are Debit and Credit

Features of Double Entry Accounting

Let us see some widely accepted features of Double-entry Accounting:

Two Parties

There are two parties involved; one is for whom the account is debited and another for whom the account is credited. The parties receiving the benefit will be debited, and the one giving the benefit will be credited. Hence, every debit of an amount will have a credit effect with the same amount and vice versa.

Exchange of Equal Amount

An equal amount will be debited and credited. Say Mr. X purchases goods from Mr. Y for Rs. 1000. Hence, in the books of Mr. X, he will enter Purchase Account debited to Mr. Y of Rs. 1000.

Separate Entity

Business and owner are treated as two separate entities.

Two Sides

The left side is called the Debit side, and the right side is called the credit side.

Debit is Equals to Credit

The total of the debit side equals the total of the credit side.

Rules on Double Entry System

The following are the rules of the Double Entry System:

Personal Accounts

Debit the Receiver. Credit the Giver

Real Accounts

Debit what comes in, Credit what goes out

Nominal Accounts

Debit the Expenses and Losses and Credit the Incomes and Gains

How Double-Entry System Works?

It is a system in which you enter both sides of a transaction. For every debit, there is a credit. For every giver, there is a receiver. If you purchase something, you are spending money, and the spent amount is received by somebody who has sold you the item. You buy either by paying cash/cheque or on credit. And the person selling receives cash or cheque for his sold item.

Process of Bookkeeping under Double Entry Accounting

Journal

The transactions are firstly recorded in the book named Journal. After this step, there is a subdivision, meaning various other subsidiary books come into the picture. The purchase transactions are recorded in the Purchase Ledger, sales in the sales journal, etc. The maintenance of subsidiary books depends on the size and nature of the business organization.

Also Read: T Accounts

Ledger

After that, the same effect is recorded in different ledgers from the journal. The transactions of a particular person or thing are collected and recorded in one particular statement called an Account. A ledger is a book in which these classified accounts are kept. Say all the transactions of Mr. A will be recorded in the account of Mr. A.

Trial Balance

In this stage, there is a preparation of a balanced statement called Trial Balance, by which the arithmetical accuracy is verified.

Financial Statement

In the end, Financial Statements are prepared to know the full year’s progress, profit or loss, and the business’s financial position.

Example

The following is a sample of entering the above transactions in your books of accounts which will clearly make you understand the meaning of the double-entry system of accounting.

1. You purchased a computer on 1/4/2012 by issuing a cheque for $800

Effect of Double Entry System: Debit Computer Account and Credit Bank Account

| Date | Particulars | Dr. Amount | Cr. Amount |

|---|---|---|---|

| 20XX, 1st April | Computer Account | 800 | |

| To Bank Account | 800 | ||

| (For Computer purchased and paid by cheque) |

2. You purchased a TV on 10/4/2012 by paying cash of $100

Effect of Double Entry System: Debit Television Account and Credit Bank Account

| Date | Particulars | Dr. Amount | Cr. Amount |

|---|---|---|---|

| 20XX, 10th April | Television Account | 100 | |

| To Bank Account | 100 | ||

| (For Television purchased and paid by cheque) |

3. You sell a Refrigerator on 30/4/2012 and receive cash of $200

Effect of Double Entry System: Debit Cash Account and Credit Refrigerator A/c

| Date | Particulars | Dr. Amount | Cr. Amount |

|---|---|---|---|

| 20XX, 30th April | Cash Account | 200 | |

| To Refrigerator Account | 200 | ||

| (For Refrigerator sold and cash received) |

The above entries can be best understood by following the traditional approach of accounting principles for Personal, Real, and Nominal accounts, which have been explained in our other topic, “What is Debit and Credit? – An Easy to Understand Explanation”.

Some special Terms in Accounting

Debit Side

Expenses and Losses- The nature of these types of transactions is Debit or recorded on the debit side. Any increase in this would debit the same and vice versa.

Assets- The nature of this transaction is Debit or recorded on the debit side. Any increase in this would debit the same and vice versa.

Credit Side

Incomes and Gains- The nature of these types of transactions is Credit or recorded on the credit side. Any increase in this would credit the same and vice versa.

Liabilities- The nature of this transaction is Credit or recorded on the credit side. Any increase in this would credit the same and vice versa.

Advantages of Double Entry Accounting

Easy to Access Data

As all the data is maintained in a systematic manner. So, if one wants to check any data, he can easily assess it.

Complete Accounts of Transactions

Due to the dual and simultaneous effect in this system, there are a complete set of books of accounts of each party.

