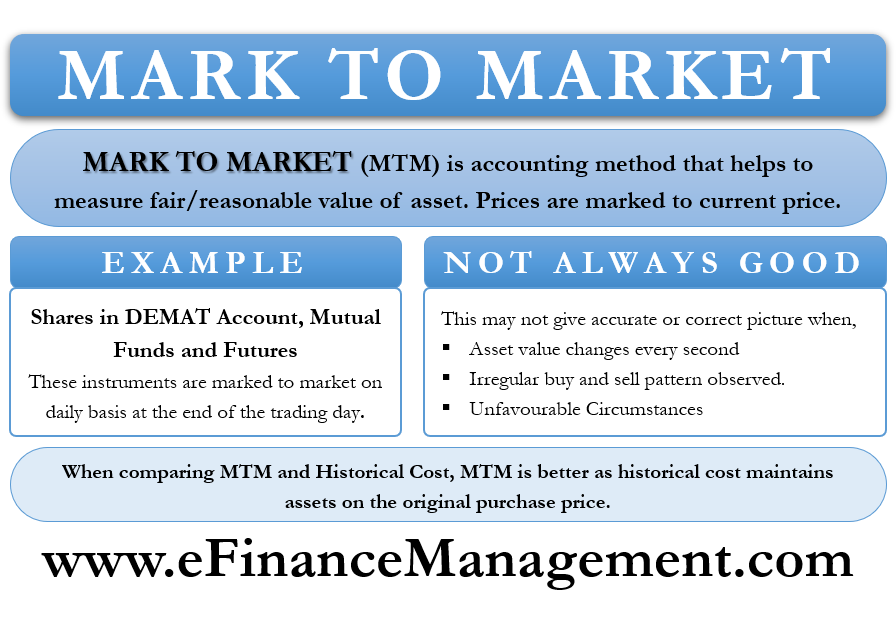

Mark to Market or MTM is an accounting method that helps in measuring the fair or reasonable value of assets. We primarily use this approach for assets that see constant fluctuations in their price. The primary objective of using MTM is to get a realistic estimate of the assets’ worth. Or, we can say, it helps determine the asset’s price if you were to sell it now. Because of this, we also call this approach fair value accounting or market value accounting.

In mark to market, the price of an asset is marked to the current market price. Or, we can say the price of the asset reflects the current market price of that asset. In MTM, the value of an asset could either increase or go down depending on the market conditions.

Mark to Market Example

Stocks are a very good example of MTM. Shares that an investor holds in their Demat are marked to market on a daily basis. This means that after the end of the market on each day, the stock prices reflect the current market prices. Similarly, mutual funds and futures are also MTM.

An example will better help us to understand this concept of MTM. Suppose an investor buys 100 shares of company A at $10 each. His total investment would be $1,000.

At the end of the first day, the value of shares goes down to $9. So, the value of the investment would adjust to MTM and thus will be $900 (loss of $100).

Now, at the end of day 2, suppose the share price rises to $12. The value of the investment now will be $1,200 (a gain of $300 for the day, but the net gain of $200 on the original investment).

At the end of day 3, suppose the share price goes back again to $10. Now, the investment value would be $1,000 (a loss of $200, but no net loss or gain on the original investment).

Mark to Market – Not Always Good

MTM is a very popular accounting approach. In the U.S., it is part of the GAAP (generally accepted accounting principles) since 1990.

Many believe that MTM shows the true price of an asset. However, those against it argue that the MTM approach may not give accurate results when the value of assets changes every second/day. Or, this method could give an unreal picture when the buyers and sellers follow an irregular pattern when buying and selling assets.

Also, the MTM method may not give the correct picture in cases where the market value does not show the true value of an asset. The MTM may also not give the true value at times of unfavorable conditions, like during a financial crisis, volatility, or any big natural calamity.

MTM vs. Historical Cost

Among the two, MTM usually gives a more accurate picture of the financial health of the assets. This is because, under historical cost, the company maintains assets on the original purchase price. In MTM, on the other hand, the asset price reflects the price at which the company can sell it in the market.

However, in times of crisis, the historical cost may prove better.

Mark to Market and Crisis

There is no one way to look at the mark to market. On the one hand, there are instances proving MTM helps to avert a crisis. On the other hand, there are several live examples and conditions that suggest that MTM can unnecessarily trigger a financial crisis.

For example, there is a belief that had banks used MTM during the 1970s and 1980s; it would have prevented the Savings and Loan Crisis. At the time, banks were largely using the historical cost approach. Thus, they were recording the assets at the original purchase prices.

Now, when there was a massive drop in the oil prices in 1986, the property prices also dropped. The banks, however, continued to record the properties on their accounts at the original price. Though such a practice made banks’ balance sheets look attractive, in reality, their investments were deteriorating sharply.

Similarly, there are also beliefs that the MTM accounting technique might have a hand in triggering the 2008 financial crisis. When the housing costs were on the rise, banks also increased the value of their MBS (mortgage-backed securities). To strike a balance between the assets and liabilities, the banks then raised their number of loans to the borrowers.

To give loans faster, they also softened the credit requirements. And as a result, they picked up more subprime mortgages, which had been the prime cause of the 2008 crisis.

So, when the real estate prices were dropping, banks (following MTM valuation) also had to reduce the values in their books. This led to an imbalance in their balance sheet, triggering their collapse. To limit the crisis, the U.S. FASB (Financial Accounting Standards Board) eased the requirement of the MTM.

More Uses of Mark to Market

Apart from investing, mark to market has more uses in the financial world.

In the balance sheet, certain items are on the basis of MTM, while others are at historical cost. For instance, companies in the financial sector may have to mark down the value of their assets in the case of borrower default or bad debt. This markdown is through provision for bad debt.

Similarly, a company that offers a discount to the debtors to encourage them to make payments early would have to mark down the accounts receivables amount by the discount amount.

Likewise, foreign currency holdings also need to be stated in the balance sheet as per the MTM, and necessary profit or loss needs to be booked accordingly.

MTM is also useful in the insurance sector. In insurance, the market value is equivalent to the replacement value of an asset. For instance, in a homeowner’s insurance, you will have a replacement cost. This is the money homeowner will get if there is a need to build the home from scratch. The replacement cost would be different from the original or historical cost of the house.

Final Words

MTM is a very important concept in the financial world with its own benefits and drawbacks. Even at the individual level, we can use this financial concept to benefit from this, such as in managing finances. For instance, one can periodically review their retirement portfolio to determine its current value. This will help you to determine if you require to re-plan your portfolio. You can take the help of an adviser as well to ensure your portfolio is in-line with your financial objectives.