Each one of us knows the definition of Account Receivables. That said, account receivables are the monies receivable from the debtors/customers towards the supply of goods and services by the entity. However, many of us get confused when it comes to the accounting treatment of account receivables. We will often find people asking: Is Account Receivable an Asset?

Since account receivables represent the sales of a business, many mistook them as an item that appears in the income statement. In reality, however, they are monetary assets. An account receivable is the money that customers or clients owe to the company.

Almost every company sells goods and services on credit. The sale that a company makes on credit is what makes up accounts receivables. Or, if a company has supplied the goods and services but has not yet received payment for them, this amount falls under account receivables. We also call account receivables as debtors or simply A/R.

Now that we know what account receivables are, let’s answer the question – Is an Account Receivable an Asset?

Whether Account Receivable is an Asset or Income?

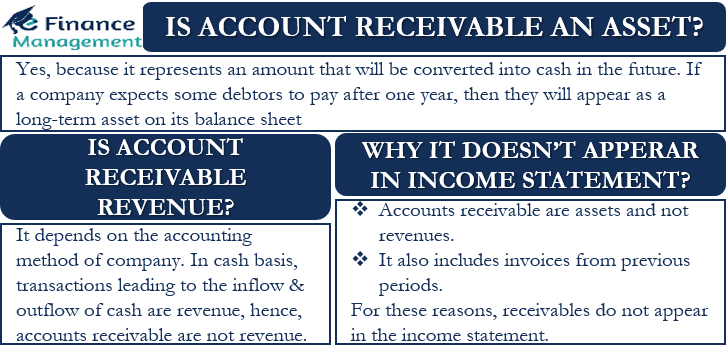

As we discussed above, of course, account receivables are an asset. And therefore finds a place in the balance sheet on the assets side. This is because it represents an amount that someone owes to the entity. And in due course, this amount will ultimately be converted into cash in the future. We list account receivables under current assets because they are usually converted into cash within one year, as the standard credit period normally ranges up to 90 to 180 days. If a company expects or understands where some debtors will pay after one year, they will appear as a long-term asset on its balance sheet.

Example

For example, a utility company bills and collects the payment only after the electricity has been supplied. For all such utility companies, and values of all their sales and supplies forms/clubbed as accounts receivables on the date of balance sheet.

Let’s take another example: Suppose Company A makes mobile phones, and Company B sells mobile phones. Company B places an order for 100 mobile phones to Company A at $100 per piece. Company A delivers the mobile phone to Company B and generates an invoice for $10,000 with a credit term of 60 days. This means that Company B can make a payment within 60 days.

After issuing the invoice, Company A records the sale on its books. An invoice amount of $10,000 comes under account receivable in Company A’s books. As soon as Company B makes the payment, Company A will reduce the account receivable balance by this amount.

Accounts Receivable & Credit Limit

The entities generally get a credit limit from bankers against their current assets for running their day-to-day operations. And this credit limit /working capital limit is arranged by placing these assets as collateral or creating a charge on these assets in favor of the banker. Since accounts receivables are also acceptable as collateral for such credits/borrowings, they are very much assets, and their accounting treatment is also like an asset. Thus, companies can use accounts receivables as collateral to borrow short-term from financial institutions.

Also Read: Bills Payable

For all financial calculations, mainly the current and liquidity ratios, again, these account receivables become an important part of the assets of the organization. And the extent of such receivables, together with other assets, throws light on the operational liquidity and operational sustainability of the organization.

In a company, there are always debtors who do not pay at all. Such debtors are considered bad debts. A company makes a provision for such doubtful debts, and we reduce these debtors from the account receivable.

Is Accounts Receivable Revenue?

Answering the question Is Account Receivable an Asset is easy in comparison to answering Is Accounts Receivable Revenue?

Whether or not account receivable is revenue depends on the accounting method used by a company. In the cash basis of accounting, transactions that lead to the inflow and outflow of cash are revenue. Thus, in cash basis accounting, this makes accounts receivable revenue. In the accrual basis of accounting, revenue is the cash inflow after the sale and therefore remains as an asset. Realization of that is still to take place.

Some people also mistook accounts receivable as the owner’s equity, but it is also wrong. Owner’s equity is the money that the owners invest in the company. Moreover, it includes the net income that a company earns and retains and does not spend by paying to the owners.

Why Accounts Receivable Doesn’t Come in Income Statement?

A simple answer is that since receivables are assets, they do not appear in the income statement. However, there is another valid reason why receivables do not appear in the income statement.

An account receivable includes all invoices that have not yet been paid. Thus, it can include invoices from the current period as well as from previous periods. Therefore, receivables do not appear in the income statement. Or we can say that only the receivables of the current year appear in the income statement and that too under sales.

Since receivables also include invoices for an earlier period, it is possible that the amount of account receivables exceed the turnover of the current year. However, this would largely depend on a company’s credit policy. Even if the value is low, it may include receivables of the earlier period. Hence it should not find a place in the current year’s profit and loss account.

From another point of view, the company may be having an excellent credit management policy. And therefore the sales converted into cash very fast. It means the outstanding accounts receivable as on any date could be only a small part of the total sales. Hence, again, accounts receivables can no way be treated as revenue; otherwise, the revenue will fall short substantially despite doing exceedingly well.

Therefore, if a company follows a loose credit policy by giving its customers more time to make a payment, then it would have a big account receivable. If a company does not allow credit sales, it won’t have any accounts receivable. In both cases, the quantum of accounts receivables will be at a large variation from the actual sales/revenue.

Final Words

Hence, we all must have no confusion with regard to the accounts receivables that these are an asset and only assets. Except in the cash basis of accounting, it can never be the Revenue. Moreover, it is a very important and critical part of the current assets. And it has a preference over the inventories, as inventory conversion to cash may not be so fast. Therefore, only accounts receivables are considered in liquidity ratio calculation, while inventories are excluded.

Frequently Asked Questions (FAQs)

Accounts receivable are treated as assets in our normal accrual basis of accounting. Because almost in all the cases, it is not possible that the quantum of accounts receivables could be equivalent to revenue. Moreover, the accounts receivables could have the pending balances from earlier years which should not flow to the current year’s income statement.

1. Accounts receivable are assets and not revenues.

2. It also includes invoices from previous periods.

For these reasons, receivables do not appear in the income statement.

It is the amount that customers owe to a company; therefore, receivables are the company’s assets.

RELATED POSTS

- Assets vs Liabilities – All You Need To Know

- Allowance for Doubtful Accounts – Meaning, Accounting, Methods And More

- Meaning and Different Types of Assets

- Debt vs Liabilities – All You Need to Know

- Factors Affecting Liquidity of Accounts Receivable

- Bills Receivable – Meaning, Endorsement, Characteristics, and Journal Entries