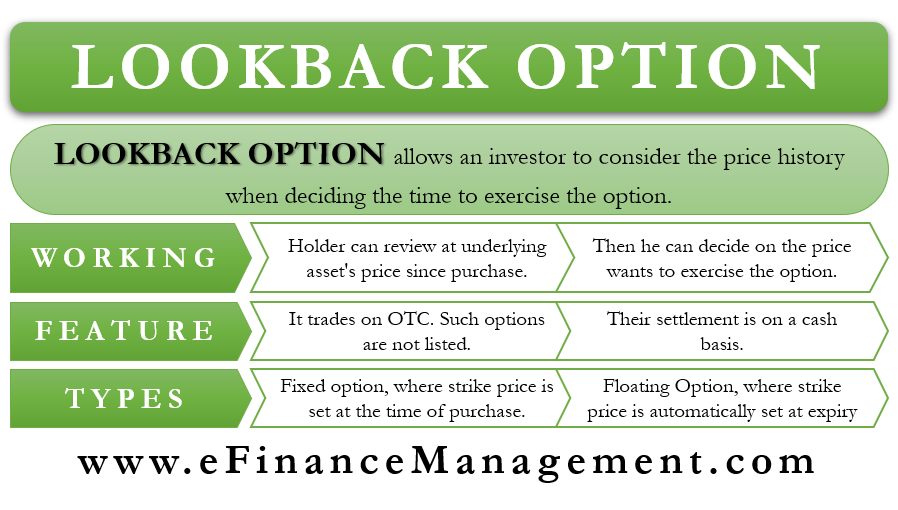

Lookback Option allows an investor to consider the price history when deciding the time to exercise the option. One major benefit of this option is that it helps to lower the uncertainty over the timing of market entry. Also, it lowers the chances of an option going to waste. Of course, with such kind of flexibility available, this option becomes a costly one to execute.

We also call such an option a hindsight option, and it is a type of exotic option. An exotic option is more complex than a vanilla option, and they usually trade OTC (over the counter).

Lookback Option – How it Works

Basically, this option allows the holder to review the prices of the underlying asset during the option period. Or, we can say the holder can ‘look back’ at the underlying asset’s price since the purchase of the option. After reviewing the price, the holder can decide on the price that they want to exercise the option. It is best for the investor to choose the highest difference between the strike price and the underlying asset’s price.

A seller of such an option would price it at or near the biggest expected differential on the basis of historical volatility. Also, the seller considers the demand of the options when pricing the option.

The seller gets the cost of the options upfront. And the settlement of the option is on the basis of the profit it would have made by buying and selling the underlying asset. The holder would make the profit in case the settlement amount is more than the option cost or vice versa.

Features of Lookback Option

The hindsight option does not trade on major exchanges like other exotic options. Instead, it trades on OTC. Or, we can say that such options are not listed.

Another feature of this option is that their settlement is on a cash basis. This means, on execution, the holder gets cash on the basis of the most beneficial differential between the high and low prices during the option period.

Types of Lookback Option

Fixed and Floating are the two types of lookback options available for trade. Let us understand them in slight detail:

Fixed

In the fixed one, the strike price is set at the time of purchase. This is the same as any other vanilla or normal options. However, when executing, the most favorable price of the underlying asset over the option term is taken. This feature is the key differentiation over other options, where the current market price is considered at the time of the execution.

If there is a call option, the holder would look back at the price history and then select to execute at the price at which they get the maximum return. In the case of a put, the holder would execute the contract at the lowest price differential so as to ensure maximum profit. The settlement is at the set strike price and the beneficial market price.

Floating

In the case of a floating option, the strike price is automatically set at the time of the expiry. The price is set to the most beneficial price during the option period. Once the strike price is set, the settlement would be at the current price so as to come up with the profit or loss.

We can say that the fixed strike option addresses the market exit issue. The floating strike option addresses the issue of market entry.

Examples of Lookback Option

Let us take different scenarios as examples to better understand the lookback option:

Scenario 1: Suppose the underlying stock trades at $10 throughout the option period. There is no profit or loss in both fixed and floating strike options in such a scenario.

Scenario 2: Suppose the highest price of the underlying asset during the option period is $20, while the lowest price is $10.

In the case of the fixed option, suppose the strike price is $15. Since the best price was $20 and the strike price was $15, the profit (excluding cost) for the holder would be $5 ($20 – $15).

In the case of a floating option, suppose the stock price is $15 at maturity (it would be the strike price). Since the lowest price during the option period was $10, the profit (excluding cost) for the holder, in this case, would be $5 ($15 – $10).

Scenario 3: Suppose the stock has the same high and low as above of $20 and $10, respectively, during the option period. However, at maturity, the stock trades at $18.

In the case of a fixed option (with a strike price of $15 set at the time of purchase), the profit (excluding cost) would be the same as above, i.e., $5. This is due to the strike price ($15) being less than the highest price ($20).

Now, in the case of a floating option, suppose the strike price (at the time of maturity) is $18. Since the lowest price is $10, then the profit (excluding cost) for the holder would be $8 ($18 – $10).

Final Words

Lookback is a pretty useful option and helps the holder maximize their profit and minimize the risk. It helps to lower uncertainty and hence the risk. However, this option is relatively expensive because the seller assumes a higher risk. Thus, holders must consider the cost of this option when taking it up this option.