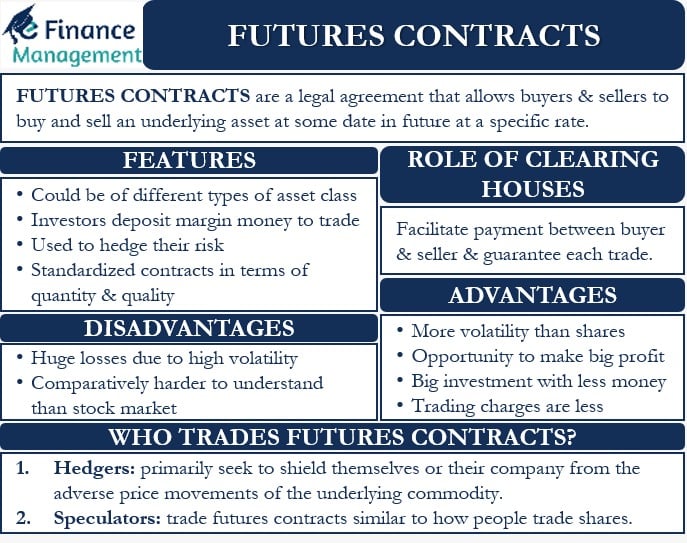

Futures Contracts are a legal agreement that allows buyers and sellers to buy and sell an underlying asset at some date in the future at a specific rate. The underlying asset could be shares, bonds, metals, commodities, etc. These are standardized contracts in terms of quality and quantity. We also call these contracts derivative because the contract derives value from the underlying asset and its other futures contract specifications.

Moreover, these contracts represent an obligation for the buyers and sellers to buy and sell the underlying asset at the expiry. However, the buyer and seller can end the agreement anytime before the expiry. So, we can say that these contracts give the buyer the right to buy and the seller the right to sell.

A buyer will gain from the futures contract if the price of the underlying asset goes up. So, at the expiration, the buyer will exercise the contract and buy the asset at a price lower than the spot price.

Similarly, a seller would make a profit if the price of the underlying asset drops at the time of expiry. In this case, the seller would be able to sell the asset at a price higher than the spot price.

Also Read: Futures Market

Key Features of Futures Contracts

Let us discuss now the key features of a futures contract:

- A future contract could be of different types of asset classes. For instance, there are futures for shares, commodities or currencies, indices, and more.

- These are standardized contracts, both in terms of quantity and quality. For instance, a usual futures contract for oil is for 1000 barrels. This means to trade 10,000 barrels of oil, an investor would need to buy ten contracts.

- Investors need to deposit margin money to trade a futures contract. But, this margin money is much less than the total value of the contract. This allows investors to participate in the futures market even with a small sum of money.

- Apart from making profits, investors also use these contracts to hedge their risk.

Role of Clearing Houses

Clearinghouses play a crucial role in the execution of futures contracts. They facilitate payment between the buyers and sellers and guarantee each trade. This is why they require investors to deposit small-margin money. As said above, this margin money is much less than the contract value.

So, this essentially means that investors use the money of their broker or clearinghouse to trade in futures. Owing to the high level of risk, the clearing members are generally big banks and financial services firms.

The settlement of futures contracts is on a daily basis. This means your profit or loss position will also fluctuate on the basis of the price movement of the underlying asset. If your loss position widens, the clearinghouse or the broker may ask you to deposit more margin money to cover the loss. This is known as Mark to Market.

However, your final profit or loss will be calculated at the expiry or when you close the trade.

Who Trades Futures Contracts?

Primarily, there are two types of investors who use futures contracts:

Hedgers

These investors do not trade futures contracts to make a profit. Hedgers primarily seek to shield themselves or their company from the adverse price movements of the underlying commodity.

Also Read: Types of Futures Contracts

Let us take an example of a corn farmer and a corn canner to understand what a hedger is. The farmer would not want the prices to go down, while the canner would not want the prices to rise.

Thus, to get protection against the drop in prices, the farmer will buy a futures contract to sell corn at a specific price in the future. Similarly, the canner will buy the right to buy corn at a future date and at a specific price. Thus, since both have bought a contract, irrespective of price movements of the commodity, they are certain of receiving or paying the contracted sum only.

