Cost Accounting and Management Accounting

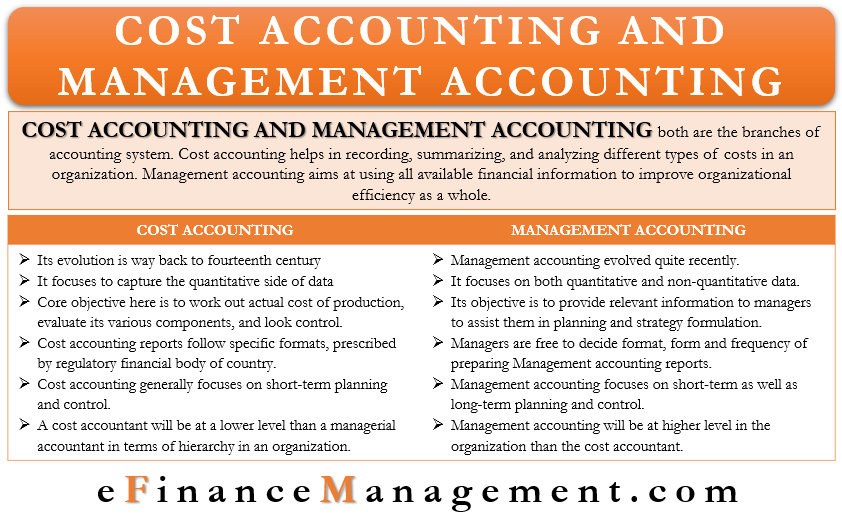

Cost accounting and management accounting are both branches of the accounting system instead of further advancement. These advanced accounting systems’ main aim is to assist the management in their key tasks, like properly planning, evaluating, and controlling the organization’s activities. Cost accounting helps in recording, summarizing, and analyzing different types of costs in an organization. These costs can be fixed costs, variable or semi-variable costs. These costs may be for a process, a product, or a service. The main goal is to spend in a planned manner, control costs, and improve the organization’s cost efficiency. The managers need to evaluate processes to reduce and eliminate unnecessary movement, spending, and wastage.

Management accounting is a broader term, and it encompasses cost accounting as part of it. Management accounting aims at using all available financial information to improve organizational efficiency as a whole. It is meant for internal use and helps managers make prudent business decisions for both the short-term and long-term. It helps the managers properly plan and forecast, decide on important matters like make-or-buy, forecast income, cash-flows, evaluate performance variances, regularly evaluate the return rate from business and investments, etc.

One important point to note here is that the accounting system and records leading to the preparation of various financial statements are mandatory and available for outsiders and the public. However, cost and management accounting is the system for support, review, and facilitation for the use and view of internal organization. These reports are not public, nor an outsider has access to these systems and records, except for a few cost accounting records and reports, as per regulatory requirements.

Differences between Cost Accounting Vs. Management Accounting

Origin of Cost Accounting

The evolution of cost accounting dates back to the fourteenth century. However, management accounting evolution is relatively more recent. Its presence and prominence in the commercial world are somewhere in the middle of the twentieth century.

Meaning and Type of Information Processing

Cost accounting involves activities that record, summarize, and analyze data about costs spent at various stages and association with the organization’s cost structure. Moreover, It focuses on capturing the quantitative side of data and related details that has links with cost incurrence.

On the contrary, Management accounting involves the study of both financial and non-financial data in an organization. It focuses on both quantitative as well as non-quantitative data. Therefore, in management accounting, all data types are co-related to see their association with the quantity, quality, costs, and flow throughout the organization’s structure or operational activity.

Objective and Scope

The ultimate aim of all commercial organizations is to produce goods or provide services at minimum cost. Therefore, the cost accounting system’s core objective is to work out the actual cost of production, evaluate its various components, and look for the areas to control it wherever possible. So that with the help of all these records, data analysis, and triggers, the wastages and time loss could be avoided, and production cost minimization can happen. Here, the costs can be about a product, service, department, or process.

On the other hand, management accounting’s main objective is to provide relevant information to the managers to assist them in planning, setting up long and short-term goals, and strategy formulation. Moreover, based on the various details and plans, regular report preparation and sharing happen to understand and monitor the plan’s progress. Suppose somewhere operations are not moving as planned. In that case, the management, based on these reports, initiates corrective action so that the business’s performance remains as near as possible to the plan.

Apart from considering the various types of costs, the scope of management accounting includes studying the impact of costs on the overall organization. The scope of activities is much wider than cost accounting and includes cost accounting, financial accounting, and tax planning.

Specific Format and Audit

Cost accounting reports follow specific formats as prescribed by the financial regulatory body of the respective country. It is so because these reports are for both internal uses and outsiders and regulatory bodies. Also, a statutory audit of these reports is mandatory. There are so many types of techniques and methods available in cost accounting to generate various reports. However, techniques of marginal costing, break-even analysis, standard costing, etc., remain the preferred and popular ones for preparing various reports.

But management accounting reports are strictly for internal usage of the organization. Hence, there is no specific format for these reports. Managers are free to decide the form and frequency of preparing these reports. There is no compulsion of a statutory audit of these reports too. Preparation of these reports can be by using complex financial accounting techniques like ratio analysis, funds flow analysis, sensitivity analysis, buy or manufacture, etc. Also, the managers may use costing techniques too if the need arises and for better clarity to understand and appreciate the impact of various costs.

Decision-Making Approach

Cost accounting generally focuses on short-term planning and control. It relies on historical and present-time data for preparing reports. Thus, the reports are based on past and present data.

Management accounting focuses on short-term as well as long-term planning and control. It relies on historical, present, and predictive future data to formulate plans and strategies. It provides a future vision for the company. Hence, it uses a prediction of what the costs will be in the future if a particular alternative is chosen. Accordingly, managers can decide which alternative is the best for the company.

Hierarchy

A cost accountant will be lower than a managerial accountant in terms of hierarchy in an organization. But cost accounting can exist alone or without management accounting, but the latter cannot exist without cost accounting.

Importance of Cost Accounting and Management Accounting

As we have seen, both cost accounting and management accounting are important advanced accounting branches with a little difference. Both are mostly for internal use and helpful to the management in the discharge of their duties and decision-making. Both complement each other, and it would be right to say that they are indispensable in modern-day businesses.

Cost accounting is the basis of costing and compliments management accounting in achieving effective strategic planning; budgeting and planning for profits; right costing, acquisitions, and proper use of available finance; their proper recording; proper internal and external communication of operating and financial information, bringing in any corrective actions, if required; and finally making sure a proper reporting to comply with statutory regulations.

For more details, refer to Cost Accounting vs. Financial Accounting.