Easy in Determining Results

Since the preparation of the final accounts at the end of the year counts the debit and the credit side, the profit or loss and the financial position of the assets and the liabilities are clearly reflected. Hence, if any entry is recorded only once, there will be a difference on the opposite side of the same amount.

Comparison

It facilitates you to compare the business performance of a period with figures of a previous period or with last year’s corresponding figures.

Clarity regarding Assets and Liabilities

There is clarity regarding the position of the assets and the liabilities. For example, in the past year, the company had creditors of raw materials of Rs. 1400000 and in the current year it has increased to Rs. 1820000. The increase in 420000 may be due to the increase in sales. So, one can analyze whether the increase is worth it or not, means due to such an increase whether the company is producing products using those raw materials sufficiently or not.

Increase in Income and a Decrease in Expenditure

If a proper analysis is done of the incomes and expenditures, one can come to know the growth of one’s business. One can compare the incomes and expenses of the current year with that of past years. This helps to plan the strategies for the forthcoming financial years.

Detection and Prevention of Frauds

There are very few chances of errors and mistakes as a single transaction has two effects. So, if there is only one entry of a single transaction, the trial balance and the financial accounts will not match. Also, if any fraud is intentionally or unintentionally committed, it can be easily prevented.

Information Easily Available

The beauty of the double-entry system is the dual effect and proper system of maintaining the books of the accounts. So, any information whenever required of whichever year is easily available.

Utility

The books of accounts maintained under this system are highly useful to the management, analysts, auditors, executives, and ultimately to the company as a whole. This is highly useful to them because every transaction clearly mentions the date and name from the Journal to the Financial Statements. So, any year’s data is easily available.

Disadvantages of Double Entry Accounting

Paperwork

Since one transaction goes through four stages (process), handling so many books becomes too voluminous. Also, if there is no accuracy in maintaining the data in one place or misplaced, it becomes very difficult to obtain the data if needed urgently.

Complexity

If one is not thorough with the rules of the Double Entry System, one may get confused at any point in time. Say, for example, there are some journal entries that have an effect before an effect of the other transaction. For example, the bad debt provision for the current year is to be reduced to 20%, and the creditors of Rs. 2000 have wrongly recorded as debtors. So, firstly there has to be the deletion of the extra Rs. 2000 from the debtors, and then the debt provision entry is to be done. Hence such complexity arises.

Expensive

The person who is not literate enough to write his own books of accounts or whose business is too voluminous hires an accountant. Also, in big companies, there are various people involved in the accounting field, which is expensive.

Qualified Persons Required

It requires the knowledge of the experts to record and maintain the books under this system. The qualified and skilled experts may not be easily available; also, they charge high fees for that.

Chances of Committing Mistakes

As discussed earlier, if one is not familiar with and clear about the rules of the Double Entry System, one may apply wrong facts, due to which the entire accounting process may turn out incorrect. Hence, due to sheer negligence and misconceptions, the mistakes can turn out to be a huge issue leading to big losses.

Not Preferred by Small Businesses

It is too obvious that small business concerns will not generally prefer this method of accounting. Complexity and complicatedness are one of the reasons. Also, the reasons can be that their business transactions are too less, they can manage their accounts on their own or may not afford an accountant, and many such similar reasons.

Secrecy not Maintained

Since the Double Entry System involves substantial effort, time and accuracy, there is a clear record and entry of each and every transaction except non-monetary ones. Therefore, there is difficulty in maintaining secrets.

Double Entry Accounting Vs. Single Entry Accounting

| Points of Difference | Double Entry Accounting | Single Entry Accounting |

|---|---|---|

Meaning |

A two-sided and complete record of transactions | A one-sided and partial record of transactions |

Nature |

Complex | Simple |

Preferable Business |

Large business | Small business |

Faults |

Fewer chances | More chances comparatively |

Type |

Complete | Incomplete |

Accounts Involved |

Personal, real, and nominal | Personal and cash |

Preparation |

Difficult | Easy |

Suitability for Taxation |

Yes |

No |

Continue reading – Fundamentals of Accounting

Important points are covered!!

If possible, mail me the articles on double entry accounting system along with the examples for better understanding.

Hi Swapnil,

All relevant articles are present on the website. And periodically, we keep on improving the content over here. It’s better to come and read from here.

For searching for any topic, you can use our search feature.

You can go through Double Entry Accounting to get a good insight on the topic.

It is so easy and meaningful fora nonaccounting student, like me..

This is useful blog on Double Entry system as it helped me gain some knowledge on Double entry system and its meaning, features and other aspects as well. This blog will be shared among my friends and others as well. Thanks a lot for useful information