Speculators

They are the investors who do not intend on taking delivery of the underlying asset at the expiry. Instead, they aim to profit from the price movement of the underlying asset before the expiry. We can say that speculators trade futures contracts similar to how people trade shares.

For instance, if a speculator believes that the price of corn will go up, he would buy a futures contract to lock the current price. And, if the prices go up, the speculator would make a profit by selling the futures contract, which will now be of more value. The speculator would have to sell the contract before the expiry to avoid taking the delivery.

Usually, speculators face allegations of massive price swings in the futures market. But, their biggest benefit is that they ensure liquidity to the futures market.

Also, read – Types of Futures Contract.

Advantages and Disadvantages of Futures Contracts

Below are the advantages of futures contracts:

- Usually, a futures market has more volatility than the share market. Though this means more risk, it also means more opportunities and liquidity for investors to make big profits.

- In a futures market, an investor can make big investments even with a small amount of money. This is because an investor usually needs to deposit 10% to 15% of the value of the trade as a margin. Thus, the real return in the case of positive trade is quite high due to lower invested capital.

- The futures contracts relate to weather and commodities. Where it is difficult to have any such insider information relating to weather etc, hence, there could be fewer possibilities of trading futures contracts based on insider information.

- In comparison to other investments, the trading charges are less in the futures market.

- These contracts are good instruments for businesses to lower their risk. And, in turn, helps them to lower their input cost.

Below are the disadvantages of futures contracts:

- Because of high volatility, investors can incur huge losses in the futures market, including their margin money.

- Though the margin money requirement is relatively small, it still amounts to a big sum of money owing to the minimum contract size. This keeps away many small investors from participating in the futures market.

- A futures market is comparatively harder to understand than the stock market.

Examples

The below example will help you understand futures contracts better:

Mr. X expects the oil price to rise before May. Currently, the oil contract for May is selling for $60. So, Mr. X buys one contract (of 1,000 barrels). Now, if near the expiry, the oil price rises to $65, Mr. A will make a profit of $5,000 [($65 less $60 * 1000]. And, if the oil price drops to $55, Mr. A would incur a loss of $5,000 [($ 60 – $55) x 1000].

The above example was involving a speculator. Let us consider another example, but this time of hedging.

A producer is planning to produce a million barrels of oil in six months. Or, the oil would be ready for delivery in six months. The current oil price is $50, and the producer is okay selling the oil at this price. However, the price could change a lot in the six months.

If the producer expects the prices to rise in the future, then he would not want to lock the price. But, if he believes the price to drop, then he would want to lock the price by using a futures contract.

Now, assume the cost of a six months oil futures contract is $53. By entering the contract, the producer will have an obligation to deliver one million barrels of oil at $53.

Final Word

Futures contracts are a zero-sum game. This means, that if one party loses millions of dollars, the other party gains millions of dollars. Nevertheless, such contracts give investors another investment avenue to make big profits, as well as hedge risk. Though the market features higher volatility, it benefits investors with low trading costs, as well as the opportunity to earn greater profits.

Read Futures vs. Options and Forwards vs. Futures to know more about the difference between these.

Frequently Asked Questions (FAQs)

Futures Contracts are a legal agreement that allows buyers and sellers to buy and sell an underlying asset at some date in the future at a specific rate.

The underlying assets in a futures contract could be shares, bonds, metals, commodities, and more.

Assume a producer is planning to produce a million barrels of oil in six months. Or, the oil would be ready for delivery in six months. The current oil price is $50, and the producer is okay selling the oil at this price. However, the price could change a lot in the six months.

If the producer expects the prices to rise in the future, then he wouldn’t want to lock the price. But, if he believes the price to drop, then he would want to lock the price by using a futures contract.

The major drawbacks of a futures contract are as follows:

1. Investors can incur huge losses due to high volatility.

2. Big sum of money is required owing to the minimum contract size. This keeps away many small investors from participating in the futures market.

3. It is comparatively harder to understand than the stock market.

Clearinghouses play a crucial role in the execution of futures contracts. They facilitate payment between the buyers and sellers and guarantee each trade. That is why investors are required to deposit small-margin money. That means investors use the money of their broker or clearinghouse to trade in futures. Owing to the high level of risk, the clearing members are generally big banks and financial services firms.