What do we mean by Markup pricing?

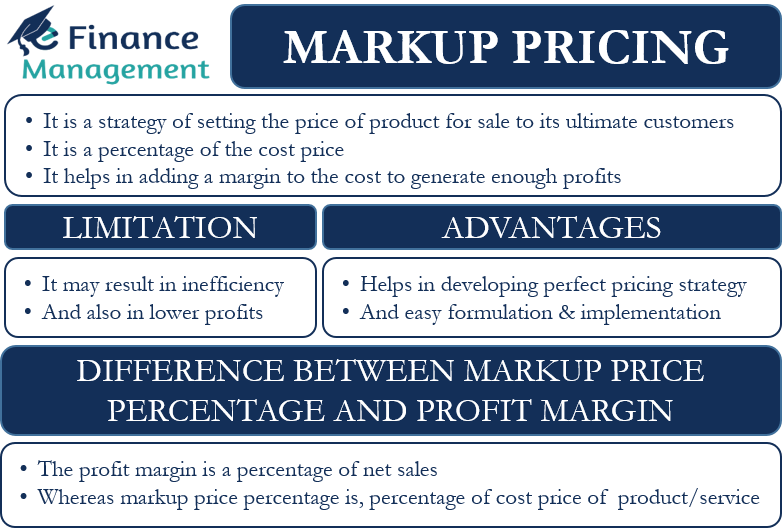

Markup pricing is a strategy of setting the price of the products or offerings of a business enterprise for sale to its ultimate customers. Mark up or mark up pricing is generally a percentage of the cost price of the product or service. We markup or increase the price of the offering from the cost price by that mark-up percentage point. Thereby, we arrive at the selling price. Markup pricing is essential and nothing but adding a margin to the cost to generate enough profits for the business. And therefore, it is known as cost-based pricing. This is quite essential for the smooth running, existence, and growth of the business. Moreover, this is the profit that will be shared by all the stakeholders of the business, who have invested in the business and taken the risk of business associated with it. The higher the markup price of the offering of a business, the higher will be its profits.

However, a business has to be very cautious while setting the markup price. This is so because improper pricing can result in losing customers and business. A business that goes for an unusually high markup price for its offerings in comparison to its competitors will end up losing its customers to others. On the other hand, a business will make low profits or even suffer a loss if it sets a very low markup price for its products.

The markup pricing technique is very simple and logical to implement in any business organization. A business can simply add the markup price percentage that it has decided to the cost price of its offerings. While doing so, it has to keep in mind the profit margin that it desires. It can apply this markup percentage to all of its offerings uniformly. Also, it can vary this percentage according to the demand and price acceptability of its products in the market. And this can defer from product to product or service to service.

What are the advantages of markup pricing?

Markup pricing has a number of advantages. Let us have a look at them.

Developing a perfect pricing strategy

Markup pricing strategy helps to arrive at an appropriate selling price for the bouquet of products or services of an organization. A business can fix the markup pricing of its variety of products according to their type and usage, price and availability of substitutes, demand and supply, etc. A fixed markup price percentage for every product will help in saving a lot of time and money for an organization. It can simply calculate the markup from the cost price of the products and arrive at the selling price. It can be very useful for businesses in which the cost price of the products varies frequently due to price fluctuations of the inputs. Thus, this helps a business to develop a perfect pricing strategy over time.

Easy to formulate and implement

Markup pricing strategy is simple and easy to formulate and implement. A business has to simply decide the profit margin that it wishes to keep for it after taking into account its cost of production and other expenses. It eliminates ambiguity or confusion in correctly pricing the products. Also, the method is fast and free from errors, especially in cases where the markup percentage is the same across multiple products and categories.

What is the difference between markup price percentage and profit margin?

Let us understand the difference between the markup price percentage and the profit margin of a business with the help of an example.

ABC Inc. is a toy manufacturing company. It manufactures 2000 units of toy X in a month at a cost price of $10 per unit. Thus, the total cost price of 2000 units of toy X is $20000 (2000 units x $10). The selling price of toy X is $20 per unit. Therefore, the total selling price of 2000 units is $40000 (2000 units x $20).

The profit of ABC Inc. from toy X in a month= $40000 – $20000= $20000.

Profit margin = (Net sales – cost price of the goods)/ Net sales x 100

=($40000 – $20000)/ $40000 x 100

= $20000/ $40000 x 100= 50%.

However, we can calculate the markup price percentage of the toy X with the help of the following formula:

(Selling price of toy X – Cost price of toy X)/ Cost price of toy X x 100

= ($40000 – $20000)/ $20000 x 100

= $20000/ $20000 x 100= 100%

Therefore, we see that while the profit margin is a percentage of net sales, the markup price percentage is a percentage of the cost price of a product or service.

What are the limitations of Markup pricing?

May result in inefficiency

The cost price of the product or service under consideration remains the base for calculating Markup pricing. It does not provide any incentive for cost reduction or its control. For example, if the cost price of an article is $10 and its markup price percentage is 20%, the selling price of the product will be $10 + 20% of $10= $12. Now suppose the cost price rises to $12, the business will automatically adjust the selling price to $12 + 20% of $12= $14.4.

Therefore, this pricing strategy does nothing to keep a check on the cost price of the products. The managers may blindly increase the selling price of the product to achieve the fixed markup price percentage. This can result in lower sales and loss of business to the competition. Moreover, it can, over a period of time, build inefficiencies in the system. Because indirectly, the inefficiencies are getting rewarded with increased markups and profits in terms of overall value.

Lower profits

In many organizations, the management fixes a uniform markup pricing percentage for all of its offerings. This can result in lower profits for the organization, especially if some of its products are unique or rare and have the potential to command a high selling price.

Thus, a uniform markup pricing strategy can be disadvantageous in such cases. The business can lose an opportunity to charge a much higher price for such products and make higher profits. This could be vice-versa, too, wherein the similar margin may not be sustainable for some of the products and services. And that ultimately leads to the loss of customers and business.

Summary

Businesses should be careful while adopting a constant markup pricing strategy across their entire product range. Such pricing should be dynamic in nature and match the market pricing. The management should be proactive enough to incorporate quick changes to the markup percentage fixed by them as per the changes in the cost price of the product or other market conditions. This will help them to adjust the selling prices in time and move ahead of the competition. Also, this strategy will be beneficial for any business organization in the long run because of its simple and logical nature.